How to start Singapore Permanent Portfolio

Post on: 11 Июнь, 2015 No Comment

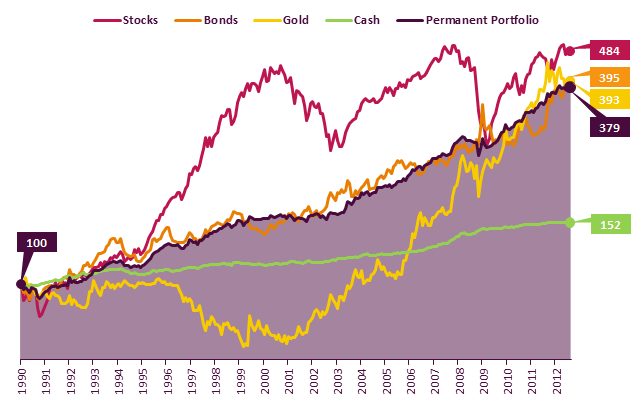

Following is an example plan to show how an investor can start a Singapore Permanent Portfolio. The figures here are for readers to double check against the figures in their own plans to start a Singapore Permanent Portfolio, and are not advices nor recommendations that readers should invest in these particular assets. In the example, an investor starts with minimum sum S$12,000. The investor strives to get as close to 25% initial allocation for each asset as possible. Below figures exclude brokerage fees and annual fees.

Example. Using data from 2 April 2012, to start a Singapore Permanent Portfolio, an investor can invest about S$12,000 all at once in:

25% Stocks. 1 lot (1000 shares) of SPDR STI ETF (SGX symbol ES3) at S$3.04 per share total investment S$3040. ES3 is traded in individual board lot of 1000 shares each.

25% Bonds. 3 lots (30 units) of Singapore Government 30-year Bond (SGX symbol PH1S) at S$100.0 per unit total investment S$3000. PH1S is traded in individual board lot of 10 units each.

25% Gold. Invest 1 lot (10 share) of SPDR Gold Shares GLD 10US$ (SGX symbol O87) at US$161.48 per share total investment US$1614.80 or S$2023 (USDSGD 1.25293). O87 is traded in individual board lot of 10 units each.

Alternatively, 45 grams of gold in UOB Gold Savings Account at S$67.45 per gram (S$2098 per ounce) – total investment S$3035.25 note that this will incur 1.44 grams per year or 3% annual fees, so Gold Savngs Account is not advisable if annual fees is more than 1% of the gold investment.

For gold investments, there is no need to hedge the gold value back to SGD, irregardless of which currency the gold is bought in this allows gold to do its job as a inflation protection hard asset.

25% Cash. deposit about S$3000 in Philip Money Market Fund or LionGlobal SGD Money Market Fund avoid initial sales charges when investing into these funds.

Alternatively, invest S$3000 in 1-year Singapore Treasury Bill – total investment S$3000 Singapore T-bill is the most insured asset as government are least likely to default on bond obligations compared to corporate and municipal bonds.

Rebalancing Managing Portfolio. After starting the Permanent Portfolio fund, the investor does not need to monitor the portfolio frequently. The only time to manage the portfolio is during rebalancing event. Rebalancing can happen in 3 ways.

- First, the investor will leave the portfolio alone untouched, until one of the asset reaches 35% or 15% of portfolio, in which case the portfolio will be rebalanced back to 25% equal spilt among the 4 assets this is the method to use when there will be no fresh fund entering portfolio,and aims to capture profits and rebalance risks.

- For second method, if there is fresh fund to put into portfolio, the fresh fund will usually buy into the worst performing asset at every year end, or at regular monthly or quarterly interval, so that each asset becomes 25% of portfolio again this is to reset the risk/reward ratio of the portfolio and buy assets when they are cheap.

- The third method of rebalancing is to use fresh fund to buy into different assets, while keeping the asset ratio unchanged this aim to let profits run and to only rebalance when one of the asset reaches 35% or 15% of portfolio.

All the 3 rebalancing methods have very similar long term returns, so choice of rebalancing method can be based on whichever method suits the investor more conveniently.

An investor should understand and plan their investment strategy well, including reasons for asset allocations, how and when to rebalancing portfolio, and the benefits and disadvantages of a particular portfolio strategy. An example of a well designed investment portfolio strategy is the Permanent Portfolio strategy, and detailed description of Singapore Permenent Portfolio investment strategy can be found on this website.

This article is contributed by Epps, reposted from singapore-permanent-portfolio.blogspot.sg. Epps invests in and blogs about the Singapore Permanent Portfolio.

>>> Warren Buffett’s secrets to investing is buying a great company at a fair price. Now you can use this simple yet powerful spreadsheet to determine the intrinsic value of a stock. You can download it here for FREE.

DO YOU KNOW: Blue chips stocks are expensive to buy and slow to profit. Discover the uncommon approach to stock gains. Find off radar stocks for profits (Hint: They often give triple-digit returns). Simple method you wished you knew in our 1-day content packed course. Click here to register

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D80&r=G /%