How to protect your 401k from a Treasury Default Independent Financial Advice

Post on: 15 Июнь, 2015 No Comment

A 401K may have limited investment choices, so it may be difficult to find something to invest inside the 401K that will protect your money from a Treasury debt default. Many 401K’s offer only a few equity mutual funds and two bond funds, with no way to invest in gold or foreign currency.

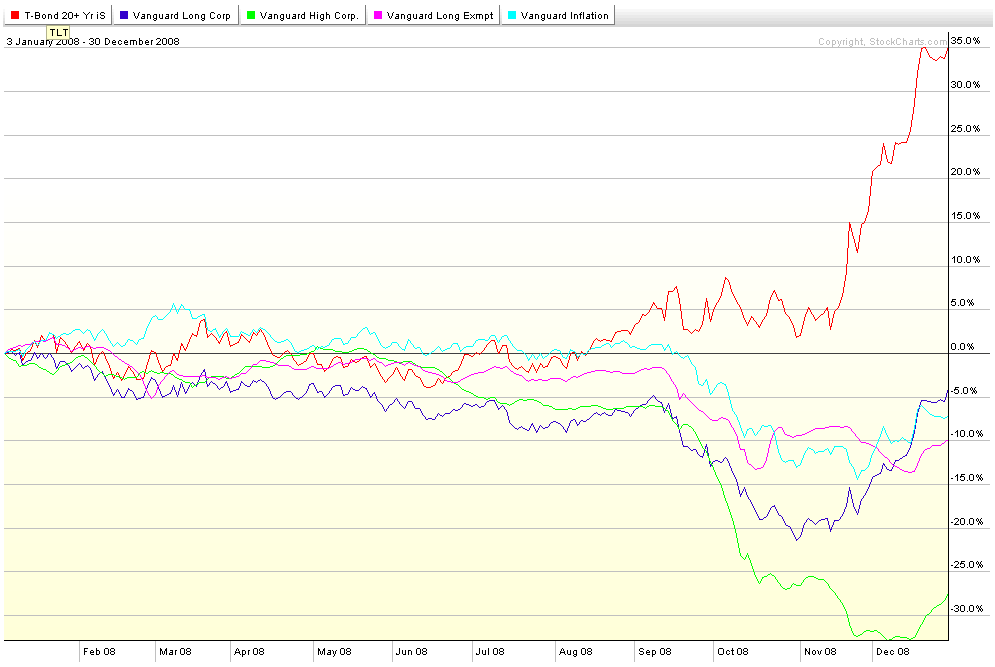

One possible but weak solution would be to invest in a short term investment grade money market mutual fund or a “Guaranteed Income Fund” (GIC) offered inside of many 401Ks. Even those are risky. When Lehman failed a prominent money market fund lost 3% of value. And when some employers failed then the GIC’s in 401K’s also lost value.

A GIC is a contract by an insurance company to provide a bond like investment where they guarantee the principal. The problem is that the insurance company can go bankrupt thus ruining the “guarantee”. So watch carefully when someone says “guarantee”. The insurance company should have an “AA” or higher rating to make their “guarantee” a reasonable bet. That is all it is, a “bet” that the insurance company will remain solvent. You have no guarantee of the “guarantee”!

Is this all you will get if a guarantee fails?

One hypothetical strategy that is too risky to recommend is to buy a futures contract on gold that is equivalent to the amount of your 401K assets. Then if gold goes up during a crisis that might offset the damage caused that a crisis did to your 401k. But I do not recommend it because gold has behaved in an unreliable manner and could go down and if coupled with the extreme leverage of a futures contract then you could go bankrupt, so please don’t do it.

There is no guarantee that gold will go up in lockstep with a decline in the dollar. Gold could have been overpriced due to emotions of other investors and thus gold could go down. There is some reason to believe that a fair value for gold is between $750 to $1,000, so it may be overpriced at $1,600 today. During the 1970’s it went down 50% in 1975 and then in 1980 it went down 50%. Since futures contract are leveraged up about 20 times the initial deposit then you could lose 10 times your investment if gold futures dropped 50%.

Fortunately most people change jobs every few years at which time they can roll over their 401K to an IRA where they have a huge amount of freedom of choices. Always ask your employer if they allow a “brokerage window” in a 401K that allows you to buy any publicly traded investment even though it is in a 401K and ask if they allow “in-service” withdrawals where you can roll it to an IRA. Never do a distribution of the money from a 401K directly to you, instead tell the new broker that will hold your IRA that you want him to pull the funds from the old 401k and roll it to the IRA. If you withdraw funds from a 401K by having a check payable to you then it is taxable transaction and probably can’t undone.

Investors should seek independent financial advice.