How to protect against hyperinflation and destruction of the US dollar

Post on: 19 Июль, 2015 No Comment

How to protect against hyperinflation and destruction of the US dollar

User Forum Topic

Submitted by mixxalot on October 8, 2008 — 10:42pm

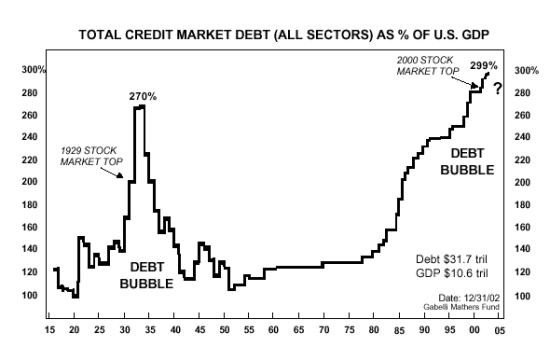

With the bailout passing and Fed slashing interest rates and Helicopter Ben printing money like no tomorrow, I am afraid that we will see a nasty period of hyperinflation unless a miracle takes place.

I don’t trust Wall Street as these insiders are behind the bailout so gold coin looks to be the best bet.

Submitted by stockstradr on October 8, 2008 — 10:57pm.

I’m not understanding why some people on here view liquidity of holding gold as a problem?

What am I missing here?

Take my E*TRADE account, which inludes brokerage, savings, checking, retirement accounts.

I move say $10,000 from savings into brokerage. I buy $10K in gold via the ETF (Symbol: GLD). Wow, that took a total of sixty seconds.

Three years later. Wow, those same gold ETF shares are worth $30,000.

Oh, I need some grocery money. OK fine.

Sell a few shares of GLD then transfer proceeds into checking. All online. Wow, that took another sixty seconds.

Ten minutes later at the grocery store, whip out my E*TRADE ATM card and pay for groceries with dollars that were gold only twenty minutes ago.

I don’t see the problem!

And please don’t give me that blather about Oh, I don’t trust the gold ETF, blah blah blah. They’ll go bankrupt!

Hello. They have a gold warehouse. When you buy their ETF, they go buy gold essentially matching their net monetary inflows/outflows. They have over 700 metric tons of gold in a warehouse matching their ETF deposits.

OR you could buy physical gold. Now you gotta Fed Ex that stuff back to your broker, such as KitCo in order to redeem it into dollars.

But again, you are causing yourself inconvenience because of trust issues. Why not just let Kitco hold it for you?

Submitted by peterb on October 8, 2008 — 11:07pm.

Dont be so quick to write-off the US$. It’s been hammered for 4 years. It’s a little payback time. If history has anything to do with it, the US$ should stay as a superior currency for a year or two. Cash in a crash.

And gold could be topping right now. It costs about $500 and ounce to get it. At $900, that’s a pretty good premium. If it goes over $1000, it’s in bubble territory. It’s really good as an accurate indictor of the currencies purchasing power. So it’s got that going for it. But if it’s measured in US$, it could be stagnating for a while. IMO