How to Profit from Inflation Think Emerging Markets_1

Post on: 17 Май, 2015 No Comment

Its par for the course that emerging market economies are flush with inflation. The root generally stems from vast government subsidies and legislative measures intended to help businesses compete in international trade. Although inflation is often considered a terrible stain on any portfolio, the good news is that with emerging markets, it may just make you more money!

How Inflation Spreads

Typically, newly inflated currency stocks are spent through the government, which then passes on the funds to business and local economies. Inflation is first present in the most liquid of markets, where buying and selling easily allows for the entry of new monies. One needs to only look within the United States to see where the vast increase in currency has gone: oil, gold, and food. Why these products? Theyre easily bought and sold, and virtually everyone can buy them. Other economic catalysts like labor and industrial products often lag inflation, due solely to being a part of illiquid markets.

Stocks Are Liquid

Stocks are just as liquid, if not more, than commodities, and typically increase quicker than other prices due to the ability to invest in stocks easily. Based upon how inflation is calculated, investors with a long term investing horizon outpace inflation.

Consider the growth in the money supply in the United States; the monetary base exploded by 10 times from 1990-2000. Stock prices soared similarly, but the cost of living went up only a portion of this value. This is a perfect example where the investing class benefited while those who werent invested saw no return on their money. Therefore, when facing inflation, the key to profitability is to remain as invested as possible. The more you have invested during inflationary periods. the better off you will be.

Companies Benefit (in the Short Term) from Inflation

In the short run, companies benefit from inflation, as there is instantaneously more money and greater demand for their products. A growing money supply can only help companies, as they can charge more for their products or service more people who now have more expendable income to buy their wares. In the long run, however, as prices plateau, companies are less benefited by inflation, as their costs to produce rise equally with the expansion in the monetary base.

Run With It Dont Fight It

Unless you share a seat in the decision-making entities of every emerging market country around the world, its unlikely you have any pull in the monetary policy of one nation. Therefore, rather than avoid nations that are in fact inflating their currency, look for economically and politically sound nations that are favoring certain businesses with their monetary policy. One example is China, which infused its economy with nearly $600 billion in stimulus cash to be used mostly in rebuilding its crumbling infrastructure. As a result, Chinese infrastructure stocks have been some of the best performing of this year. Other stocks, which dont have the same benefits as those receiving newly inflated cash, are at a disadvantage, having to rely on organic growth rather than a one-off benefit.

Inflation Doesnt Always Mean a Weak Currency

Developed nations are more susceptible to inflation, as they generally do not have as many high producing investments in which the inflation could go. In one example, during the early 2000s, Brazil suffered from high inflation, but its currency actually appreciated against the US Dollar, which was not as inflated. American investors who had invested in Brazil would have actually benefited from both sky-high savings account rates and stock market yields all while protecting themselves from a decline in the dollar. In this case, Brazil had ample opportunities to invest and grow its economy (in sugar production, ethanol, etc.) and had shown economic growth from the investments.

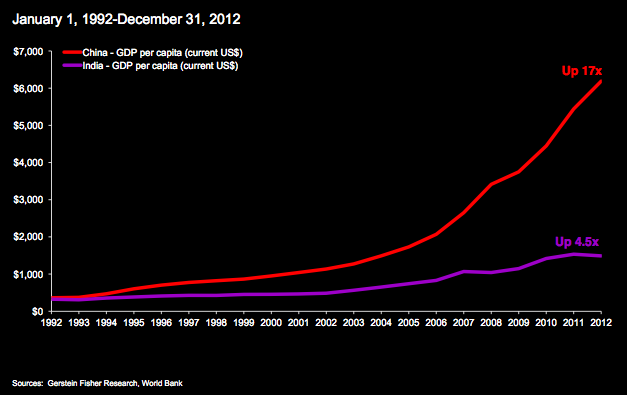

Thinking BRIC

The BRIC nations. or Brazil, Russia, India and China, all have high inflation rates, not only due to their own monetary policy, but also due to a strong export economy. When nations export products, they import an abundance of money, impacting the local economy. In this case, the inflation is healthy, as it doesnt devalue the currency, but rather creates more of it in a localized society. These nations are prime investing ground; inflation, in these cases, is excellent, as it brings more and more money to the economy and promotes growth not only internally, but externally.

Whether youre looking for a strong investment in the human capitals of China or India. the export strength of Brazil, or the oil in Russia, emerging markets create an excellent investment opportunity especially with inflation on your side.