How to Pick The Right Mutual Funds For Your 401K

Post on: 17 Май, 2015 No Comment

How to Pick The Right Mutual Funds For Your 401K

When I was a kid I lived for the month of July. This was the best time to pick cherries! My brothers and I would climb cherry trees looking for the best fruit. We wanted the ones that were dark red. Why? They had the most juice and tasted perfect! The less desirable ones were at the bottom.

Picking the right mutual funds is no different. You want to make sure you or your manager picks the mutual funds with the best results. When it came to picking ripe cherries, getting up each tree required a different process. You can’t approach mutual funds in just one way. There are a few things you must do to make sure you properly stock your 401K. Here are four common reasons folks pick green fruit for their 401K’s.

Four Reasons People Have Trouble Picking Mutual Funds

Reason #1: Confusion

Sometimes choosing mutual funds for your 401K can be like trying to pull teeth in the dark. Where do you start? What sector should you choose? How do you know which ones performed the best? And lets’ be honest. The stock market alone can be confusing. Most people are turned off further, because of the market volatility. There are a host of websites that can help you sort through the mess, but which one is the best?

Reason #2: Stock Ignorance

Most of us aren’t Warren Buffet. And maybe you don’t know a stock symbol from your birth date. One of the reasons I stayed away from the financial arena was because I hated math. How about you? Did you know a hatred or dislike for math can turn you off from the stock market? By not knowing how stocks work, ignorance sets in. This can cause you to make some bad choices in picking mutual funds.

Reason #3: Getting Started

My first question about mutual funds was where do I start? Do I call a Financial Planner, Fund Manager of the company 401K or the IRS? It may sound silly, but it’s true for most of us. We simply don’t know where to start looking for the right mutual funds. Another reason is good old procrastination. If you’re 25 and won’t retire until you’re 70, what’s the rush? But time has a funny way of coming faster than we thought.

Reason #4: How Does It Work?

When you think about a traditional 401K, how do you think it works? From an employee perspective, you get paid and money automatically comes out of your check. When you get your 401K balance sheet money has magically appeared! But it’s problematic when you think this way. The old saying, out of sight, out of mind, can be a dangerous thing. If you don’t know how a 401K really works, you won’t know when or why you’re losing or making money. Not knowing how it really works causes us to procrastinate or make foolish choices. One of the most common mistakes is making early withdrawals from your 401K plan.

But you can safely pick mutual funds without breaking a sweat!

Here are a few friendly suggestions.

Recession-Proof

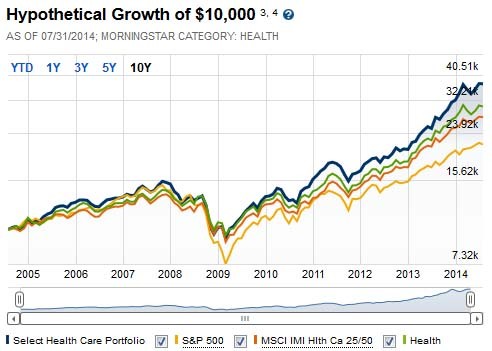

When the market is down which sectors still make money? During the bear market of 2000-2002, one sector had gains of 174%. The almighty healthcare sector rarely misses a stride in down times. All of us want to live longer and healthier lives. It makes sense to pick healthcare mutual funds. You don’t have to overload your portfolio with them, but they’re an excellent choice in a down economy. You can also pick a commodity mutual fund. These include gold, wheat, sugar or silver. From 2007-2008 investors saw gold average $650-$1,000+ an ounce!

As we both know nothing is for free. Find out from your Fund Manager what the cost is. If your expense is 2.1% per fund, this lowers your annual returns. Look for mutual funds with low management fees and higher returns.

Managerial Experience

Who’s running your 401K plan and why? What kind of experience do they have? Make sure your Fund Manager has extensive experience. I like to go with the ten year rule. I’d like my Fund Manager to have a minimum of ten years experience with 401K plans. Ten years is a great time frame. The Fund Manager will know how to keep your portfolio afloat in bad times. It’s easy to run a 401K in good financial times. But you truly see what you’re paying for when the hits come.

Determine Risk

What kind of an investor are you? When I got my first 401K I made of list of my personality traits. Am I a risk taker, do I like adventure or do I like to play it safe? Answering these questions told me what kind of investments and risks I was willing to take. The test worked! Based on my risk thresh hold I picked stocks that tripled my portfolio over several months. Make a list of your personality traits. And don’t be shy about being conservative. There are plenty of mutual funds that fit you. These steady funds can bring you consistent money even in a down market.

It’s simple, but powerful advice. Most investors lose money in down times for one reason. They panic. The emotion factor is so important that Wall Street uses an important tool to measure it. It’s called the Volatility Index. The higher the number, the more worried investors are about the market. When you first set up your 401K and pick mutual funds, you’ll devise a long term strategy. Stick to this strategy when things get tough. Wall Street history shows that the market always rebounds. When it does the folks who stuck with their original long term strategy will win.

Listen to Russell

I’m talking about the Russell 2000 Index. This is the little-known cousin to the S&P 500. Your 401K is made up of small cap securities. The large caps are big company stocks in the S&P 500. These include Microsoft, IBM, Apple and Proctor & Gamble. This small, but crucial index tells you how mutual funds perform. You’ll instantly know how your 401K is really doing in a down market.

A man’s reputation follows him wherever he goes. The same is true with mutual funds. Check the ten year run of any given mutual fund. If it’s made money most or all of those years, put that puppy in the mix! Anything from 1-5 years may be too risky. In these tough financial times even the most aggressive investors are watching their picks.

Retirement Goals

If you’re in your 20’s or 30’s you’ll want to have a more aggressive 401K strategy. By choosing high growth mutual funds, international and small cap funds, your money will work harder for you. But what if you’re in your seasoned years, at ages 50-60? You’ll want to invest in something safer. These include large cap companies. Mutual funds like these, offer less risk and more stability in a down market. This doesn’t mean you won’t take a hit in a down market, but can lessen the blow to your retirement portfolio.

The Best Performing Funds For 2008

Top 10 Performers