How to investing in Fracking Fracking For Gas

Post on: 3 Май, 2015 No Comment

Some thoughts on how to make the most of Fracking in the UK.

Introduction A boom Coming?

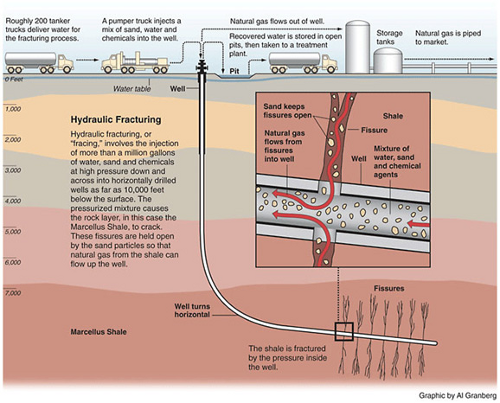

Much has been said, and written, in the media about the risks (real or not) associated with fracking as a method to extract hydrocarbons from shale rock. However, given the backing by the UK Government and the strong interest shown by the oil companies there seems little doubt that some form of shale gas exploitation will take place in the UK despite the protests by the various anti fracking organisations. This article therefore attempts to move the discussions on from the endless claim and counter claim about the environmental risks associated with fracking and instead focus on this new UK business sector and how the investor can gain investment exposure and how the budding entrepreneur may create a new business for this sector.

What can we learn from the recent past.

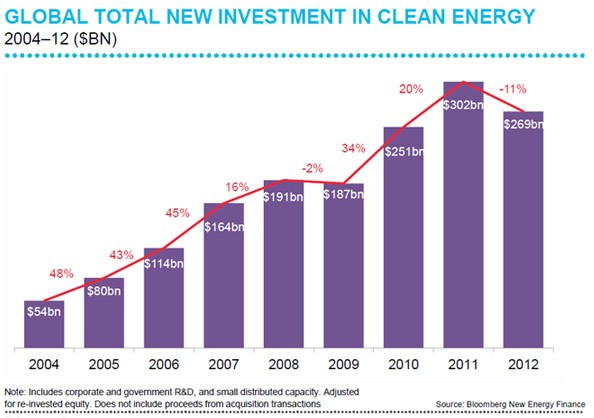

Emerging booms have huge opportunities and huge risks. Much like the dotcom boom in the early 2000, there will need to be smart investment in the right businesses. Hindsight is easy, and seeing the winners of the internet easier than remembering the many companies that now no longer exist. There is a lot we can learn about emerging technology from the dotcom era, by analysing those companies that failed.

Remember Altavista? Boo.com? Some were too early, others did not innovate fast enough, and many others never had the investment needed to expand into the massively growing opportunity, while others overspent on advertising, when there was not enough business to sustain it.

The key is that there will be many economic opportunities in the coming shale gas economic boom that will emerge just like the surge in new opportunities during the dot.com boom.

Some of the first dot.com businesses went on to establish themselves are now market leaders worth billions. Some of these companies were existing businesses that simply repositioned themselves. Others were set up at home and have since moved on to become household names.

Investors who were brave enough to put their money in the IPO’s of some new start ups have seen huge returns on their initial investments, will others lost their shirt. What we need to do is to spread investments amongst a portfolio where hopefully the end outcome is positive.

Behind this hundreds of thousands of small businesses were set up or existing businesses repositioned to take advantage of this new business format. Some did not. Like Morrisons, who did not take online shopping seriously enough. Indeed it could be argued that the lack of engagement of the internet by the High Street shops as a whole, has allowed shops like Amazon, play and Asos take a huge portion of business that used to be high street business.

The coming shale gas boom is certainly not proven but neither was the dotcom businesses in the early years. There were many doubters about the internet and the impact it would have on the retail business when it first emerged.

Perhaps the same will happen for UK businesses. Energy utilities that do not get exposure to cheap shale gas may find themselves unable to compete. Similarly, some local business with large and expensive energy costs may be able to extract their own cheaper shale gas energy giving them a massive competitive advantage over other companies poorly located and dependent on expensive energy from mainstream sources.

Shale gas production is not a new concept and in some ways the shale gas boom has already occurred. The much vaunted shale gas boom of the USA has seen hundreds of thousands of wells drilled and in the process created hundreds of millionaires and quite a few billionaires. Indirectly the country has enjoyed a dramatic reduction in energy costs which in turn is driving the current upturn in economic recovery and bringing a manufacturing business back to the USA instead of countries with cheap labour costs. For instance the giant chemical company BASF is investing $5.7bn on new plants in the USA rather than Europe where the company is concerned about cost. Similarly, the Austrian steel maker Voestalpine is building a new $700m plant at Corpus Christi Bay, Texas. Obviously it would be great if some of these large manufacturing companies moved operations back to the UK as a result of the shale gas activities.

What does Shale Gas mean for the UK?

So what will a shale gas boom mean for the UK? Some will see it as nothing more than another source of energy. However, the search and development of shale gas offers much more than that. The oil industry has created hundreds of thousands of jobs for the UK not just servicing the North Sea oil rigs but has enabled Aberdeen to move from a provincial Scottish town largely dependent on the fishing and agriculture to an affluent city servicing the oil industry globally.

Could the same happen further south in the Bowland Shale province of northern England or the Jurassic shale province of southern England? What is clear is that the logistics of supplying equipment and consumables to the operations is a major issue and that none of the current oil logistic centres in the UK are ideally suited to receive equipment from overseas, store it and then despatch at short notice to the required site. The service centre for the Bowland province, almost certainly it will be one of the existing major ports in northern England, but whether this is on the east or west coast remains to be seen.

There are many uncertainties associated with shale gas in the UK and many people use these uncertainties to justify why a shale gas boom will not happen. However, it would be foolish to ignore this opportunity. So here is a quick summary of what might happen if the shale gas boom does happen and if it does what investment opportunities could emerge. If you believe then perhaps this will give you some ideas.

A bit about the Geology.

The British Geological Survey has produced a report (https://www.bgs.ac.uk/shalegas/#ad-image-0 ) assessing the potential of the shale rocks of England to produce hydrocarbons. The numbers are huge and even if only a small proportion were developed and produced this would represent a major business.

In broadest terms the shale potential of the UK can be divided into two. The Bowland Shale province of northern England and the Jurassic shale of southern England. These two shale provinces will evolve quite separately and in different ways. More specifically for the investor these provinces will generate different investment opportunities.

Under pining these differences in provinces is the geology. The Bowland Shale, for instance, is thought to be almost exclusively gas prone although some liquids may be produced close to the Cheshire coast and in the East Midlands. The Jurassic shales of southern England are more oil prone. A second significant difference is the fact that the Bowland Shale is much thicker than the Jurassic shales. These geological differences will create two quite different extraction businesses.

en.wikipedia.org/wiki/Kimmeridge_Oil_Field ) and an oil storage tank.

In both cases the oil companies are likely to do their upmost to hide from view the sites, typically placing them

Another material difference is the location.

What are the timescales?

First and foremost the Exploration & Production companies have to acquire a license before any drilling activity can take place. So unless the license is an old one that has been in place for many years activity will have to wait until the 14th Onshore Round has taken place and been awarded. So the first thing to do is to look at a map showing held acreage and compare to the area identifies as having shale gas potential.

The 14th Round is expected to open in June / July 2014 and will probably close 3 to 6 months later. DECC normally takes 6 months from bid submission to award the license.

These will just be exploration wells however. There is very little data about the true value of the scale, and the extent, that the first wells drilled will be all about analysing the core, and finding out if the gas is viable. Of course the Exploration companies believe it is, otherwise there would not be an estimated £300 million being invested this year in the process. Depending on what the find in the first wells will have an impact on the scale and speed of the uptake.

First lets look at what has happened with stocks in theUSA.

Investment in US shale gas companies has yielded huge returns for shareholders. Mitchell Energy, who some regard as being the company that pioneered exploitation of the Barnett Shale Gas in Texas saw a 600% growth in its stock price between mid 90’s, pre shale gas success, and when it was eventually sold to Devon Energy in 2002 for $3.5Billion. Chesapeake is the USA’s largest producer of unconventional gas. Since its IPO in 1993 at $1.33 per share to its current price of over $26. EOG resources has seen an even more spectacular rise in its share price over a similar period, $10 share to its current price of $165 per share although this growth also includes a contribution attributable to exploitation of conventional resources.

What About the UK?

Ideally we need exposure to shares in listed companies with UK shale gas interests. There are only a few Exploration & Production companies that are active onshore the UK.

The best known of these are Cuadrilla (www.cuadrillaresources.com ), IGas (www.igasplc.com ), Dart (www.dartgas.com ) and Egdon (www.egdon-resources.com ). IGas and Egdon are listed on AIM. Dart is listed on the Australian ASX market. Frustratingly, the company with the biggest exposure to shale gas in the UK is private. However, a way to get exposure to Cuadrilla is via one of its principal share holders, AJ Lucas (www.lucas.com.au ) listed on the Australian stock market.

Recently, a number of larger companies (Centrica, GDF and Total) have bought into licenses held by the smaller companies. Whilst listed, the impact on their share price of any shale gas success will be diluted by the value of the other conventional assets.

If not the Gold mines, how about the people selling the spades?

I would like to look at a few key areas that might be worth further analysis. There are many areas of the oil and Gas industry that supply services of one sort or another to them. These companies where listed will potentially show good growth in share value.

Listed companies providing services to shale gas companies provide an indirect way to get exposure to shale gas activities. Halliburton Company, Schlumberger Ltd and Baker Hughes Incorporated are the three leading suppliers of services to companies exploiting shale gas. The average growth in share price of these companies since the late 90’s is more modest than the likes of Chesapeake and the like but still healthy at approximately 250% since the US shale gas boom started.

One reason that shale gas was able to happen so quickly in the USA was the fact that oil and gas exploration and production onshore was already big business with lots of different companies established to provide the various service needed to drill lots of wells quickly and efficiently. Historically, and unlike the offshore North Sea sector, only a few wells a year have been drilled onshore in the UK. As a result the service sector is poorly established. There is cross over from the offshore drilling business but not for everything and many of the companies servicing the offshore sector currently do not have the infrastructure based sufficiently local to service drilling in northern England or further south.

Rig companies offer an obvious target for investment in the UK’s coming shale gas activities especially as oil & gas companies rarely own their rigs. Instead rigs are leased to oil companies by specialist drilling companies that typically own a fleet of rigs with different specifications and capabilities. The UK has seen only limited drilling to date so this is an area which is under resourced and investment by rig contractors can be expected. Unfortunately the main rig contractors active in the UK are not listed currently although that status may change.

KCA Deutag (www.kcadeutag.com ) is one of worlds leading drilling contractors and has rigs available for onshore UK operations. Unfortunately it is own by various private investment funds and therefore currently unavailable to the private investor.

The Marriot Drilling Group www.marriottdrilling.com. This company claims to be the largest onshore deep drilling company based in the UK with over 20 drilling and workover rigs. Founded in 1947 this is still a family owned and managed business.

BDF (www.bdf.co.uk ) is another British largest onshore drilling contractor in private hands.

Geometric Cofor (www.geometriccofor.co.uk ) is based in Sheffield but is own by Entrepose Contracting of France which in turn is part of Vinci, a large European conglomerate of businesses.

In the UK there are also numerous companies offering much smaller rigs for ground investigation in the construction industry and shallow boreholes for water extraction and ground source heat extraction. It is likely that one or more of these smaller rig companies will target expansion into the shale gas rig sector.

Similarly, larger overseas based drilling companies to explore options for expansion into UK operations and one way to achieve that quickly would be acquisition of one of the above companies.

Drilling services.

Apart from the supply of the rig and its crew there are many, many other services contracted to provide services during drilling. Some services such as highly specialised such as wireline logging, coring, drilling mud suppliers and these tend to be provided by some of the worlds largest corporations, such as Schlumberger and Halliburton. However, there are many other more services required including security, catering, waste disposal and site construction.

Seismic companies.

Before any well can be drilled, seismic data needs to be acquired and processed. This requires the services of specialist companies. The only company with a UK acquisition base is Tesla Exploration Ltd (www.teslaexploration.com ). Listed on the Toronto stock exchange this company has not yet seen the growth in share price that other service companies with exposure to shale gas activities have experienced.

Drilling materials

You can’t drill wells and undertake fracking without using a substantial amount of various materials.

Environmental companies. e.g. Barton Wilmore, RPS.

Companies importing consumables, e.g. Guar (uses in drilling mud) or specialist sand (propant)

PR companies

Finally there are so many other ways this business will have an impact on our economy, that will be good. Not only will 1% of the revenue go to the local community, (this will be huge potentially completely changing the value of local property upwards, to the more affluent areas, as well as providing employment, etc) But all these drilling workers will need looking after. They will need food, housing,entertainment, accommodation and legal support. The companies they work for will need lawyers, Environmental services, security, PR, communication and IT, photography, cleaning…. I could go on and on. Whatever your business, the chances are good you will benefit in the areas the gas is being drilled.

As an executive summary, the chances are high that Shale Fracking is going to happen in the UK. There are opportunities for buying shares on Aim in Exploration Companies. However the biggest opportunities available at present are in the related industries. For those prepared to jump in now, and lay claim to a stake in the industry there are some substantial opportunities. for those who want to speculate in shares, the opportunities are not so clear cut.