How To Invest In Commodities as an Average Investor

Post on: 16 Май, 2015 No Comment

by Silicon Valley Blogger on 2010-04-18 6

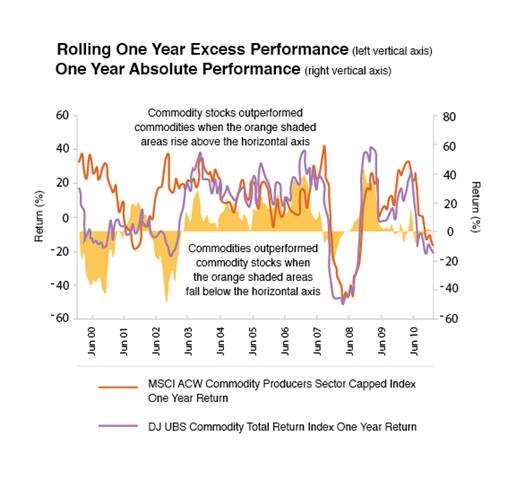

Commodity market prices can serve as an inflation indicator (via a commodity market index ). If youre looking for an inflation hedge, you may want to look at investing in this market.

One of the funnier stories on investment trading that Ive come across is this one about the hapless commodities trader.

It was that moment that Brad’s palm almost immediately made contact with his forehead. He realized that something must have really gone awry: instead of virtually trading 28,000 tons of coal, Brad had somehow ended up with 28,000 tons of real coal.

The point here is made clear: when it comes to your money, dont get too overconfident. or stupid.

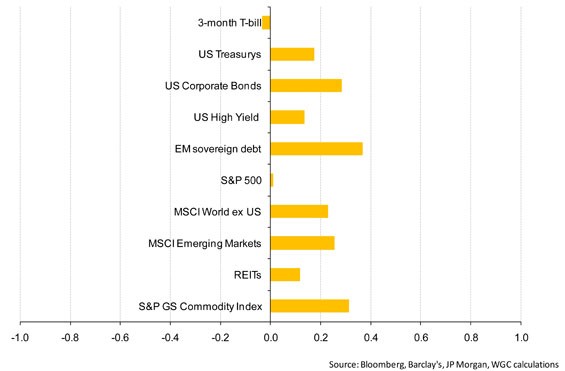

But this story shouldnt scare you away from making trades or investing in (what seems to be like) more esoteric markets. If youre interested in truly diversifying your portfolio and pursuing stock market diversification in earnest, then look into other asset classes, particularly those that dont correlate as much to the standard investments you already own. In fact, our earlier story seems like a good segue into exploring the idea of investing in commodities a little further, especially as it relates to the average investor. While Im not an expert in this area, its one aspect of investing that Ive been curious about, given the diversification angle.

The Commodities Market

The commodities market is actually a collection of 48 worldwide markets that trade 96 commodities. Everything from silver to orange juice concentrate can be sold. The largest market here in the United States is located in Chicago. Smaller in size and fame, the Chicago Mercantile Exchange or CME trades in a large amount of commodities.

Before we can talk any more about this market, we have to know what a commodity is. A gold bar, a barrel of oil, a pig, a brick of orange juice concentrate, and wheat are all examples of commodities. The two that tend to be the largest overall market movers are oil and gold. When theres uncertainty in the air and investors become fearful about the economy and major investment markets, we often hear of them flocking to and investing in gold because as a commodity, its inflation proof as a tangible asset.

The CME isn’t a glorified grocery store, though. Farmers don’t show up in semis full of soybeans. Instead, the commodities market deals with futures contracts. A futures contract is simply an agreement to buy a commodity at some point in the future at a price dictated today. But as explained in this Q & A. its a zero sum game, and a stunningly fast way to lose money. While this is certainly one way to get involved with commodities, this is not the recommended way for small investors to go.

How To Invest In Commodities? Some Pointers For The Average Investor

How does the average investor play the commodities market? Well its a different story to trade vs invest in an asset. In this case, using commodities as a way to round out a diversified portfolio may actually be a reasonable strategy. There are many ways to invest in commodities, ranging from the simple to the complicated, but the easiest way is through an ETF (heres more on ETF investing basics ).

Here are a few examples:

The SPDR Gold ETF (GLD) is one of the most useful commodity ETFs on the market. This fund is currently the 6th largest holder of actual gold. Investors regard GLD as a great hedge against downturns. So you may want to have this in your portfolio to help balance things out when the overall stock market goes down.

PowerShares has a sugar, corn, soybean, and wheat ETF (called the PowerShares DB Agriculture Fund with symbol: DBA ). The ETF tracks the performance of these four commodities, so when prices of these commodities go up, so does the ETF.

Now you can also decide to get directly involved in futures contracts but in general, that should only be for the serious, full time investor. The last thing you want is a truckload of corn showing up at the doorstep of your apartment (as per our introductory story earlier ).

For more information, you can check out your online stock broker for the list of ETFs they have available for purchase. And for a more in depth coverage and analysis of commodity investing, check out this link .

Categorized under: Investment Written by SVB