How to intelligently use gold in your portfolio

Post on: 19 Июнь, 2015 No Comment

Get social

Article utilities

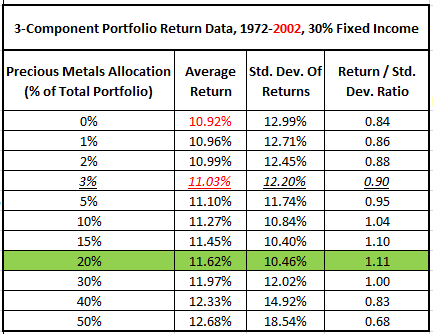

Its a sign of the times when gold is constantly referred to as a safe haven. Despite its own volatility, gold does play an important portfolio role to a point. Theres a good argument that even conservative, long-term investors should allocate a small weighting, say no more than 5 per cent, to the precious metal.

The 5pc rule

Dixon Advisorys head of funds management, Alex MacLachlan, says his firm (which advises self-managed super funds) increased the weighting of gold in its model portfolios to 5 per cent in 2007.

At the time, the gold call was about including a bit more protection in portfolios, MacLachlan says. Then gold became a hedge against a bout of high inflation or deflation as central banks worldwide competitively devalued their currencies. Now it has morphed into a third stage, where gold is acting as an alternative to paper-based currencies. I wouldnt suggest a weighting above 5 per cent in gold, however, for most investors.

MacLachlan sought exposure to gold bullion, rather than gold stocks. We favoured physical gold exposure in portfolios rather than adding gold stocks, simply because gold stocks can behave more like regular stocks. That is, if the sharemarket falls, gold stocks usually fall, even though the gold price is rising.

Diversification

Many investors see gold as a fast way to make money, and it can be when the gold price soars. For long-term investors, gold offers something more precious: diversification. Including gold bullion exposure in portfolios means having an asset that has a different type of relationship with items like shares or bonds.

Gold historically has a negative correlation with the US dollar: it rises when the greenback falls and vice versa, although the relationship is not always clear-cut. And gold has a lower correlation with key equity indices, so it can rise as sharemarkets fall.

The global financial crisis forced the US Federal Reserve to engage in quantitative easing (an unconventional form of monetary policy that, simply put, involves printing more money to buy financial assets and stimulate the sagging economy).

Ultra-loose monetary policy forces the US dollar lower and stokes concerns about the value of paper currencies. Too much money in the financial system creates fears of higher inflation in the medium term a reason why gold is often bought as a hedge against this.

Add to that persistently higher global sovereign and financial risk, and its easy to see why gold bulls believe the metal is one of few safe ways to store wealth.

Preservation and generation

Having gold exposure in your portfolio is as much about wealth preservation as it is about wealth generation, says Gavin Wendt, founder and resource analyst of the Australian stock report MineLife. It protects your wealth in volatile markets while most other assets are going backwards.

Wendt adds, however, that gold can perform well when other assets are rising: It doesnt have to be the case that gold only performs well when everything else is performing poorly. Over the past 11 years, the gold price has outperformed most other asset classes and been a consistent performer.

LimeStreet Capital non-executive director Grant Craighead, a veteran gold analyst, says: I cant see the gold price going down much further from current levels (as at October 2011). To be a bear on gold, one would have to believe the US and European economies are about to go back into a growth phase and that their currencies will rise. That said, Ive learnt over many years that youre better off not trying to predict the gold price and [should] instead focus on getting leverage through gold equities, where you can get a multiplier effect on the gold price by choosing companies with good management and good assets.

Mining cashflow

Craighead notes an important change in gold-sector investing. In years past, an investment in a gold company was purely about leverage to the gold price, he says. Now, more producers have good balance sheets, reasonable earnings and even rising dividends. An investment in an established producer is about getting leverage to the cashflow theyre enjoying with the gold price at such high levels.

For most investors, trying to predict the gold price and the Australian dollar is a mugs game. A better strategy is cautiously including a small amount of pure precious metals exposure in portfolios after prices have fallen the caveat being that this approach doesnt suit retired investors who seek income (theres no yield).

Portfolio investors should avoid the silver market, which better suits traders and is prone to the odd bout of manipulation. Also, they should take care with platinum. which is used in cars and is sensitive to a weaker global economy.

Bullion or stocks?

The next question is whether to gain exposure through bullion or stocks. Tolpigin prefers shares, which have badly lagged the gold price rise over the past year. Historically, gold stocks lag the gold price and then rally when the broader sharemarket settles down, he says.

Fat Prophets analyst Colin Whitehead also favours equities over bullion. The case now is much stronger for buying gold shares because the majority have not participated in golds gains. he says. We believe higher gold prices are here to stay, we expect gold to consolidate around $US1700, and have a bullish medium-term view on the metal. When it becomes clear that high gold prices are sustainable, analysts will use higher gold prices in their models and the gold sector will be re-rated.

Gold equities have lagged bullion for several reasons. A higher Australian dollar has dampened gold price gains for some domestic producers, exploration and production costs are rising, and gold stocks have fallen along with most others during the latest global sharemarket rout. A lack of global mergers and acquisitions activity in the sector has been another factor.

Whitehead says: I dont expect to see gold stocks rocket higher while overall sharemarket sentiment is so poor but they could be among the first to gain when market volatility subsides and the gold price consolidates.

Larger gold shares certainly looked better value after recent share price falls in late 2011. Nine interesting precious metals stocks are included in the table on page 43. Most suit investors at ease with small and mid-cap gold explorers.

For most investors, buying gold shares offers less portfolio diversification than buying gold bullion, simply because these stocks tend to rise or fall more in line with broader market movements.

Gold shares come with company and market risks, which is fine for investors who believe a businesss management can leverage a higher return than the gold price, but not so good for investors who want pure exposure to the price as part of a broader portfolio diversification strategy. The lack of large ASX-listed gold stocks is another problem for conservative investors seeking blue-chip exposure. Most stocks are too speculative for portfolio investors.

The easy option

The easiest way to gain pure gold exposure is through low-cost, ASX-listed, exchange-traded commodities (ETCs) and funds, such as ETF Securities Physical Gold ETC (GOLD), which aims to replicate movements in bullion prices. Most ASX-listed ETCs arent hedged for currency moves, meaning investors take commodity and exchange-rate risk using precious metals ETCs.

The BetaShares Gold Bullion ETF ($A hedged) eliminates Australian/US dollar currency risk and provides purer gold exposure. The story below explains precious metals ETCs in more detail.

Whether you choose bullion or shares, the key is to take a long-term view. Theres much to like about gold in the next few years as the US and Europe struggle with weak economies; as central banks in emerging countries buy more physical gold for diversification; as markets such as India consume more jewellery; and as gold supply remains quite constrained.

Gold producers will enjoy fat earnings if the rise proves sustainable. Consider a producer that has cash costs of, say, $A700 an ounce, against a gold price higher than $A1500. Thats a huge profit margin and enough to bring some previous uneconomic projects back to life, and to see more dividends paid. It could be a sweet spot for gold as a weakening global economy lessens the industrys cost pressure, while more quantitative easing to boost economies encourages a higher gold price.

The safe haven that surprises

However, even though the odds favour higher prices in the next few years, remember that gold can go through long downturns and should always be considered speculative. That sounds like a contradiction for a safe haven but in this market nothing surprises.

Follow us on Facebook and Twitter

You can follow Smart Investor on Twitter: @smartinvestr (this is the correct spelling for us on Twitter) and on Facebook at facebook.com/afrsmartinvestor