How To Inflation Proof Your Portfolio With ETFs

Post on: 28 Март, 2015 No Comment

Inflation is a sneaky pickpocket that slinks into your wallet in the form of higher prices on food, gas and other necessities, quietly robbing you of wealth.

Its the invisible tax or the hole in your water bucket. Because of this, investors are becoming increasingly attentive to the evolving inflation story.

What many investors dont know, however, is the Federal Reserves dirty little inflation secret. When the Fed reports on inflation, it reports on core inflation, a calculation that excludes food and energy costs.

The Fed has not always calculated inflation in this way. In February of 2000, the Federal Reserve rejected its old method of calculating inflation, which included food and energy, in favour of this new core inflation method, claiming that highly volatile food and energy prices made their influence impractical in determining monetary policy.

When you hear of the inflation rates of the late 70s for instance, you are hearing about a number that included food and energy, whereas todays number is skewed lower. Similar to how unemployment calculations have been skewed lower, using the 1970s method, both inflation and unemployment are higher today than most people realise.

The Fed has clearly revealed it wants inflation that is high enough to globally weaken the U.S. dollar, promote exports, and debase U.S. debt, but also low enough to keep investor confidence high and the economy moving forward. Fed chair Ben Bernanke has stated that the Fed is looking to stoke inflation to a rate of around 2 per cent a year.

Unfortunately, inflation is not so easy to control. Inflation has a history of suddenly lurching out of control. Like a careening car that unexpectedly fishtails to one side, driver overcorrection will suddenly send the car dramatically sliding in the opposite direction and potentially out of control. Knowing this, the Fed wants to keep investors calm regarding the inflation story. Just last week, Bernanke suggested that inflation is not a threat and that the U.S. base interest rate will stay close to zero for an extended period.

What does this mean for you? Historically, developed economies have maintained an inflation rate of around 2 per cent, while emerging economies have maintained a blended rate of around 6 per cent. Strangely, these same economies tend to grow at similar rates as well.

People who live in emerging economies spend approximately 50 per cent of their income on food and energy. In developed economies like the U.S. that drops to around 20 per cent. Essentially, the poorer you are, the more your dollars must go to basic needs like food and energy. For the poor, their inflation tax goes up. Sadly, recent inflation of food, energy, and other basic commodities coupled with the deflation of the U.S. dollar is hitting many Americans harder than they may realise.

[For more investing and money advice, visit U.S. News Money. or find us on Facebook or Twitter .]

To respond to the inflation threat, every retirement portfolio needs to be inflation proofed. Start by allocating a part of your portfolio to Treasury Inflation-Protected Securities (TIPS). TIPS pay a stated dividend and also add the Consumer Price Index rate—a common measure of inflation—to the underlying value (PAR value) of the bond bi-annually.

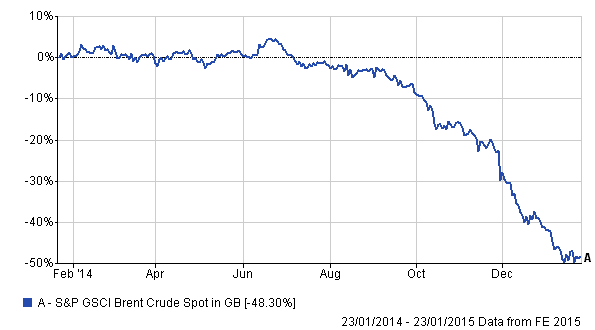

Additionally, by adding exchange-traded funds like iShares S&P Global Energy (symbol IXC), iShares Dow Jones US Oil & Gas Ex Index (IEO), and iShares Dow Jones US Oil Equipment Index (IEZ) to your portfolio, you gain diversification to more than 300 companies impacted by the price of oil and gas.

Finally, add some precious metal exposure to your portfolio though ETFs like SPDR Gold Shares (GLD) or iShares Silver Trust (SLV), both of which will give you low-cost exposure to gold and silver. Beware of farming and food related ETFs because they involve futures contracts and are unpredictable.

But before you run out and turn your entire portfolio into an inflation hedge, remember that like inflation, deflation is also an ever-present risk. Just as quickly as the economy can careen toward inflation, a sudden overcorrection by the Fed can send the economy sliding wildly towards deflation.

Through global diversification and disciplined rebalancing, you can get the inflation pickpocket out of your wallet and rest assured that no matter which way the economy slides, you stand prepared to emerge a winner.

Steve Beck is cofounder of MarketRiders. an online investment advisory and management service helping Americans invest for retirement. MarketRiders gives investors greater peace of mind knowing that they are leveraging the best thinking of Nobel laureates and the investing methods used by the worlds most elite institutions and wealthiest families. MarketRiders is on the investors side, helping reduce investment costs and risks, and increasing retirement savings.