How To Hedge Against Inflation With ETFs SPDR Gold Trust iShares Silver Trust ETFS Physical

Post on: 29 Май, 2015 No Comment

Have you ever wondered how billionaires continue to get RICHER, while the rest of the world is struggling?

I study billionaires for a living. To be more specific, I study how these investors generate such huge and consistent profits in the stock markets — year-in and year-out.

CLICK HERE to get your Free E-Book, “The Little Black Book Of Billionaires Secrets”

The report states, Countries with high debt loads are vulnerable to an adverse feedback loop in which doubts by lenders lead to higher sovereign interest rates, which in turn make the debt problems more severe Countries with debt above 80% of GDP and persistent current-account deficits are vulnerable to a rapid fiscal deterioration as a result of these tipping-point dynamics.

The authors of the report estimate U.S. net debt, excluding debt held by the Social Security Trust Fund, at about 80% of GDP in 2011, double what it was a few years before. To make matters worse, the United States runs a persistent current account deficit, which is funded by borrowing from other countries.

This puts the U.S. in a worse spot than Japan which, although its debt is much higher as a percentage of GDP, has a large current account surplus and a high savings rate.

Will Politicians Make a Deal Before its Too Late?

The report notes that, despite record amounts of government debt, interest rates remain near all-time lows. That is due to the Feds quantitative easing policy, which has artificially held down interest rates by purchasing long-term Treasury notes and mortgage-backed securities (MBS) from its member banks.

This cannot continue indefinitely. Unless Congress can get a grip on spending, the United States faces the risk of fiscal dominance where the Fed will be forced to fund the fiscal deficit through inflation.

As we pointed out on Thursday, the Fed is buying $85 billion a month in Treasury notes and mortgage-backed securities from its member banks each month. The Fed also pays its member banks interest on the excess reserves they hold at the Fed.

Mishkin argues that the Fed is incentivizing the banks to keep excess reserves at the Fed to prevent that money from increasing the money supply and igniting inflation.

We have argued that, under the Feds zero-interest-rate policy (ZIRP), banks are unable to charge enough interest to cover the risk of lending money to businesses and consumers so they are happy to keep their money as excess reserves at the Fed.

Either way, the result is the same. The Fed is buying long-term debt from the banks and exchanging it for overnight money.

Any swap of long-term for short-term debt in fact makes the government more vulnerable to a fiscal crunch, namely, more vulnerable to a self-fulfilling flight from government debt, or in the case of the U.S. to a self-fulfilling flight from the dollar, the report stated.

Why the Government Makes Money Off of the Fed

The expansion of the Feds balance sheet through quantitative easing means the central bank earns a lot of money $88.9 billion in 2012 in interest, which it passes on to the government. If the Fed decides to end quantitative easing, its balance sheet will shrink and, assuming interest rates do not rise much, the Feds contribution to the national budget will decline.

Mishkin and his co-authors argue the Fed could come under pressure from Congress to slow or delay the end of quantitative easing so the revenue from the Feds bloated balance sheet will not decline.

If the federal government continues to pile up debt, then the Fed will be forced to monetize the debt create new money to buy new government debt or else interest rates could move sharply higher.

As interest rates rise, more of the federal budget will have to go toward paying interest on the growing debt, leaving less for everything else and increasing the risk of default.

Remember, as interest rates rise, bond prices fall. That means the Fed will be booking losses on all the Treasury notes and mortgage-backed securities it has purchased so far. The reports authors fear these losses could even exceed the Feds capital.

For any other bank, that would mean bankruptcy. However, the Fed can create as much money as it needs. But that is monetization and that is likely to ignite runaway inflation and a flight away from the dollar.

How to Hedge Against Inflation

Unless you trust Congress to get its act together and come up with a long-term plan to bring spending under control, your best bet is to hedge against inflation by buying gold or other hard assets and selling short long-term U.S. Treasury notes.

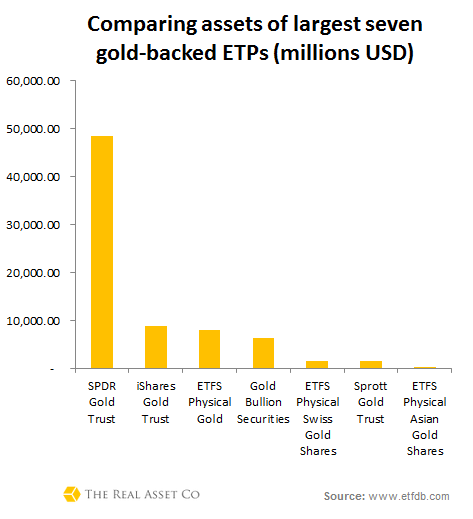

The SDPR Gold Trust (NYSEARCA:GLD) is trading just above major support around the $150 level, which could be a good entry point. Other precious metals, including silver through the iShares Silver Trust (NYSEARCA:SLV) or platinum though the ETFS Physical Platinum Shares (NYSEARCA:PPLT), would be good alternatives.

To short long-term U.S. Treasury notes, there are a number of ETFs that trade inversely to long-term Treasuries, including ProShares Short 20+ Year Treasury ETF (NYSEARCA:TBF), which goes up when long-term U.S. Treasury notes go down in price (up in yield).

The ProShares Ultra Short 20+ Treasury ETF (NYSEARCA:TBT) is a leveraged ETF that aims for twice the return of TBF. Direxion Daily 20+ Year Treasury Bear 3x Shares (NYSEARCA:TMV) seeks three times the inverse return on the NYSE 20+ Year Treasury Bond Index.

Written By Jeff Uscher For Money Morning

We’re in the midst of the greatest investing boom in almost 60 years. And rest assured – this boom is not about to end anytime soon. You see, the flattening of the world continues to spawn new markets worth trillions of dollars; new customers that measure in the billions; an insatiable global demand for basic resources that’s growing exponentially; and a technological revolution even in the most distant markets on the planet.And Money Morning is here to help investors profit handsomely on this seismic shift in the global economy. In fact, we believe this is where the only real fortunes will be made in the months and years to come.