How to construct a hIgh income lower risk portfolio using CEFs

Post on: 15 Май, 2015 No Comment

A version of this post was published on Seeking Alpha.

Summary

- A high income portfolio was constructed based on the constituents of the ISE High Income Index.

- Over the entire bear-bull cycle, the high income CEF portfolio outperformed the S&P 500 on a risk-adjusted basis.

- Over the past 5 years, the high income CEF portfolio generated a higher return with less risk than the S&P 500.

ISE High Income Index

As a retiree, I am always looking for new income opportunities. Thus I was fascinated when I read Lance Brofmans article on a new Exchange Traded Note (ETN) that was paying almost 18%. The ETN was the UBS ETRACS Monthly Pay 2xLeverageed Closed End Fund (CEFL) . This ETN is based on the ISE High Income Index that is comprised of 30 Closed End Funds (CEFs) that are selected based on their yield, discount, and liquidity. The objective of the ETN is to generate twice the income that you would receive from a portfolio of the CEFs making up the index.

Because the ETN had only a short history (it was launched last December), I was not interested in adding this ETN to my portfolio. However, I was intrigued by the ISE High Income Index and wanted to assess if the components of the index might be a good source of high income CEF ideas. The index composition is reviewed annually for eligibility and weights. I will use the index as it was constituted on 2 January of this year.

Since risk is as important to me as return, I assessed each component of the index in terms of reward versus risk, where I equated risk with volatility. To facilitate the analysis, I partitioned the index into three groups as follows: 12 covered call funds, 12 fixed income and preferred stock funds, and 6 funds that do not fall into the first two groups. Since I wanted to analyze performance over a complete market cycle, I excluded funds that were launched after October 12, 2007 (the start of the 2008 bear market). The CEFs in each grouping are summarized below.

Covered Call Funds.

The following CEFs invest primarily in common stock and use a covered call or option strategy to enhance income.

- BlackRock Enhanced Equity Dividend (BDJ). This fund sells for a 12.9% discount, does not use leverage, has an expense ratio of 0.9%, and has a distribution of 7%. It has 93 holdings, all domiciled within the U.S.

- BlackRock International Growth and Income (BGY). This fund sells for a discount of 9.5%, does not use leverage, has a 1.1% expense ratio, and has a distribution of 8.2%. It has 111 holdings, with 97% domiciled outside the U.S. Geographically, the U.K accounts for 19% of total assets, Japan 12%, and Switzerland representing 9% of assets.

- BlackRock Global Opportunities (BOE ). This fund sells at an 11.8% discount, does not use leverage, has an expense ratio of 1.1%, and a distribution of 8.4%. It has 117 holdings, with 47% domiciled within the U.S.

- BlackRock Enhanced Capital and Income (CII ). This fund sells at a discount of 8.9%, does not use leverage, has an expense ratio of 0.9%, and a distribution of 8.4%. It has 66 holdings, all domiciled within the U.S.

- ING Global Equity dividend and Premium Opportunities (IGD). This fund sells for a discount of 9.4%, does not use leverage, has an expense ratio of 1.2%, and has a distribution of 10%. It has 119 holdings with 42% domiciled in the U.S.

- EV Tax-Managed Global Dividend Equity Income (EXG). This fund sells for a 7.3% discount, does not use leverage, has a 1.1% expense ratio, and has a 9.6% distribution. It has 133 holdings, with 41% domiciled in the U.S and the rest primarily in Europe.

- EV Risk-Managed Diversified Equity Income (ETJ). This fund sells for a 10.2% discount, does not use leverage, has a 1.1% expense ratio, and has a 9.9% distribution. It has 83 holdings, all domiciled in the U.S.

- EV Tax Managed Buy-Write Opportunities (ETV ). This fund sells at a discount of 9.3%, does not use leverage, has an expense ratio of 1.1%, and has a distribution of 9.1%. It has 208 holdings, all domiciled in the U.S. About 34% of the portfolio is from the information technology sector

- EV Tax Managed Global Buy-Write Opportunities (ETW). This fund sells at a discount of 7.1%, does not use leverage, has an expense ratio of 1.1%, and has a distribution of 9.6%. It has 455 holdings, with 52% domiciled in the U.S.

- EV Tax-Managed Dividend Equity Income (ETY). This fund sells for a discount of 9.3%, does not use leverage, has an expense ratio of 1.1%, and has a distribution of 9.1%. It has 131 holdings with 75% domiciled in the U.S. and the rest international

- NFJ Dividend Interest and Premium (NFJ). This fund sells for a discount of 2%, does not use leverage, has an expense ratio of 1%, and a distribution of 9.9%. It has 155 holding with 72% equities and 26% convertible bonds. Most (87%) of the portfolio is in securities domiciled within North America.

- Nuveen Equity Premium Opportunities (JSN). This fund sells at a 7.3% discount, does not use leverage, has a 1% expense ratio, and a distribution of 8.1%. It has 223 holdings, all domiciled within the U.S.

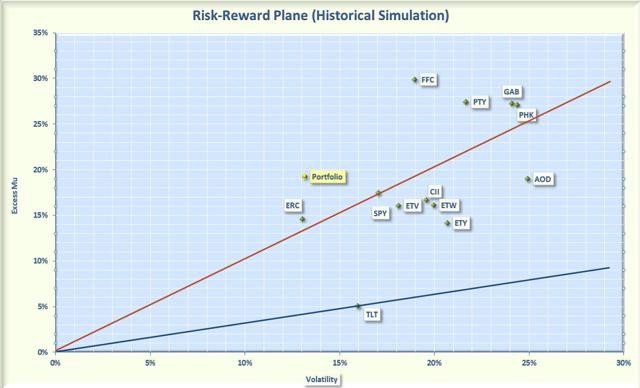

These funds have an average distribution of a whopping 8.9% so they definitely satisfy my desire for high income but how about the risk? To assess reward versus reward I utilized the Smartfolio 3 program (www.smartfolio.com ) to plot the rate of return in excess of the risk free rate (called Excess Mu on the charts) versus the volatility of each stock. The results are shown in Figure 1 for a look-back period from October 12, 2007 to now. To compare the performance to the overall stock market, I used the SPDR S&P 500 (SPY) ETF as a reference.

Figure 1: Covered Call Reward and Risk Over Cycle (click to expand)

The figure indicates that there has been a wide range of returns and volatilities associated with covered call funds. For example, ETV had the highest return but also had a relatively high volatility. Was the increased return worth the increased risk? To answer this question, I calculated the Sharpe Ratio for each fund.

The Sharpe Ratio is a metric, developed by Nobel laureate William Sharpe that measures risk-adjusted performance. It is calculated as the ratio of the excess return over the volatility. This reward-to-risk ratio (assuming that risk is measured by volatility) is a good way to compare peers to assess if higher returns are due to superior investment performance or from taking additional risk. On the figure, I also plotted a red line that represents the Sharpe Ratio of SPY. If an asset is above the line, it has a higher Sharpe Ratio than SPY, which means it has a higher risk-adjusted return than the S&P 500. Conversely, if an asset is below the line, the reward-to-risk is worse than SPY.

Some interesting observations are apparent from the plot. Over the bear-bull cycle from 2007, over half the covered call CEFs outperformed the S&P 500 on a risk-adjusted basis. The best performer was ETV, likely because of its emphasis on technology stocks. Other top performers included three more Eaton Vance funds (ETW, ETY, and EXG) as well as funds from BlackRock (CII), Nuveen (JSN), and NFJ. ETJ was the least volatile but also had one of the poorest returns so it lagged on a risk-adjusted basis.

I also calculated the correlation matrix for these funds and somewhat surprisingly found that these funds are only moderately correlated with one another, with correlations ranging from 50% to 80%. ETJ was the least correlated with the other funds with correlations in the 50% to 60% range.

Fixed Income and Preferred Stock Funds.

The following CEFs invest primarily in corporate and Government bonds as well as preferred stocks.

- Aberdeen Asia-Pacific Income (FAX). This fund sells for a 9.5% discount, utilizes 25% leverage, has an expense ratio of 1.5%, and has a distribution of 6.9%. It has 256 holdings, split about 50/50 between corporate and Government bonds. All the bonds are from the Asia Pacific region and about 85% are investment grade.

- BlackRock Multi-Sector Income (BIT). The fund sells for a discount of 10.4%, employs 43% leverage, has an expense ratio of 1.2%, and has a distribution rate of 7.9%. It has 416 holdings, split about equally between corporate bonds and asset backed bonds. Almost all (99%) of the securities are domiciled outside the U.S. This fund was not included in my analysis since it was launched in February 2013 and does not have a long history.

- BlackRock Credit Allocation Income (BTZ). The fund sells for an 11.6% discount, uses 33% leverage, has an expense ratio of 1.2%, and has a distribution of 7.9%. It has 534 holdings, all domiciled within the U.S, with 76% in bonds and 13% in preferred shared. About 60% of the bonds are investment grade.

- Cohen & Steers Limited Duration Preferred and Income (LDP). This fund sells at a 9% discount, utilizes 30% leverage, has an expense ratio of 1.7%, and has a distribution of 7.8%. It has 120 holding, with 96% in preferred stock, all domiciled within the U.S. This fund was not included in my analysis since it was launched in July 2012 and does not have a long history

- EV Limited Duration Income (EVV). This fund sells for a 7.5% discount, uses 35% leverage, has an expense ratio of 1.6%, and has a distribution rate of 7.9%. It has 1666 holdings, with 39% in senior loans, 36% in corporate debt, and 23% in mortgage debt. About 90% of the securities are domiciled in the U.S.

- Flaherty & Crumrine Preferred Securities (FFC). The fund sells at a premium of 1.8%, utilizes 35% leverage, has an expense ratio of 1.6%, and has a distribution of 8.4%. It has 135 holdings, with 92% in preferred stock, all domiciled within the U.S.

- MFS Intermediate Income (MIN). The fund sells at a discount of 7.3%, does not utilize leverage, has a low expense ratio of 0.7%, and has a distribution of 9.1%. It has 351 holdings, with 66% in corporate bonds and 23% in short and mid-term Government bonds. Only 3% of the holdings are domiciled in the U.S. and 95% of the holdings are investment grade.

- Pimco Income Strategy II (PFN). This fund sells for a discount of 3.2%, utilizes 21% leverage, has an expense ratio of 1.2%, and has a distribution of 9.3%. It has 196 holdings, with 29% invested in asset backed bonds, 26% in corporate bonds, and 20% municipal bonds. About 56% of the holdings are investment grade.

- Pimco High Income (PHK). This fund sells for a huge premium of 51%, utilizes 30% leverage, has an expense ratio of 1.1%, and has a high distribution rate of 11.6%, with most of the distribution coming from income. This fund has a history of large premiums, with the 52 week average premium at 46%. It has 286 holdings, with 41% in municipal bonds, 32% in Government bonds, and 28% in corporate bonds. About 56% of the holdings are investment grade.

- Pimco Corporate & Income Opportunity (PTY). This fund sells at an 18% premium, utilizes 22% leverage, has an expense ratio of 0.9%, and has a distribution rate of 8.6%. It has 269 holdings, with 45% in asset backed bonds and 21% in corporate bonds. About 47% of the assets are investment grade.

- Western Asset Emerging Markets Debt (ESD). This fund sells for a discount of 11.5%, utilizes 8% leverage, has an expense ratio of 1%, and has a distribution of 8.3%. It invests primarily in emerging market debt securities and has 186 holdings, with 50% in Government bonds, 42% in corporate bonds, and 5% in convertibles. About 75% of the holdings are investment grade.

- Wells Fargo Advantage Multi-Securities Income (ERC). The fund sells for an 11.1% discount, utilizes 25% leverage, has an expense ratio of 1.3%, and has a distribution of 8.2%. It has 698 holdings, with 50% in corporate bonds, 22% in Government bonds, and 14% in senior loans.

These fixed income and preferred stock funds also qualify as high income, with an average distribution of 8.6%. The reward versus risk associated with these funds is plotted in Figure 2, again using the period from October 12, 2007 to now. To compare the performance to the with other fixed income investments, I used the iShares 20+ Year Treasury Bond (TLT) ETF as a reference. In the figure, the blue line represents the Sharpe Ratio associated with TLT.

Figure 2: Fixed Income/Preferred Reward and Risk Over Cycle (click to expand0

About 5 of the CEFs in this category had comparable or better risk-adjusted returns when compared with TLT. The three largest volatility CEFs also had the highest returns, indicating that the risk was commensurate with reward. Only one of the CEFs (MIN) had volatility less than TLT and the reward was also slightly less than TLT. ERC also had a risk-adjusted return similar to TLT. Of these funds, PFN and BTZ lagged over the period of interest.

All of these CEFs were negatively correlated with TLT, indicating that they provided good diversification for a fixed income portfolio. Among themselves, the CEFs were only moderately correlated with one another, with correlations typically ranging from 50% to 60%.

Other Funds in the ISE High Income Index .

The following 6 CEFs did not fall into the first two categories.

- Alpine Total Dynamic Dividend (AOD). This CEF invests in global equity securities. It has 127 holdings, with 59% domiciled in North America. The fund sells at a discount of 14.9%, uses less than 1% leverage, has an expense ratio of 1.2%, and has a distribution of 8%.

- BlackRock Real Asset Equity (BCF). This CEF invests securities and derivatives associated with energy, natural resources, and basic materials. It also enhances income by using an option strategy. Because of the narrow focus, I placed this CEF in the “other” category even though it uses an option strategy. This fund has 99 holdings, with 74% domiciled in North America. The fund sells at a discount of 11.3%, does not utilize leverage, has an expense ratio of 1.3%, and has a distribution of 7.8%.

- BlackRock Resources and Commodity (BCX). This CEF invests in equities, related to the commodities markets. It holds 49 global securities, including oil, chemicals, and basic materials. About 61% of the assets are domiciled in North America. The fund sells at a 13.8% discount, does not use leverage, has an expense ratio of 1.3%, and has a distribution of 7.95. This fund was not included in my analysis since it was launched in March, 2011 and does not have a long history

- GAMCO Global Gold and Natural Resources and Income (GGN). This CEF invests in gold and natural resource stocks and enhances income by using an option strategy. Because of the narrow focus, I placed this CEF in the “other” category even though it uses an option strategy. It has 120 holdings, with 74% in North America. The fund sells at a 2.6% discount, uses 8% leverage, has an expense ratio of 1.4%, and has a distribution of 10.4%.

- Gabelli Equity Trust (GAB). This CEF invests In common stock and has 404 holdings. It sells at a premium of 7.2%, uses 20% leverage, has an expense ratio of 1.4%, and has a distribution of 7.9%.

- Nuveen Diversified Currency Opportunities (JGT ). This CEF invests in short duration global bonds, forward currency contracts, and other types of derivatives. It has 107 holdings. It sells at a discount of 15.9%, does not utilize leverage, has an expense ratio of 1%, and has a distribution of 8.1%.

This set of CEFs has an average distribution of 8.4%. The reward versus risk associated with these funds is plotted in Figure 3, again using the period from October 12, 2007 to now. To compare the performance to the overall stock market, I used SPY as a reference and the red line represents the Sharpe Ratio associated with SPY.

Figure 3: Reward and Risk Over Cycle for Other CEFs (click to expand)

Among the other CEFs, only two (GAB and AOD) had better risk-adjusted performance than SPY. The other CEFs lagged SPY and GGN had a slightly negative return over the period.

High Income Portfolio

Using the ISE High Income Index as my basis, I chose 10 of the best performing CEFs for my portfolio. Note: I realize that this is a form of curve fitting but I felt it would be interesting to see performance data. I chose 4 CEFs (PTY, FFC, PHK, and ERC) from the Covered Call category, 4 CEFs (ETV, ETW, CII, and ETY) from the fixed income and preferred category, and 2 CEFs (GAB and AOD) from the Other category. I weighted each CEF equally and the risks versus reward results over the bear-bull cycle are shown in Figure 4. The composite risk and reward for the portfolio is depicted by the yellow dot.

As the figure illustrates, over the entire bear-bull cycle since October, 2007, the composite portfolio has outperformed both TLT and SPY on a risk-adjusted basis. The composite portfolio has a return significantly better than SPY and has generated this return with less risk.

It is also interesting to note that TLT had a better risk-adjusted return than SPY over this cycle. As you may remember, TLT was one of the few assets that did well during the 2008 bear market. All the CEFs also had a better risk-adjusted return than SPY, which is not surprising given the way the CEFs were selected.

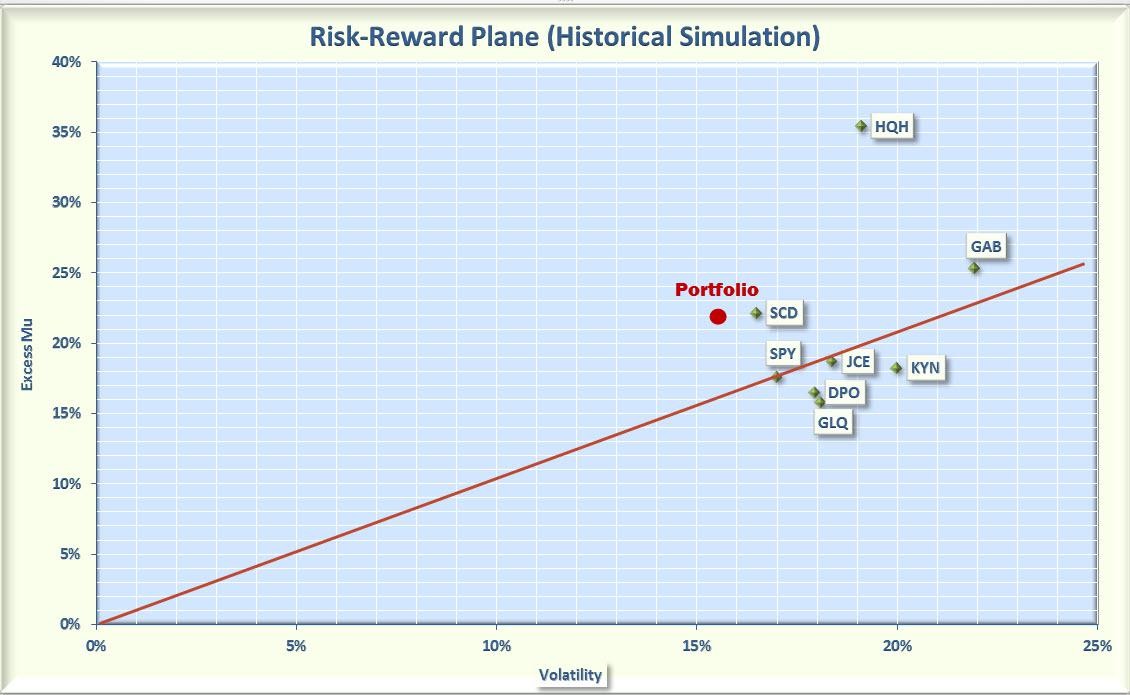

High Income Portfolio in Bull Market

This composite CEF portfolio performed well over a cycle that included a severe bear market as well as a rip-roaring bull market. I next wanted to assess what would happen if I limited the look-back period to the past 5 years, when the bull market was in full force. This data is shown in Figure 5 for the 5 year period from April, 2009 to the present.

Figure 5: Reward and Risk for High Income portfolio (5 years) (click to expand)

This figure illustrates that this portfolio still significantly outperformed the SPY over the period when the S&P 500 was in a strong uptrend. During this period, the composite portfolio actually generated a higher return with less risk than the SPY, a very robust portfolio performance.

No one knows what the future will hold, but investors looking for high income without excessive risk should consider this composite CEF portfolio.