How to Compare and Evaluate Online Brokers

Post on: 28 Март, 2015 No Comment

There are a lot of options available to someone looking for an online stock broker. Most of these brokers are cost–competitive and there are many things you have to keep in mind when selecting the right broker for you. Here are some key things to consider when evaluating an online broker.

How to Evaluate Online Brokers

Cost: This is the most important factor and you need to compare the cost of transactions across certain categories such as:

- Market or Limit Trade

- Options Trade

- Automatic Investing

- Buying No Load Mutual Funds

- ETFs

Tools and services. Compare the tools and services offered by brokerages, including educational and training resources, advanced tracking, real time quotes, cost basis tracking for taxes, and other tools.

Price of Assisted Trades: Some brokers charge you extra if you call up and place an order. If you intend to call up and trade, then make sure you find out what they charge on phone trades.

Account Minimums and Differential Pricing: Some brokers require you to keep a minimum balance and then still others would charge you a lower price if you maintain a certain balance or trade above a certain number. For example, E*Trade charges $9.99 per trade. or $7.99 when you make at least 150 trades per quarter.

Inactivity Fee: Some brokers charge you inactivity fee if you don’t trade for a quarter or sometimes even a month. If you are not a regular trader – watch out for the inactivity fee.

Dividend Reinvestment Plans: Some brokers allow you to reinvest dividends and hold fractional shares in a company. This helps you gain the benefits of compounding your dividend returns over longer periods of time.

Automatic Investments: If you are not a market timer and are happy to invest a certain amount in fixed securities recursively, then you need to find out whether the broker offers you the convenience of automatic investment. You can select a schedule and the broker will automatically execute your trade according to that schedule.

Availability of Certain ETFs: For a long time, I assumed that you can buy any ETF through any broker. I was surprised to see that there were certain ETFs that weren’t available through my broker. If you like to research and buy stocks and funds of a slightly exotic nature – like something that replicates the Australian Dollar or Gold funds. then you will need to find whether your broker offers such funds or not.

Customer Service: Read reviews about the brokers you are screening and read about people’s experiences in dealing with them. Reading reviews on forums sometimes gives valuable insight about how a broker really acts, when you need them.

Promotional Offers: Some brokers give you cash back if you switch to them from some other broker. If you already have an account and are looking to move to another broker, then be sure to check out the rewards for moving out. Here are some brokerage coupon and promo codes that can get you some free trades or free bonus money when you open a new account.

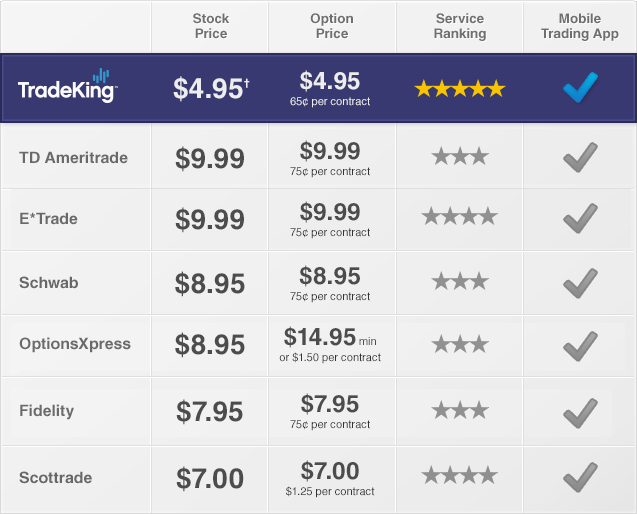

TradeKing will reimburse new customers up to $150 to transfer their assets to TradeKing. Be sure to visit the the TradeKing site for more information about the TradeKing Asset Transfer program. or click the picture below for more information.

Special Rebates: Sharebuilder has certain special rebates for Costco Members and so if you have a certain membership already and a broker gives you some special offers on that – be sure to compare the brokers in this new light.

Choose your brokerage base on your needs, not a catchy slogan

These are some factors that I think are important to consider while selecting a broker. Different users will have different needs and based on what is important to you – evaluate the various brokerages that offer their services.