How to Calculate the Book Value of a Company

Post on: 16 Март, 2015 No Comment

Instructions

Download the companys most recent annual report from the Securities and Exchange Commission website (see Resources) or the company’s website, if it makes it available there. At the SEC site, select the Search for Company Filings link, enter the companys ticker symbol and search for the most recent Form 10-K, which is the annual report.

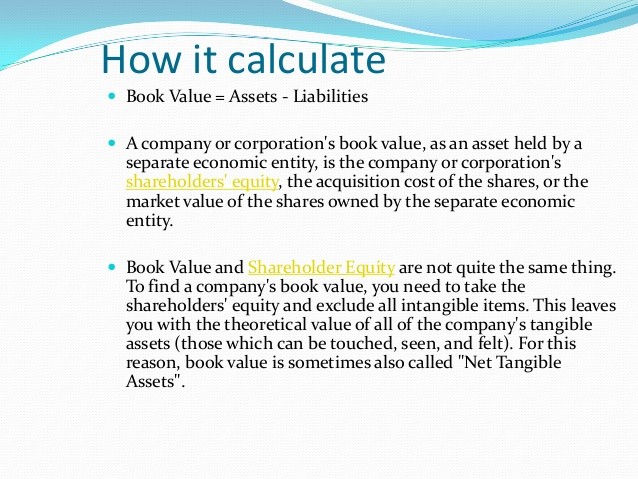

Subtract the reported value of the companys intangible assets from the stated value of all of the companys assets. Intangible assets include such things as trademarks, patents, brand names and goodwill. Because intangibles are so difficult to place an objective value on, they’re usually left out of book value calculations. The result of this step is the company’s tangible asset value.

References

Resources

More Like This

How to Calculate Book Value Per Share

How to Calculate Book Value Per Share of Common Stock

You May Also Like

Net book value is a key figure for many investors. Since it's the closest estimate of the company's underlying value — both.

Because financial data such as company balance sheets and income statements are readily available on the Internet and from various financial news.

In the world of accounting and finance assets tend to have two different values: book value and market value. Market value is.

How to Calculate Car Values. A car is an investment and it can be a gamble just like the stock market.

The book value of a company's equity (for investment research) is the same as stockholder's equity. How to Calculate Book Value.

The book value refers to the carrying value of an asset, liability or the entire business. It is based on historical costs.

Ascertain the Book value of a company. Book value is the price of an asset minus any depreciation that is declared. The.

Determining the value of a book is not as difficult as it may seem. It's very similar to trying to find the.

How to Calculate the Book Value of a Company. A company's book value represents the excess of the company's assets over its.

The value of a companys stock is ultimately determined on the stock market by how much investors are willing to pay for.

The book value of a business is the difference between the total tangible assets and the total liabilities, as presented on the.

How to Calculate the Book Value of a Company. A company's book value represents the excess of the company's assets over its.

The carrying value, or book value, of an item is related to business accounting. Accountants record the value of items based on.