How leveraged ETfs are handling volatility

Post on: 16 Март, 2015 No Comment

IanSalisbury

—As market gets rocky, leveraged funds can lag

—Some top funds perform well in wake of U.S. downgrade

—Over longer periods, returns look iffy

NEW YORK (MarketWatch) — For investors that hold leveraged exchange-traded funds, rocky markets can be a top concern. That’s because the complex math behind the funds’ investment strategies leads to a phenomenon known as volatility drag.

The upshot: When markets yo-yo as they have over the past several weeks, both bullish and bearish funds can lose value, regardless of where prices eventually end up.

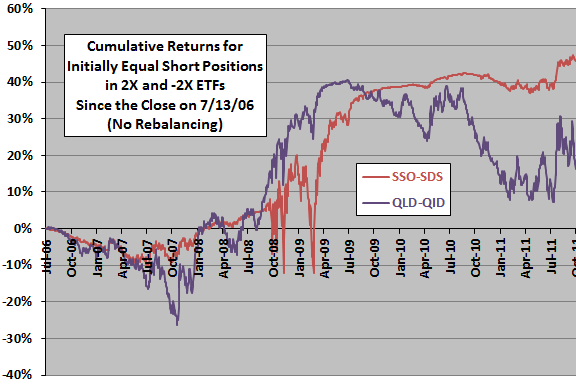

Leveraged ETFs, which help investors magnify market bets or bet against certain corners of the market, first appeared in 2006 and quickly became investor favorites, collecting about $30 billion in assets, according to Morningstar Inc. The financial crisis brought criticism from the press and regulators, however. At first blush, plunging stock prices seemed like a moment for some funds—those that magnify negative bets —to shine. In fact, the effect of the market’s gyrations on the way funds compound daily returns, turned potential gains into losses over long periods.

ETF firms that oversee funds responded with increased efforts to educate investors, emphasizing the funds’ target returns only over a single day. While investors may find it useful to hold them longer, they do so at their own risk. With volatile markets back, Dow Jones asked Morningstar Inc. for the returns of five popular leveraged exchange-traded funds and their benchmarks, to see how they’re faring this time around.

The results are mixed. For short-term investors—perhaps someone looking for a buffer against immediate stock-market losses in the wake of Standard & Poor’s Aug. 5 U.S. Treasury downgrade—the funds have performed relatively well. However, such an investor would need impeccable timing. Over longer periods—a year or more—returns look much less reliable.

For instance, worries about the economy sent the Standard & Poor’s 500 down 6.15% over that past four weeks through Monday. ProsShares UltraShort S&P 500 ETF SDS, -2.54% designed to rise 2% on a day when the benchmark falls 1% ideally would have climbed 12.3% in that time. In reality, the ETF delivered some but not all of the returns investors might have hoped for, gaining 7.12%. Over three years things look less rosy. The S&P 500 has been relatively flat, rising about 0.3%. The fund has posted big losses, declining nearly 25%.

Both ProShares Group and Direxion Shares, the two largest sponsors of leveraged ETFs, emphasize their funds are designed to deliver stated returns over only a single day. They believe most investors hold the funds for short periods. The companies also note that, while volatile markets can crimp funds’ returns, trending markets, such as those that produce a steady stream of up or down days, can make leveraged ETFs perform better than their stated strategies might suggest, in a reverse of the volatility drag effect.

Low volatility can help, says Direxion Portfolio Manager Paul Bergandi.

www.djnewsplus.com/docs/Comparing-ETF-returns.gif