How a Strong Dollar Affects Investors At A Glance

Post on: 11 Май, 2015 No Comment

Is a strong dollar a good thing for the U.S. markets—and your investments? We asked the Experts t o weigh in on how investors should think about a rising dollar.

This discussion relates to the latest Wall Street Journal Investing in Funds & ETFs report and formed the basis of a discussion on The Experts blog in December.

The Dollar’s Strength Cuts Both Ways for Investors

MICHELLE PERRY HIGGINS: The strength of the dollar is a double-edged sword, and it remains to be seen which edge is the sharper. The strong dollar speaks not so much to the strength of the U.S. economy, but to the continuing weakness in much of the rest of the world.

Our economy, while anemic by our standards, is still growing faster than those of Europe and much of the rest of the world, with the notable exception of China. When global investors look at the state of world economies, the U.S. stands out not only because it has solid, if unspectacular, growth, but also because it has a stable political and legal system. Hand-in-glove with the relative economic strength of the U.S. is a significant interest-rate differential, as the U.S. prepares to possibly increase rates next year while other countries and the European Union announce their willingness to pursue more monetary easing. Rising interest rates encourage more investment for fixed-income investors and supports the dollar. A strong dollar has the positive effect of putting a lid on inflation in the U.S. and putting more money in the pockets of consumers as imports become cheaper. This is especially true of commodities like gold and oil that are traded globally, largely in dollars.

However, the strong dollar is indeed a double-edged sword. It makes U.S. goods and services more expensive in comparison to the offerings of competitors. It also has the effect of reducing the value of corporate profits from overseas operations. This makes for a more challenging environment for U.S. companies and may ultimately end up negatively affecting their profit margins. With the profit margins of U.S. companies in record territory supporting stock market valuations, the strong dollar may well impact a number of large U.S. companies that compete in world markets.

Michelle Perry Higgins (@RetirementMPH ) is a financial planner and principal at California Financial Advisors.

How to Invest in a Strong-Dollar Environment

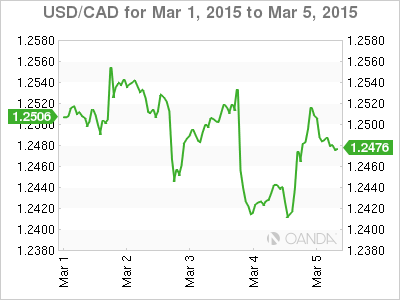

LARRY ZIMPLEMAN: There is no question that weve seen a strengthening dollar against virtually all other currencies. I’m not a currency “expert,” but in my view the likely reason for the strengthening dollar is due to the U.S. economy showing better gross-domestic-product growth than almost all other developed markets, and even better than many of the emerging markets that continue to struggle with consistent GDP growth. So in thinking about the likelihood of a rising dollar, one has to first think about whether the outperformance of the U.S. economy is likely to continue. While it will be difficult for the U.S. economy to “stand out” relative to all other global economies for long periods, it seems likely that the U.S. outperformance will continue into 2015.

So what would the continuation of a strong dollar mean for investors? It means you would want to keep most of your fixed-income investments invested in U.S. denominated assets (which is likely what you have today). If you invest in other currencies and the dollar continues to strengthen, it can detract from the return you will receive.

As for equities, it would mean you would want your U.S. equity exposure to continue to be at the higher end of your long-term asset allocation. For example, if you have a long-term allocation for equities to be 80% in the U.S. and 20% in international equities, you would want to be at least at the 80% level. Within the U.S. equity exposure, you might want to think about which U.S. domiciled companies are likely to benefit from a strong dollar, and which U.S. domiciled companies might be hurt more by a strong U.S. dollar. In general, U.S. companies with most of their business located in the U.S. will fare better by a strengthening U.S. dollar. U.S. companies that are large exporters will be hurt by the strengthening dollar.

However, for many investors, they really invest in mutual funds or commingled accounts vs. individual companies. In that case, you might think about investing a bit more in mid-cap and smaller-cap companies, where their business is more likely to be domestically focused. Larger-cap stocks are more likely to have greater proportions of their business in markets outside the U.S. where the strengthening dollar will reduce returns.

Ultimately, while you might want to give some thought to the impact of a strengthening dollar, it is likely to be more of a “second order” impact on returns when compared with the fundamental factors like the level of interest rates and the trends in corporate profitability.

Larry D. Zimpleman is chairman and chief executive officer of Principal Financial Group.

Why a Strong Dollar Is a Mixed Bag for Investors

CHARLES ROTBLUT: The U.S. dollar has strengthened, in part, because the U.S. economy is in better shape than that of many other countries. This had led to interest from foreign investors. The dollar is also benefiting from expectations of a tighter monetary policy stance by the Federal Reserve even as other central banks are focused on stimulating their economies.

For U.S. investors, the stronger dollar presents a mixed bag. It feels good from a patriotic standpoint. The stronger dollar makes it cheaper to travel abroad and lowers the cost of imported goods. It also increases U.S. consumer purchasing power. At the same time, a stronger dollar makes U.S. exports more expensive, hurting foreign demand. It also reduces the value of profits earned overseas.

The impact on individual investors’ portfolios is not clear. Companies with significant revenues recognized in foreign countries will likely see their profits hurt. On the other hand, to the extent that prices stay unchanged or fall in the U.S. consumer purchasing power will increase and the Federal Reserve will be able to maintain its accommodative stance with monetary policy for a longer period of time.

I personally do not factor currency fluctuations into my portfolio decisions. None of the rules for portfolios we run at AAII factor in currency fluctuations, either. It’s easy to identify macro factors influencing the strength or weakness of the dollar, but very difficult to predict what the greenback will actually do. I think it’s simply better to stay focused on the attributes of a particular investment and your long-term portfolio allocation than it is to make changes based on what you think may or may not happen to the U.S. dollar.

Charles Rotblut (@charlesrotblut ) is a vice president with the American Association of Individual Investors.

How to Take Advantage of a Rising Dollar

GREG MCBRIDE: Currencies rise, currencies fall, and depending on which side of the fence you sit on, it may be good or bad. For individuals, a stronger U.S. dollar makes imported goods cheaper and reduces the cost of overseas travel, but erodes the investment returns of any unhedged international investments, as well as undercutting the attractiveness of precious metals such as gold. If you have an export-dependent employer, chances are the boss isn’t particularly happy right now.

My feeling is that it is unproductive for individual investors to “time the market” of currency appreciation or depreciation by trying to get out of long-term holdings based on short-term movements. Instead, recognize the opportunities that lie in front of you.

Been weighing a trip to foreign shores? Consider doing so in an environment where the dollar goes further, particularly if you’d be loath to go if the dollar were appreciably weaker. Need to boost your international investment allocation? Overseas returns have ranged from “muted” to “beaten up” when converted back to U.S. dollars, so perhaps this is an attractive entry point. Your precious-metals allocation has undoubtedly been hammered in part due to the rising dollar, and with some rebalancing now in order, this could be an opportune time to add to those holdings.

While the landscape of an improving U.S. economy and the prospect of higher interest rates bode well for the U.S. dollar in the foreseeable future, rest assured that the wind will not continue blowing in the dollar’s direction forever.

Greg McBride (@BankrateGreg ) is senior vice president and chief financial analyst for Bankrate.com, providing analysis and advice on personal finance.