History’s lessons on recession and inflation 1930s or 1970s

Post on: 6 Июль, 2015 No Comment

Search form

Back to the ‘Thirties with a Twist

Barry Eichengreen 30 August 2008

One of the chief ways financial market participants make sense of events is by drawing parallels with the past. The subprime crisis, when it first erupted, was widely perceived as the most dangerous financial crisis since the 1930s. The implication was that it was critical to avoid the policy mistakes that transformed that earlier crisis into a macroeconomic disaster. Specifically, it was important to avoid an excessively tight monetary policy.

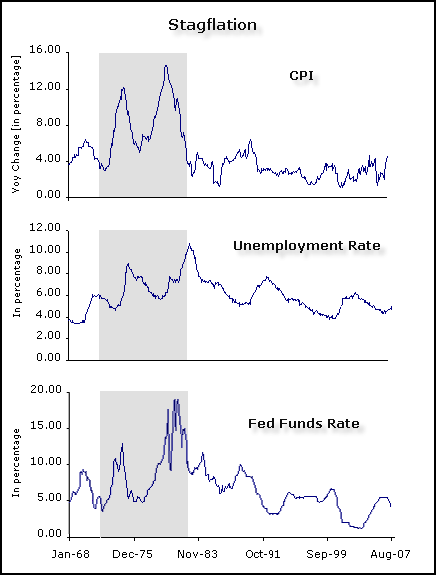

Now, with inflation surging, the popular parallel is not the deflationary 1930s but the stagflationary 1970s. Again the implication is that it is important for policymakers to avoid past mistakes. This time, however, past mistakes means a monetary policy that allows inflation expectations to become unanchored.

In fact both analogies are misleading, precisely because market participants and policy makers are aware of this history. Their awareness means that financial history never repeats itself in the same way. Biochemists can replicate their experiments because molecules do not learn. Central bankers lack this luxury.

In the 1930s the critical mistake was the Fed’s failure to recognize its lender-of-last-resort responsibilities. The result was not just financial distress but the collapse of the US price level, which fell by 21 per cent between 1929 and 1932. Since commodities, including food and oil, were demanded inelastically, their prices fell even faster than the overall price level, causing distress among primary producers.

And since other currencies were linked to the dollar by the fixed exchange rates of the gold standard, US deflation caused foreign deflation. As US demand weakened, other countries saw their currencies become overvalued. They were forced to raise interest rates in the teeth of a deflationary crisis. And by raising interest rates, foreign countries transmitted deflation back to the US. Only when they delinked from the dollar and allowed their currencies to depreciate did deflation subside.

The difference now is that the Fed knows this history. Indeed Mr. Bernanke wrote the book on the subject. 1 Seeing the analogy, Bernanke’s Fed responded to the subprime crisis with aggressive lender-of-last-resort operations. If anything, it may have been too impressed by the analogy.

The Fed’s mistake was cutting interest rates so dramatically when it expanded its credit facilities. Better would have been to lend freely at a penalty rate, a la Bagehot. Higher interest rates which made its emergency credit more costly would have meant better targeted lending and less inflation.

The Fed’s failure to respond this way means that other central banks managing their exchange rates against the dollar are importing inflation rather than deflation. Their currencies have become undervalued rather than overvalued. Their real interest rates having fallen, they are exporting inflation back to the US. Where global deflation led to the collapse of commodity prices in the 1930s, devastating commodity-exporting economies, our current inflation is having the opposite effect, primary producers being the principal beneficiaries this time around.

What is the solution? Emerging markets need tighten further to damp down inflation as I discuss more fully in my Vox column on Asia macro policies. They need to revalue against the dollar to fend off inflationary pressures emanating from the US, just as they needed to devalue in the 1930s to protect themselves against US deflation. We have seen small steps in the right direction, like the interest rate hikes taken by the Bank of Korea and Bank Indonesia in the last fortnight, but more needs to be done. 2

The Fed’s position is more difficult. If it now tightens, it risks compounding the recession. If it fails to do so, it risks undermining confidence and precipitating a dollar crash – which still could happen, relief rally of the last two weeks or not. Here at least the historical analogy is direct. In the 1930s the US needed expansionary policies to counter the Depression but worried that moving too aggressively would demoralize the markets and destabilize the dollar. FDR oversaw the process personally, setting the new dollar exchange rate each morning while taking breakfast in bed. In hindsight, his judgment looks sound. One hopes that history will judge the Fed as favorably.

James Bryce had it right when he wrote that the chief practical use of history is to deliver us from plausible but superficial historical analogies. Or as Mark Twain more prosaically put it, the past may not repeat itself, but it rhymes.

Editor’s note: A shortened version of this was first published in the Financial Times print edition.

1 See Ben Bernanke, Essays on the Great Depression. Princeton: Princeton University Press (2004).

2 A more nuanced version of these arguments, with specific recommendations for different countries, is Barry Eichengreen and Yung Chul Park, “Asia and the Decoupling Myth,” at emlab.berkeley..edu/