Hedging Using Contracts for Difference (CFDs)

Post on: 16 Март, 2015 No Comment

You already know that the one thing just as important (if not more) as making more money in the market is preserving and protecting what you already have. One way to do that is by hedging your earnings; more precisely, hedging your earnings using contracts for difference (or CFDs).

What Is Hedging?

Hedging is the defensive investment strategy of protecting your earnings from sudden and unexpected losses. It helps prevent you from either being forced out of a position or to sustain a loss. Perhaps the biggest advantage of hedging is that you dont have to hedge every trade you make, however, you can apply a hedge to just about any trade at any given time.

Hedging With Contracts for Difference

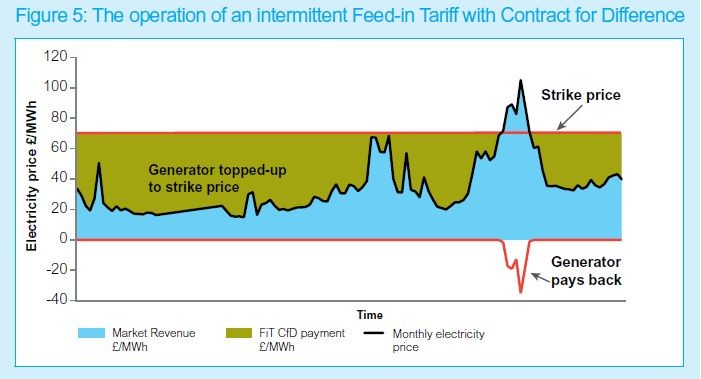

Contracts for difference (or CFDs) act as a form of insurance for investors. CFDs are tradable instruments that allow investors to create an agreement with a separate party, in order to swap the difference in value between the opening of a contract and the closing of the contract.

CFDs are used as a hedging strategy that can protect the total value of the share position while only having to pay a small percentage of the price up front. They not only protect your existing shares, but can protect your overall portfolio as well.

Hedging with CFDs does not guarantee that youll either come out ahead or break even. If an investor makes a share purchase and a subsequent proportional CFD purchase the price of the shares can still fall; however, because of the CFD purchase the total loss will be smaller or, in a best-case scenario, break even.

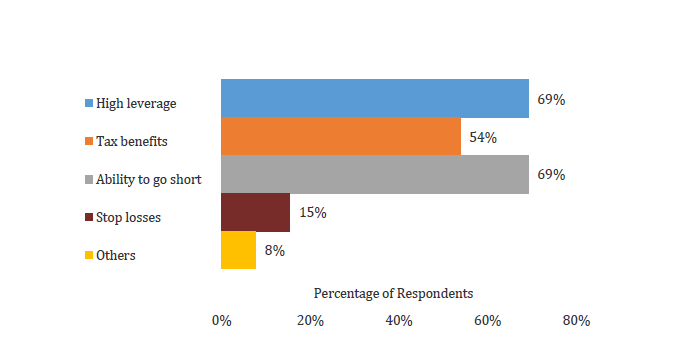

Benefits of Hedging With CFDs

CFDs are not required to be purchased at a fixed quantity, which means that you can purchase a contract for the exact quantity of shares you hold.

You can hedge with CFDs for an unlimited duration. There is no CFD expiration date.

A short-position CFD earns interests. Where typical CFD positions are charged interest, short CFDs earn interest throughout the duration of the hedge.

CFD Hedging Strategies

www.cfdspy.com/guide/trading-strategies.php ):

Single-Share Hedging

Single-share hedging is one of the more common CFD hedging strategies investors use when the market is unstable.

With single-share hedging, you sell a proportionate number of CFDs to offset your current shares. If the share price goes up, you gain on your share, which offsets the loss on the CFD. If the stock price goes down, you win on your CFD, which will offset the loss on your shares. And if the price doesnt change, your positions on both the shares and the CFD will not change either.

Pair Trading

This method of CFD hedging is named this as you are trading CFDs from different companies within the same industry.

Pair trading involves the process of selling a CFD of one company while simultaneously buying a CFD of a different company located in the same industry.

The premise is that companies in the same industry will most likely see the same changes in their share prices (either up or down) based on the current performance of their particular industry.

Index Diversification

As the name implies, this CFD hedging strategy involves diversifying your investments by purchasing index-tracking CFDs in order to hedge your account risk. Index-tracking CFDs get their value from a large share index, like the S&P 500, instead of single shares.

The following article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.