Hedging Against Inflation CXO Advisory

Post on: 29 Апрель, 2015 No Comment

How can long-term investors best hedge against inflations erosion of purchasing power? In their April 2009 paper entitled Inflation Hedging for Long-Term Investors. Alexander Attie and Shaun Roache assess the inflation hedging properties of traditional asset classes over different investment horizons. Using total return indexes for several asset classes from initial data availability (January 1927 at the earliest) through November 2008, they conclude that:

- Over a one-year investment horizon:

- Cash has not been an effective hedge against inflation.

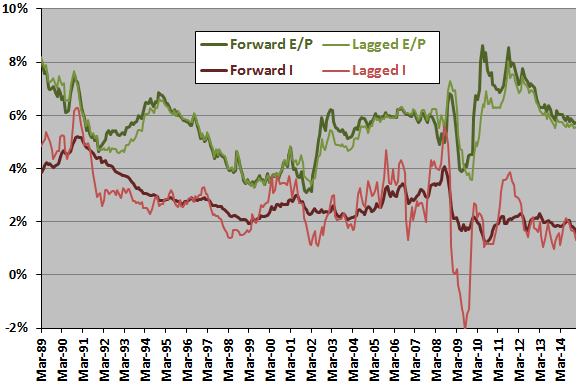

- Stock and bond returns tend to decrease as the inflation rate rises, particularly since 1973. A 1% increase in the inflation rate over a one-year period leads to a decline in the nominal annual return on bonds (equities) of about 1-2% (3%).

- Commodity returns tend to increase as the inflation rate rises. A 1% increase in the inflation rate over a one-year period leads to an increase in the nominal annual returns for the CRB Index. the GSCI and the spot gold price ranging from about 4% to 10%.

The following table, taken from the paper, summarizes the effects of unexpected increases in the inflation rate on returns for different asset classes based on available index data. Elasticity is the cumulative percent change in the asset class total return divided by the cumulative percent change in inflation. An elasticity of 1 indicates that the asset class provides a perfect hedge against inflation shocks.

In summary, evidence indicates that inflation hedges effective over the short run, such as commodities, may not work over long horizons and that tactical asset allocation following inflation surprises could enhance long-term investment returns.

Why not subscribe to our premium content?

It costs less than a single trading commission. Learn more here.