Hedge funds invest in commodity spreads The Globe and Mail

Post on: 17 Апрель, 2015 No Comment

Tucked away in a basement in London’s exclusive Mayfair district is a hedge fund manager investing entirely in raw materials, one of a small band trading commodity spreads — and making big money in the process.

VOC Capital Management is riding a wave of disillusionment with commodities markets that over the last three years have attracted hundreds of billions of dollars into oil, gold, base metals, livestock and soft commodities such as sugar and coffee.

More related to this story

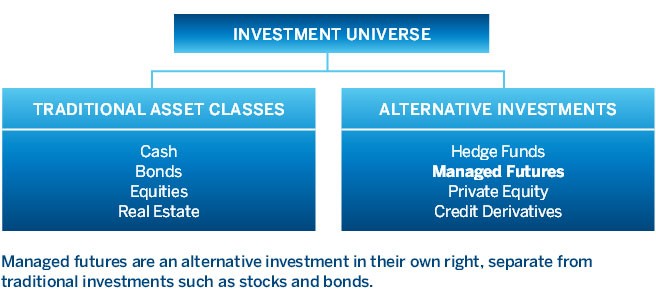

Banks and trading houses have persuaded many pension funds and other investors to buy into commodity and energy markets, arguing they can offer an attractive hedge against inflation, diversification and big returns in rising markets.

But many have lost money with such passive investments, holding long positions in range-bound or falling markets and hit by the cost of rolling over contracts in over-supplied markets.

Enter VOC and a host of other, commodity-focused hedge funds that make money trading positions within and between commodities, called relative-value or long-short spreads.

Some have suggested that commodities have somehow failed as an investment, VOC co-founder and partner Christiaen van Lanschot said. But it is not commodities that have failed. What has failed is the approach to investing in commodities.

Mr. Van Lanschot says trading strategies in commodities have in many cases been too naive, too simplistic for what is an incredibly complex and dynamic market.

The complexity of these markets has been masked by close correlations over the last year between stock markets and some commodities, which have seen equities and oil, for example, move in lock-step for several months at a time.

These correlations, in part a reflection of huge inflows of capital from passive investors, encouraged the false view that commodities are a single market moving — mostly up — together.

There is no longer one commodity trade where everything rallies and sells off in tandem, said Paul Caruso, analyst at New York-registered investment manager Galtere Ltd, which has around $1-billion (U.S.) under management.

We have seen commodities decouple because they are being driven by supply and demand fundamentals rather than purely investment flows, Mr. Caruso told Reuters.

The change in fund strategy has been reflected in data from the Commodity Futures Trading Commission, showing a decline in long positions held by money managers as they diversified risk away from inactive products.

Hedge funds were largely on the long side and now it is much more balanced between longs and shorts, said Olivier Jakob, head of consultants Petromatrix in Zug, Switzerland.

VOC and other specialist commodity hedge fund managers have developed investment strategies that aim to make money even when markets are range-bound, picking out trends and patterns of behaviour that are common to commodities by analyzing prices.

It doesn’t matter whether it is a shortage in wheat, or cocoa or gold, it is going to impact a market in a similar way. If supply is lower than demand, irrespective of the commodity, you are going to see a certain price behaviour, said VOC co-founder Nicholas Denbow.

We are looking at a lot of spreads, either spreads within a commodity or between them. One strategy used by VOC and others involves looking for the steepest points in futures price curves and selling or buying those points while taking opposing positions in other commodities.

Stockholm-based hedge fund IPM Informed Portfolio Management, with $8-billion in assets, makes 30 to 40 bets on the differences in price between commodities or time spreads in commodities and has had returns of 5 per cent net in five months.

We use a market-based model, said Alex Gioulekas, head of research at IPM. The biggest component is based on relative value, which performs well in directionless markets.

VOC trades 24 commodities, ranging from crude oil and natural gas to wheat, corn and cocoa. All its trading positions aim to limit exposure to short-term shocks and instead make money from long-term trends.

We are not in the market timing business. Our models are generally based on fundamental principles as applied to the commodities markets, said Mr. Denbow. We are trying to take a fresh look at commodity investing, a more intelligent approach.