Hedge funds Going nowhere fast

Post on: 31 Май, 2015 No Comment

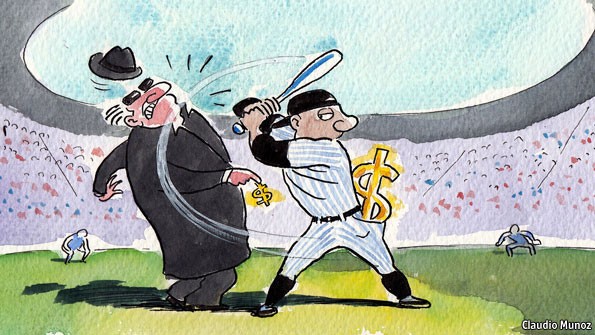

WHEN it comes to brainboxes, the name “Nobel” has a certain ring. But news that the Nobel Foundation plans to increase its investment in hedge funds, because years of low returns forced it to cut cash prizes in 2012, is one to leave laureates scratching their eggheads. The past year has been another mediocre one for hedge funds. The HFRX, a widely used measure of industry returns, is up by just 3%, compared with an 18% rise in the S&P 500 share index. Although it might be possible to shrug off one year’s underperformance, the hedgies’ problems run much deeper.

In this section

The S&P 500 has now outperformed its hedge-fund rival for ten straight years, with the exception of 2008 when both fell sharply. A simple-minded investment portfolio—60% of it in shares and the rest in sovereign bonds—has delivered returns of more than 90% over the past decade, compared with a meagre 17% after fees for hedge funds (see chart). As a group, the supposed sorcerers of the financial world have returned less than inflation. Gallingly, the profits passed on to their investors are almost certainly lower than the fees creamed off by the managers themselves.

There are, of course, market-beating superstars, as you would expect in an industry with nearly 8,000 participants (and rising). The top decile of managers has served up returns of over 30% in the past year, according to Hedge Fund Research, a data provider. But a third have lost money, including some of the stars of yesteryear: John Paulson, celebrated as an investment wizard in 2007 for having foreseen America’s housing bubble, reportedly saw his flagship fund lose 17% in the first ten months of 2012, after a 51% fall in 2011.

Justifications for poor performance are as diverse as hedge funds themselves. Mr Paulson seems to be blaming his malaise on a bet that Europe would falter. Others, from algorithmic traders spotting pricing anomalies to “macro” funds hoping to surf long-term trends, attribute their woes to choppy markets that are moved more by politicians than by underlying economic forces. “Markets are watching governments, which are watching the markets,” says Jim Vos of Aksia, a consultancy. Even a talented stockpicker will struggle to make money if the entire market is sent into convulsions by central-bank announcements. Many hedgies admit to having no “edge” in this environment. A few have slimmed or shut up shop.

For those that remain, the message to investors has changed dramatically. Whereas hedge funds used to sell themselves as the spicy, market-beating wedge of an investment portfolio, they now stress the long-term stability of their returns. Comparing their returns with a bubbling stockmarket misses the very point of “hedged” funds, say boosters.

Protecting your money from the vagaries of the stockmarket is hardly the swashbuckling stuff delivered by George Soros or Julian Robertson, the hedge-fund titans of the 1980s. But as well as reflecting the reality of meagre profits, it makes sense for the industry to sell itself as offering low volatility because of a tectonic shift in its investor base. In recent years institutions have gatecrashed what used to be an asset class catering mainly to super-rich individuals. Nearly two-thirds of the industry’s assets are now drawn from pension funds, endowments like the Nobel Foundation and other institutional investors, up from just 20% a decade ago.

These professional investors are much more risk-averse than the original billionaire backers of hedge funds. “Institutions are typically looking for more transparency and prioritise diversification over high returns,” says Omar Kodmani of Permal, a hedge-fund investor. Leverage, which once helped to juice up hedge-fund profits, is now at an all-time low.

The box-ticking requirements that have accompanied massive institutional inflows have led to a reduction in hedge funds’ octane levels. These investors want their hedge-fund managers to stick to their narrow area of expertise rather than flit between different strategies, for example.

The rigidity of the new model is one factor that has dampened returns over the years, thinks Simon Lack, an investment consultant and a vocal hedge-fund sceptic. Another reason is size. Hedge funds now manage $2.2 trillion in assets, up fourfold since 2000. Because individual trades can absorb only so much cash, the effect of all that new money is to push funds to take second-rate bets that would have been considered marginal in the past. “At $1 trillion of assets under management hedge funds delivered acceptable returns,” says Mr Lack. “Less so at $2 trillion.”

Defenders of the industry maintain that even a small allocation to hedge funds can diversify a portfolio away from turbulent markets. Perhaps, but long-term institutional investors should be well-placed to ride out market turmoil. And there are other ways to diversify. Exchange-traded funds allow investors to gain exposure to anything from gold to property to Indonesian firms, and they charge investors just a few basis points (hundredths of a percentage point) on the money they put in. That compares with fees of 2% of assets and 20% of profits (above a certain level) typically charged by hedge funds. In a low-interest-rate environment, where returns are unlikely to hit double digits, a 2% annual management charge seems particularly steep. Institutions have put pressure on fees, but with only mixed success so far.

The hedge-fund industry’s trump card is that a handful among them have delivered stellar returns over the long term. But the same is true of any sort of investment. The average hedge fund is a lousy bet, and predicting which will thrive and which will disappoint is a task that would tax even a Nobel prizewinner.