Harry Browne s Permanent Portfolio

Post on: 5 Июнь, 2015 No Comment

The Permanent Portfolio investment strategy is based on the economic cycle, which is composed of four basic categories :

- Prosperity

- Inflation

- Deflation

- Recession

Four asset classes provide a means of profiting during each of these four economic states, without having to forecast or predict their uncertain arrival or duration.

- Stocks – for profit during periods of general prosperity and/or declining inflation.

- Gold – for profit during periods of bad inflation ; during inflationary episodes gold bullion provides protection against a falling currency and other potential problems.

- Long Term Bonds – for profit during periods of declining interest rates; and especially during a deflation. Bonds also do reasonably well during prosperity.

- Cash – During a recession. no particular asset class is going to do well. The cash in a Treasury Money Market Fund offers stability when portfolio asset classes fall in price. It also protects purchasing power during a deflation.

Equal allocations of these four major asset classes comprise the Permanent Portfolio. For US investors, the portfolio would consist of the following portfolio components:

US Permanent Portfolio

- US total stock market: 25%

- Gold bullion: 25%

- US long-term treasury bonds: 25%

- US treasury bills: 25%

Lets compare this portfolio against the characteristics for a Bogleheads-style portfolio. The Permanent Portfolio:

- Uses passive management and does not time the market

- Is low cost

- Is simple and widely diversified

All of which align to the Bogleheads-style of investing. So why the malcontent?

First, it holds cash (treasury bills) and long-term bonds, which is not desirable from a Bogleheads approach.

The inclusion of gold is a subject unto itself. To briefly summarize; the use of a commodity for long-term investing is discouraged in Bogleheads-style investing.

Additionally, the Permanent Portfolio is a fixed allocation which does not adjust the stock allocation based on age.

Boglehead modifications to the Permanent Portfolio could include the following:

Since a combination of cash and long-term treasuries produces an intermediate-term duration, a Bogleheads-style investor might substitute an intermediate-term treasury bond fund for the fixed income allocation.

A Bogleheads-style investor might reduce the gold allocation and increase the equity allocation.

In Harry Brownes portfolio theory, these changes in overall portfolio allocation would be implemented through a variable portfolio that could hold any asset class or strategy with capital the investor can afford to lose. (The word Permanent was used by Harry Browne to create a contrast with what he called a Variable portfolio money you could afford to lose to speculation. Permanent refers to the fixed allocation. See this post .)

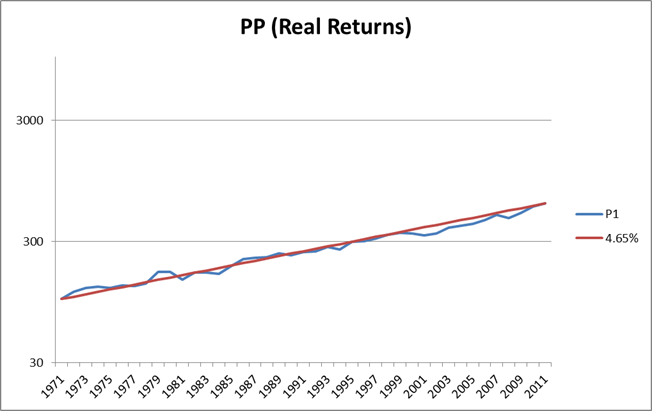

Bogleheads forum member Craig Rowland maintains historical performance of the Permanent Portfolio on his website, Crawling Road (1972 2012). Data for 2013 is here .

The performance metric is Growth of $10,000. which does not include transaction costs. While purchasing Treasury bills and bonds can be done directly at an auction with zero transaction costs, the purchase of gold bullion can be subject to commissions and premiums over the bullion price.

A Permanent Portfolio can also be constructed using Blackrock iShares ETFs (Exchange Traded Funds).

- 25% iShares Core S&P Total Market ETF

- 25% iShares Gold Trust ETF

- iShares 1-3 yr. Treasury Bond ETF

- iShares 20+ yr.Treasury Bond ETF

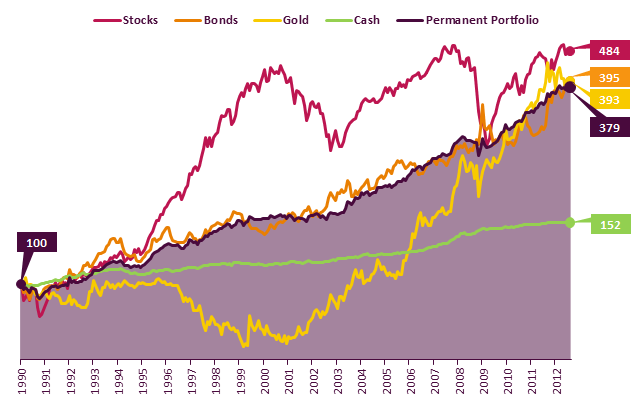

Below is the historical performance of the iShares Blackrock Permanent Portfolio for the time period in which gold bullion ETFs were available (2006). The source for these tables is on Google Drive .

The iShares funds can be held at Fidelity. or TD Ameritrade , which offer no-commission purchases and sales of the iShares Total stock market ETF, (Fidelity), the iShares Russell 3000 ETF (Ameritrade), the iShares 20+ Treasury bond ETF, and the iShares 1-3 years Treasury bond ETF. The gold ETF is the only holding that would incur a commission.

ETFs will also incur spread and premium/discount costs.

iShares Permanent Portfolio Returns