Government Debt Budget

Post on: 20 Апрель, 2015 No Comment

The finance dissertation below has been submitted to us by a student in order to help you with your studies.

Abstract

The unprecedented UK budget deficits have drawn sufficient attention to the issue of the ability of the government to finance these deficits continuously by borrowing ever-increasing amounts from domestic and foreign residents by issuing government bonds. What might be particularly worrisome is that, since the 1980s, the UK government has been issuing debt (borrowing) in the current time period to pay back the principal and interest due on the debt it issued in previous periods. In other words, it has been simply rolling over’ increasingly large chunks of government bonds. Adding to this concern is the belief intrinsic to most individuals that there is something inherently wrong with deficits and that, eventually, they would have to be reduced to zero.

Introduction

Balancing the budget is like going to heaven: everybody wants to balance the budget, but nobody wants to do what you have to do to balance the budget Senator Phil Gramm (R — Tex.), 1990.

Throughout the ages, national economies have experienced repeated fluctuations about trend in output, employment, prices, and interest rates, known as business cycles. Many explanations have been offered for these fluctuations in economic activity. They range from sudden supply-side disturbances, or shocks, caused by changes in technology or adverse weather conditions, to unanticipated changes in the money supply.

Early business cycle theories assumed that the fluctuations in output and prices about trend were caused by the internal dynamics of a market economy. Sustained economic growth was thought to place severe strains upon the economy. For example, after a prolonged economic recovery, the continually increasing aggregate demand might cause wages and input costs to rise faster than selling prices. This, according to the early theories, would lead to a cutback in business investment and employment as firms, particularly those that had overinvested earlier, started to experience shrinking profits. This link between real and nominal variables, coming in the wake of a sustained period of recovery, was thought to cause recessions.

During the era of the gold standard and fixed exchange rates, it was widely believed that business cycles were transmitted across national boundaries by detrimental fiscal and monetary policies of countries that were trading partners. Most of the early theories were in the gold standard era, and hence financial factors such as bank panics, shortages of liquidity, and fluctuations in interest rates were thought to be primarily responsible for economic downturns.

While economists are by no means unanimous in their analyses of business cycles, the trend today is towards a demand-side money-induced explanation of these cycles in economic activity (Lucas, pp. 7-8).

Since 1980s in United Kingdom there has been a growing feeling amongst economists and policy makers that an increase in taxes in the future is inevitable’. Nervousness about the large bond-financed deficits compounded by doomsday predictions in the media has convinced workers that the tax cuts are temporary. This has stunted the outward shift of labor supply and labor demand. It remains to be seen if the present administration does keep taxes at the low levels of 1987 and 1988, or conveniently ignores election year promises and raises them.

In this world of individuals with rational expectations, the results of the policies of any one administration are strongly contingent on the expectations of individuals regarding the continuation of these policies by succeeding administrations. Once again, we must remember that policy is not a one-shot deal, but a rule’ or a sequence extending into the future and the past.

Economists tend to view the aggregate effects of fiscal policy from one of three perspectives. To sharpen the distinctions among them, it is helpful to consider a deficit induced by a lump-sum tax cut today followed by a lump-sum tax increase in the future, holding the path of government purchases and marginal tax rates constant. Under the Ricardian equivalence hypothesis proposed by Barro, such a deficit will be fully offset by an increase in private saving, as taxpayers recognize that the tax is merely postponed, not canceled. The offsetting increase in private saving means that the deficit will have no effect on national saving, interest rates, exchange rates, future domestic production, or future national income. A second model, the small open economy view, suggests that budget deficits do reduce national saving but, at the same time, induce increased capital inflows from abroad that finance the entire reduction. As a result, domestic production does not decline and interest rates do not rise, but future national income falls because of the added burden of servicing the increased foreign debt. A third model, which we call the conventional view, likewise holds that deficits reduce national saving but that this reduction is at least partly reflected in lower domestic investment. In this model, budget deficits partly crowd out private investment and partly increase borrowing from abroad; the combined effect reduces future national income and future domestic production. The reduction in domestic investment in this model is brought about by an increase in interest rates, thus establishing a connection between deficits and interest rates.

Budget deficits are financed by issuing government bonds to domestic and foreign residents (borrowing) or by selling bonds to the central bank (monetizing the debt). The processes of government spending, taxes, and money creation are linked quite explicitly by the arithmetic of the intertemporal budget constraint.

The most important sources of tax revenue for the government are income taxes, corporate taxes, and payroll taxes. As all these tax revenues are functions of the national income, they consequently decrease when GNP falls, or when the economy goes into recession. On the other hand, transfer payments such as unemployment benefits increase in recessions, thereby causing budget deficits to rise in periods of economic sluggishness, even in the absence of any change in fiscal policy. Because of this independence of the magnitude of the deficit to changes in policy, many economists feel that less attention should be paid to the actual deficit and more to what is known as the high-employment or the standardized-employment deficit (also full-employment deficit, structural deficit). This is a hypothetical construct that replaces both the actual government spending and tax revenues in the actual budget by estimates of what government spending and tax revenues would be, given current tax rates and spending provisions, if the economy were operating at full employment. A 6 per cent unemployment rate is assumed to be the full-employment mark in the UK.

The high-employment deficit, therefore, is unaffected by the state of the economy, since it ignores the actual expenditures and tax revenues and instead focuses on what they would be at full employment. This measure of deficit changes only when specific policies change, and for this reason economists believe that it is a better indicator of fiscal policy than the actual deficit, as the aggregate business cycle effects have now been sifted out (Baumol and Blinder, pp. 288-290).

The inflation-adjusted deficit is the actual deficit adjusted for the inflation component of the interest payments. When the UK government (or any borrower for that matter) pays interest on the government bonds outstanding in an inflationary environment, more dollars must be returned to the lender in recognition of the fact that inflation has eroded the purchasing power of the currency. These interest payments, made to restore the lenders’ purchasing power, exaggerate interest expenses and distort the government expenditure figures. To sift out this additional government expenditure due to inflation, we subtract the inflation premium from the interest paid on the national debt, thereby counting only the real interest payments, a technique which provides us with a more accurate measure of the deficits.

Large budget deficits financed by money creation are widely believed to be the primary force sustaining prolonged high inflation processes. The relationship appears to be closer for hyperinflationary episodes, which are usually associated with the presence of massive budget deficits. Hyperinflation, understood in this paper as a process of accelerating inflation, in fact occurs because governments have unsustainably large budget deficits.

Fiscal adjustment is a prerequisite for stopping hyperinflation. Suppose the economy is initially at a point like H, moving along the unstable path with accelerating inflation. The objective of the authorities is to move the economy to a stable stationary equilibrium such as A. This will require a reduction in the deficit to [d.sub.0]. However, this will not suffice to restore inflation stability since real money balances are below the steady state level (i.e. to the left of A); expansionary monetary policy is also needed. This can be achieved through an open market purchase of government bonds. Under rational expectations, the proper combination of fiscal and monetary policies will instantaneously stop hyperinflation (Grossman and Helpman, 1991).

In this specific example, as proposed in Dornbusch (1986), expansionary monetary policy supports the fiscal effort. Indeed, an open market purchase of government bonds reduces the interest payments and the value of the total deficit. The government can thus take advantage of the higher demand for money to reduce the deficit. In this case, the reduction in the primary deficit would be smaller than would otherwise need to be. The once-and-for-all increase in the demand for money that results from a successful stabilization effort contributes to a permanent reduction in the deficit.

The stabilization strategy just discussed is useful to explain the analytical implications of assuming partial adjustment in the money market and rational expectations vis—vis instantaneous adjustment in the money market and adaptive expectations. The reduced-form dynamic equations are similar in both cases. However, as just shown, when the right policy combination is followed, hyperinflation can be controlled instantaneously in the former case, while it will at best be reduced through a gradual process in the latter. The rigidity in expectations creates a strong barrier to rapid reductions in inflation.

There are useful insights regarding the role of tight fiscal policy in anti-inflation programs. First, it is apparent that small reductions in the deficit may not be sufficient to reduce permanently the rate of inflation. Second, it was also argued that there is not a one-to-one relation between deficits and inflation rates; while a given budget deficit might be associated with a stable rate of inflation under one set of initial conditions, it could also lead to an unstable path of prices under others. Finally, there is an interesting asymmetry emerging from this model. While small increases in the budget deficit can move the economy into unstable paths that can eventually result in large increases in inflation, stabilization of the rate of inflation (once the economy is moving along the unstable path) can require even larger contractions in the fiscal deficit. In particular, if the economy is in a sufficiently hyperinflationary state, the monetary authorities might find that the only feasible stabilizing alternative is the complete elimination of the use of inflationary finance.

In this paper it is shown that under plausible assumptions regarding the adjustment of the money market it is possible to find conditions under which large money-financed deficits can lead to hyperinflation even when agents have perfect foresight. The basic analytical framework is similar to the one used in Sargent and Wallace (1973), Evans and Yarrow (1981), Bruno and Fischer (1986), Dornbusch and Fischer (1986), and Buiter (1987). It assumes that budget deficits are entirely financed through seigniorage, a Cagan-type demand for money function and rational expectations (which in the present model, given the absence of uncertainty, is equivalent to perfect foresight). The main difference is that in the present model the money market does not clear instantaneously.

Literature review

The adjusted deficit values, therefore, assist us in putting the deficits in perspective and enable us to attribute changes in deficits to specific policy regimes. Another important form of measurement of the budget deficit is the primary deficit. The total budget deficit can be divided into two components: the primary or non-interest deficit, and the interest payments on the public debt, that is

Total deficit = primary deficit + interest payments

The primary deficit therefore represents all government outlays, except interest payments, less all government revenue. This definition will have huge significance when we discuss the role of the interest payments on outstanding government bonds. The overall budget might be in deficit even if the primary deficit is in surplus (or when we have a primary surplus). This is because in every time period the government makes a significant amount of interest payments on past debt. After mandatory spending, interest payments constitute the second largest chunk of UK government expenditures. Thus we can see that the overall budget will be in deficit unless the interest payments on the existing debt are more than matched by a primary surplus (Dornbusch and Fischer, pp. 581-583). According to Dornbusch and Fischer, this forms the core of the mechanics of deficit financing (p. 597). They write: If there is a primary deficit in the budget, then the total budget deficit will keep growing as the debt grows because of the deficit, and interest payments rise because the debt is growing.’

As in Diamond (1965), a deficit is created by the government once and for all increasing its debt by reducing taxes on personal incomes. This is equivalent to the government transferring new bonds to the households. The traditional assumption has been that in subsequent periods taxes on personal incomes are raised in order to pay the interest on this additional debt. Instead, in the present paper I consider the case in which it is the future taxes on corporations that are raised.

In the present model we find that, because taxes on personal incomes are discounted at a higher rate than the interest on government debt, deficits financed by raising future taxes on personal incomes increase wealth and aggregate expenditure, causing a current account deficit. This is the general view about the effects of deficits in finite horizon models.

We, however, find that unanticipated deficits financed by raising future taxes on corporate incomes are neutral. This result arises because corporations, unlike households, are infinitely lived, and therefore taxes on corporations are discounted at the same rate as the interest on government debt. Thus, when the government incurs a deficit by transferring new bonds to the households, and it announces that it is going to raise taxes on corporations to pay the interest on these new bonds, the value of shares in corporations falls by the same amount as the value of new bonds that are issued, leaving wealth and aggregate expenditure unchanged.

A correction of the fiscal imbalance has been crucial for stopping hyperinflation. This factor is well documented in the works of Yeager (1981), Sargent and Wallace (1973), and Webb (1986) on the hyperinflation episodes in the central European countries and United Kingdom on the episodes of recessions. Substantial reductions in the budget deficit, monetary reform, and a fixed exchange rate were crucial for the successful stabilization policies in those countries. Indeed, fiscal restraint, which in most cases meant outright elimination of the budget deficit, was probably the most important of these policy measures.

One distinctive feature of hyperinflationary episodes is that the rate of inflation accelerates over time, thus suggesting that these processes are inherently unstable. Cagan’s seminal work on this issue provides an alternative interpretation. In Cagan’s view hyperinflationary episodes could only be unstable if they were self-generating, and he considered that although there is no reason why (self-generating inflations) could not occur; so far they have just not been observed (p. 73). However, Cagan’s stability analysis only considers the case in which the money process was exogenous.

If one extends Cagan’s seminal paper through the introduction of money-financed budget deficits and rational expectations, and then analyzes the dynamic properties of the system, as was recently done by Evans and Yarrow (1981), Kiguel (1986), and Buiter (1987), the results are astonishing. Large money-financed budget deficits could be the source of instability; however, they could only lead to hyperdeflation. These deficits can never be the source of hyperinflation.

The presence of large budget deficits in a perfect foresight framework has a surprising effect on the dynamic behavior of inflation. Auernheimer (1976), Evans and Yarrow (1981), and Kiguel (1986) showed that in order to obtain a hyperinflationary process one needs to assume adaptive expectations. In other words, in Cagan’s framework, large budget deficits could result in hyperinflation only when agents make systematic mistakes in forecasting the rate of inflation.

It has been recognized for some time that it is very difficult to justify the use of adaptive expectations in macroeconomic models. Economic agents eventually learn the process that generates inflation, and they will use that information in the formation of their forecasts on inflation. As a result, it is difficult to accept that large budget deficits would lead to accelerating inflation only in the presence of systematic mistakes.

The effect of anticipated deficits financed by taxing corporate incomes is the exact opposite of the conventional view about anticipated deficits in finite horizon models. If the government announces that at some future date it will incur a deficit by issuing new bonds to the households, and that corporate income taxes are going to be raised in the periods after that in order to pay the interest on this debt, then at the time the policy is announced aggregate wealth will fall, for the following reason. As taxes on corporations are discounted at the same rate as the interest on government debt, the present value of the taxes is equal to the value of the bonds transferred to the households as of the time that the policy is carried out. However, when the policy is announced households are not sure that they will survive to collect the transfer of bonds. Thus, they discount these transfers at a higher rate than the market rate of interest. On the other hand, as corporations are infinitely lived, the valuation of shares in corporation is such that taxes will be discounted at the market rate of interest. This then means that at the time the policy is announced aggregate wealth and expenditure will fall, causing a current account surplus. This result is the opposite of the conventional view about the effects of anticipated deficits in finite horizon models, as emphasized by, for example, Feldstein (1983), and Frenkel and Razin (1986).

Finally, the fact that taxes on corporations in UK are discounted at a lower rate than taxes on personal incomes means that a revenue neutral tax reform involving a shift in taxes from personal incomes to corporate incomes will result in a loss of wealth and a fall in aggregate expenditure, causing a current account surplus.

Much of the literature on monetary unions has concentrated on their effects on trade and hence on the effects on the efficiency with which factors of production are used. Rose (2000) shows, in a multi-country panel study, that there may be significant effects on trade from membership of a monetary union. Whilst Honahan (2001) does not dispute the potential for benefits, he points out that much of the weight in Rose’s results comes from small countries leaving (or sometimes joining) colonial and post-colonial monetary unions. These decisions were often associated with a bundle of changes in relation to partner countries that themselves had a major impact on trade.

Given that there are likely to be reasonably large gains in the scale of trade from joining a monetary union, there are also likely to be significant increases in the level of output. Grossman and Helpman (1991) argue that there is a strong link between openness and growth and much of the evidence is surveyed in Pain (2002). These gains come from the arrival of new technologies, increases in specialization by comparative advantage and the reaping of economies of scale within industries that have become more specialized. In addition, a monetary union reduces the barriers to trade even within a common customs area by reducing transactions costs, and this is likely to have a major impact on the level of output that can be produced with a given level of inputs.

Given the theoretical importance of the output gap, it is unfortunate that its measurement is so problematic. This will always be the case however when we are trying to separate out high frequency’ events such as the business cycle from low frequency’ events or persistent phenomena such as the trend in potential output. As Watson (1986) points out, a time series of 30 years could contain a significant number of examples of cycles of periods of less than 5 years, yet only a few examples of cycles of 10 years or more. Therefore we have more information in a finite sample on the shorter cycles, and correspondingly less information on longer cycles and the permanent shocks (which can be regarded as infinitely long cycles). Techniques for trend extraction have to address this problem directly, and filters for trend extraction are designed to remove specific frequencies and, in particular, cycles from the data under consideration.

The central point of Feldstein (1986) article is to present empirical evidence in support of the view that budget deficits cause a currency to appreciate. He regresses the real exchange rate between the U.S. and UK on a measure of the budget deficit in the United Kingdom and a set of other variables. For the period 1973 to 1984 (twelve annual observations), he finds that the estimated effects on the real exchange rate are strong and robust to the inclusion or exclusion of other variables. Branson and Love (1988), on the other hand, outline a theory that assumes that the movements in the nominal exchange rate cause movements in the real exchange rate. These, in turn, cause movements in the supply of (tradable and non-tradable) output and employment and, hence, the trade balance. Their empirical results indicate that appreciation of dollar over the period caused a large unemployment loss in manufacturing.

Barth et al. (1990) note that the choice for measuring of the deficit affects the nature of the linkage between deficits and interest rates. Specifically, studies that use cyclically adjusted deficits or federal debt instead of federal deficits are more likely to find a significant relation between the fiscal variable and interest rates. Recent evidence reported by Barth et al. conforms with these observations.

Barth et al. (1990) also conclude that low frequency data (annual versus quarterly or monthly) and long-term interest rates (instead of short-term rates) are more likely to produce a significant relation between deficits and interest rates. However, recent studies do not support these generalizations. The summary shows that many studies that use quarterly data yield a significant relation between deficits and interest rates (e.g. Bruno and Fischer, 1986; Dornbusch and Fischer, 1986; Buiter, 1987). Moreover, several of the studies surveyed (e.g. Honahan, 2001; Rose, 2000) find a significant relation for short-term interest rates.

Barth et al. (1990) note that expected deficits play a greater role than contemporaneous deficits for long-term rates. One should note that results of all such studies are sensitive to the measurement of expected deficits. Frenkel and Razin (1986) find that announcement effects of the unanticipated deficit on interest rates are positive and about the same throughout the yield curve. Both rational expectations studies (Bruno and Fischer, 1986; Dornbusch, 1986) find positive relations, one for long-term rates and one for short-term. Finally, Feldstein (1983) and Dornbusch and Fischer (1986) find a positive relation between 10-year rates and projected cyclically adjusted deficit as a percent of GNP. Therefore, this relation apparently does exist for long-term rates, but concluding the same for short-term rates would be premature.

Discussion

The politics of tax cuts are not necessarily straightforward. Since the UK Budget of March 1993, discretionary tax increases have added about [pounds] 18 billion to expected tax revenue in 1996/97. It might therefore appear odd to the electorate for there to be a remittance of [pounds] 5 billion of these tax revenues as an election approaches. However, a reasonable defense of this might be that the fiscal position has turned out to be better than originally forecast. When the first tranche of tax increases was announced in the March 1993 Budget it was expected that even with the additional revenue the PSBR to GDP ratio in 1996/97 would be 4 1/2 per cent of GDP. The additional fiscal changes announced in the November 1993 Budget contributed to a reduction in the forecast deficit to 2 3/4 per cent of GDP. Now, with no further tax changes the Treasury is forecasting that the deficit will be 2 per cent of GDP, substantially lower than they first thought it would be.

In terms of the economics of the UK Budget judgment, the slowdown in economic activity that appears to be occurring, especially the very weak state of domestic demand would appear to allow some relaxation of the fiscal stance. In addition, our projections suggest that even after allowing for tax cuts the general government financial deficit will fall below the 3 per cent reference level for the European Union excessive deficits procedure. The main difficulty with the tax cuts is that they retard the progress that the government has made in reducing its borrowing towards the level that would be permitted by the so-called golden rule’ that the government borrow no more than is necessary to finance investment. This may be seen either in balance sheet terms or by examining borrowing in relation to investment expenditure.

The consequence of the deterioration in the public sector’s balance sheet is that this year’s taxpayers are leaving more liabilities and fewer assets to next year’s taxpayers than they started with. This suggests that the future services provided by public sector capital will be lower and debt interest higher than they would otherwise have been. This means that future taxes need to be higher in order to pay for the extra debt interest. This situation can be prevented by the government following the golden rule that borrowing be no more than is necessary to finance capital investment.

Deficits have to be financed either by issuing debt or by creating base money. Sargent and Wallace (1973) have argued that persistent budget deficits will eventually result either in monetization of the outstanding stock of debt, thus depriving the monetary authorities of their autonomy in setting policy targets, or in a repudiation of at least part of the debt. Hence lack of fiscal discipline could undermine the independence of a newly created European Central Bank, which might come under potential pressure to loosen its policy stance if some member states had serious budgetary problems. Its credibility could be affected if agents thought that a softer stance would become inevitable to alleviate the financial difficulties of highly indebted countries running large deficits. One of the consequences would be an increase in interest rates reflecting a revision in expectations incorporating higher future inflation rates.

Fiscal discipline would still be a major concern even if the UK monetary authorities remained steadfast in their anti-inflationary commitment, because those states with unsustainable fiscal positions might have to pull out, whose irreversibility would then be questioned. As a result, markets could take a different view of the degree of substitutability of the assets issued by the different countries. Furthermore, other externalities would be at work, in the form of pressure on other member states to come to the rescue of those with unsustainable debt/deficit paths. Another possibility is that conflicts would arise on issues related to the distribution of. (seigniorage) among member countries’ (Pain, 2002). Other consequences for the country as a whole of the lack of fiscal discipline would be a general rise in interest rates and an external deficit for Europe vis—vis the rest of the world, with adverse effects on the ECU exchange rate. As to the introduction of binding fiscal constraints, the argument is often put forward in the literature that they may appear to improve welfare, but only if the existence of a trade-off between fiscal and monetary policy is ignored (Pain, 2002).

Development of a government bond market provides a number of important benefits if the prerequisites to a sound development are in place. At the macroeconomic policy level, the UK government securities market provides an avenue for domestic funding of budget deficits other than that provided by the central bank and, thereby, can reduce the need for direct and potentially damaging monetary financing of government deficits and avoid a build-up of foreign currency — denominated debt. A government securities market can also strengthen the transmission and implementation of monetary policy, including the achievement of monetary targets or inflation objectives, and can enable the use of market-based indirect monetary policy instruments. The existence of such a market not only can enable authorities to smooth consumption and investment expenditures in response to shocks, but if coupled with sound debt management, can also help governments reduce their exposure to interest rate, currency, and other financial risks. Finally, a shift toward market-oriented funding of government budget deficits will reduce debt-service costs over the medium to long term through development of a deep and liquid market for government securities. At the microeconomic level, development of a domestic securities market can increase overall financial stability and improve financial intermediation through greater competition and development of related financial infrastructure, products, and services.

The creation of a monetary union will inevitably affect the setting of fiscal policy. Even if only monetary policy becomes the responsibility of the new institutions, with fiscal policy remaining in the domain of national government, the fact that they will no longer be able to monetize debt has implications for policy choices. Fiscal policy may play a more important role as a stabilization tool. In the standard Mundell-Fleming framework, in which sticky prices are assumed (Frankel and Razin, 1987) fiscal policy is most effective when exchange rates are fixed and there are free capital movements, conditions which has to be fulfilled by the UK government. Because in a fixed rate system a fiscal expansion does not lead to a rise in interest rates and to an appreciation of the exchange rate, some countries might resort more frequently to fiscal measures to respond to shocks, especially if they are country-specific. Such budgetary policies could result in a looser overall fiscal stance, especially if the fiscal authorities failed to distinguish between temporary and permanent shocks. It is often claimed that fiscal policy is the appropriate policy response only to the former, whereas the latter require factor price adjustment, either on its own or in combination with migration (Grossman, G.M. and Helpman, 1991).

An active money market is a prerequisite for UK government securities market development. A money market supports the bond market by increasing the liquidity of securities. It also makes it easier for financial institutions to cover short-term liquidity needs and makes it less risky and cheaper to warehouse government securities for on-sale to investors and to fund trading portfolios of securities. Where short-term interest rates have been liberalized, development of money and government securities markets can go hand in hand. When a money market has materialized and the government securities market is ready to take hold, coordination with monetary policy operations becomes essential for sound market development. Monetary policy operations are the responsibility of the monetary authorities and have increasingly been left solely to the purview of the central bank. There are, however, some overlapping areas requiring coordination between the government securities market and the money market.

In a recession the ability of UK national government to conduct countercyclical macroeconomic policies will be limited by the fact that they can not print money to finance their fiscal deficits and meet their maturing obligations. A well-functioning government may create a centralized mechanism to at least coordinate fiscal policy across member states. Previous experiences of international coordination suggest that such arrangements are rather ineffectual as a means of counteracting cyclical fluctuations, mainly because the time lags normally associated with fiscal policy become even longer when agreement has to be reached at a supra-national level before national governments can carry out the agreed policies. While fiscal coordination may be apt in the case of a prolonged recession, the arguments for centralized decision-making are less convincing when fiscal tightening is called for, because the national government is not likely to be willing to adopt unpopular policies to follow the directives of the central UK authorities. On these grounds, therefore, it is difficult to argue in favour of a permanent UK body exercising control over national fiscal policies.

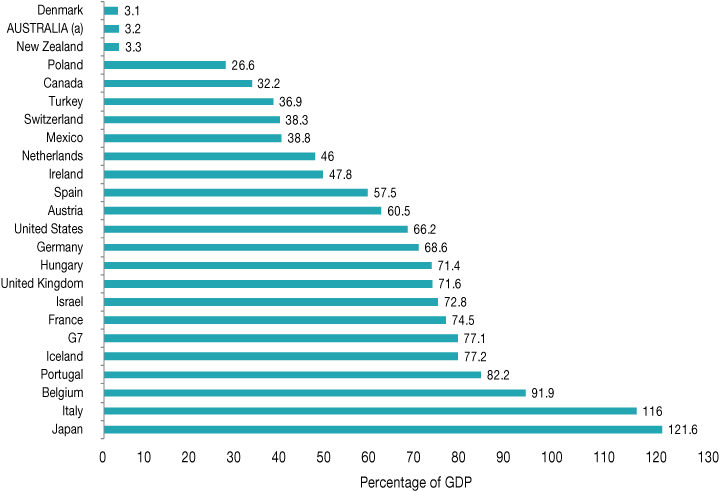

It is easy for commentators in the UK to observe that other countries have fiscal positions worse than our own, although the current situation in the UK is no longer very different from that in France or Germany. It is less well understood that, in many important respects, a house price boom has an impact similar to that of a sustained budget deficit. Budget deficits in both closed and open economies represent a means of depressing the productive capital stock in order to support current consumption. They are popular with voters and are likely to be particularly so as the proportion of old voters increases. Old voters can enjoy the benefits of government borrowing without having to face fully the reduced long-term income level arising from the depleted capital stock. Thus budget deficits serve to transfer resources from the young and the unborn to old people.

Affect of budget deficits on the money market, for instance, house price booms have a similar effect. Rising house prices depress saving because they reduce the need to save for retirement. At the same time they represent a transfer of resources from young people who are not house-owners to old people who are house-owners. With an increasing proportion of old people in the economy they are also likely to be increasingly popular with an electorate in which children and those not yet born do not have the right to vote (Baumol and Blinder, 1985).

The National Institute, along with others, has been surprised by the extent to which people are willing to incur debts, even though interest rates are currently very low; the slowdown in house prices we and others have expected has yet to materialize. At the same time it is unclear how far borrowers will be able to cope with an increase in interest rates towards the sort of normal levels.

However, the basic economic point is that it makes little sense for the Government to be actively concerned about one mechanism (the budget deficit) which crowds out productive capital and transfers resources from future generations to the present while house prices continue to rise.

There are a number of ways of moderating house price growth in addition to the supply improvement. A tax on housing transactions already exists in the form of stamp duty. It may discourage excessive trading but at the same time it reduces labor force mobility, which is bad for economic efficiency and discourages old people from moving from large family homes to smaller houses. It has little to recommend it either as a means of stabilizing the housing market or as a means of raising revenue.

Most economists regard a tax on the benefit accruing to owner-occupiers as desirable, on the grounds that this would put home ownership on the same basis as the ownership of other forms of capital. Until 1960 owner-occupiers were credited with a notional rent on which they had to pay income tax. The rent was, however, based on the 1937 rateable value and was a gross underestimate of true market rent by 1960. Facing the choice between the politically unpopular move of raising the rental values to credible figures and abolishing a tax which did not raise much revenue, the government chose the latter.

The reintroduction of such a tax would raise the cost of housing and encourage owner-occupiers to think more carefully about their housing needs. It would depress house prices, reducing the crowding-out effects mentioned above. On the other hand with the introduction of income tax shelters (PEPs and now ISAs) the argument for uniform tax treatment of income accruing to households from capital is not a strong as it was. The political difficulties are, in any case, obvious.

A third mechanism is a tax on interest payments (Barth et al. 1990); this is appropriate if the economic problem is seen as excess credit rather than excess demand for homing per se. It could be levied through the VAT mechanism, so as to fall on consumer credit but not raise the cost of credit to businesses. It would be easier to vary this tax rate in the short term than would be possible with a Schedule A-type tax, and this is a real advantage. It would be self-enforcing because the courts would not enforce debts unless the creditor could show that tax had been collected on interest payments. Once again, however, there are political obstacles; such a tax could have been more easily introduced when HM Treasury still set interest rates and at a time when they were being reduced.

Fourthly, reforming the Council Tax system, so that council tax payments are related to current property values and probably at a higher rate than at present, would go some way to discouraging over-investment in housing (Pain, 2002). This is an easier reform to deliver.

Finally, if more borrowing is long-term, there may be less housing speculation simply because long-term interest rates move less than short-term interest rates but it is unlikely that this will solve the longer-term problem of steadily rising house prices and crowding out of productive capital.

Fundamental to our concern about house price movements is the belief that the boom is continuing because retail borrowers believe that very low interest rates are likely to persist indefinitely. It is with this in mind that we now discuss the movements of interest rate expectations implicit in wholesale market movements this year.

Sharply lower budget deficits or reductions in primary deficits or increases in primary surpluses (government budget imbalance less net interest) have also contributed to lower inflation in select developing nations, but the impact of deficits on inflation is not unambiguous or universal. In declining inflation nations like UK, the deficit-to-GDP ratio has receded but in others, like India, deficits have actually increased, as they did in deflation-plagued Japan in the 1990s. And, in any ease, in most nations, the present value of government indebtedness, including unfunded liabilities of public pensions and health care, has risen unabated. The increasingly credible monetary policy of the past 20 years suggests that central banks may not readily bail out egregiously irresponsible fiscal policy — a realization that may encourage true fiscal reform — although the true test of this will be the resolution of the fiscal gaps created by the aging populations in industrialized nations. The bottom line is that sound monetary policies have been the primary reason for lower inflation -and enhanced inflation fighting credibility.

The standard view about the effects of budget deficits in finite horizon models is that they increase wealth and expenditure, causing a current account deficit. This view is based on the assumption that deficits imply higher future taxes on personal incomes. In this paper we have considered the effects of budget deficits financed by taxing corporate incomes. We have shown that unanticipated deficits financed by taxing corporate incomes reduce the value of equities by the same amount as the government debt issue, leaving wealth and expenditure unchanged. The most striking result was that anticipated deficits financed by taxing corporate incomes resulted in a loss of wealth and a current account surplus. Revenue-neutral tax reforms involving shifts in taxes from personal to corporate incomes reduced wealth and caused a current account surplus.

Conclusion

The balance of trade deficit supposedly grows from the budget deficit because it produced high interest rates, which in turn led to increased foreign lending to the United Kingdom, a squeeze on capital formation, and an overvalued pound sterling.

Given this explanation, the strategic task is one of elimination of deficits and excessive rates of spending growth. This means that the policy initiatives designed to spur output growth and to lower inflation expectations and interest rates must carry a large share of the fiscal stabilization burden. A variety of tax changes — a sort of kitchen-sink supply-side approach — would spur growth: lowering the top personal marginal rate from 70 to 50 percent, further reductions in capital gains taxes, and depreciation changes. By including so many types of cuts, supply-side could be many things to many people and gain political support, a sort of politics of tactical inclusion.

Interest is economic topic number one in UK. Why the focus on interest rates? The salience of interest rates lay in their national and local economic importance. For one, the political stratum and financial markets harped on it. High rates threaten to choke off the nascent recovery of 1983 and keep the economy in a state of permanent recession. Constituents also have complaints. Rates affect the economic base of communities back home; businesses and borrowers suffered directly, stimulating legislators to find ways to help. Rates are bad for business and consumers throughout my district and I sure hear about it. Stabilization worries and constituency protection needs fused around this problem; addressing it became tactically imperative.

A macro fear grew among those in the political stratum that large and growing structural budget deficits would effectively crowd out private borrowers in capital markets and smother economic growth. The past recessions produced alarm for many in UK government who saw tight monetary policy combined with large deficits producing high real rates even while the economy was slumping. When you take the whole picture and look at it, what you wind up with is a massive conflict between fiscal and monetary policy which has caused high, high interest rates, which has aggravated our situation greatly. Thus, high real rates continued, sustaining the fear of crowding out. Nowadays, there is an ever-present concern that as the economic recovery proceeds, growing private borrowing needs may collide with large federal borrowing and force interest rates even higher. This in turn could cut short the economic recovery and bring back stagflation.

List of references:

Auernheimer, L. 1976, The Effects of Inflationary Finance on Stability: A Theoretical

Analysis,’ Southern Economic Journal. vol. 42, pp. 502-507.

Barth, J. R. G. Iden, R. S. Russek, & M. Wohar, 1990, The Effects of Federal Budget Deficits on Interest Rates and Composition of Domestic Output,’ in The Great Fiscal Experiment. ed. R. G. Penner, The Urban Institute Press.

Baumol, W.J. & Blinder, A.S. 1985, Economics, Principles and Policy. Orlando, FL: Harcourt.

Branson, W. H. & Love, J. P. 1988, U.S. Manufacturing and the Real Exchange Rate’ in Misalignment of Exchange Rates: Effects on Trade and Industry. ed.R. C. Marston, Chicago: The University of Chicago Press.

Bruno, M. & Fischer, S. 1986, The Inflationary Process in Israel: Shocks and

Accommodation’ in The Israeli Economy Maturing through Crisis. Cambridge: Harvard University Press.

Buiter, W. 1987, A Fiscal Theory of Hyperinflation: Some Surprising Monetarist

Arithmetic,’ Oxford Economic Papers 39, pp. 111-18.

Cagan, P. 1956, The Monetary Dynamics of Hyperinflation,’ in Studies in the Quantity

Theory of Money. ed. M. Friedman, Chicago: University of Chicago Press.

Diamond, P. A. 1965, National Debt in a Neoclassical Growth Model’, American Economic Review. vol. 55, pp. 1126-50.

Dornbusch, R. & Fischer, S. 1986, Stopping Hyperinflations Past and Present.’ Weltwirtschaftliches Archiv, vol. 22, 1-14.

Dornbusch, R. & Fischer, S. 1987, Macroeconomics. New York: McGraw-Hill.

Evans, I.L. & Yarrow, G.K. 1981, Some Implications of Alternative Expectations Hypotheses’ in The Monetary Analysis of Hyperinflation. Oxford Economic Papers 33, pp. 61-80.

Feldstein, M. S. 1983, Why the Dollar Is Strong’ in Foreign Exchange Value of the Dollar, Hearing before the Committee on Banking, Finance, and Monetary Policy. House of Representatives.

Frenkel, J. A. & Razin, A. 1986, Fiscal Policies in the World Economy,’ Journal of Political Economy. vol. 94, pp. 564-94.

Grossman, G.M. & Helpman, E. 1991, Innovation and growth in the global economy. Cambridge, MA. MIT Press.

Honohan, P. 2001, Currency unions and trade: how large is the treatment effect?’ Economic Policy. vol. 16, no. 33, pp. 435- 48.

Kiguel, M. A. 1986, Deficit e Inflacion,’ Revista de Desarrollo Economico. vol. 26, pp. 256-68.

Lucas, R.E. 1977, Understanding business cycles’, in Carnegie-Rochester Series on Public Policy 5:7-29.

Pain N. 2002, EMU, investment and growth: some unresolved issues’, National Institute Economic Review. vol. 180, April.

Rose, A.K. 2000, One money, one market the effect of common currencies on trade’, Economic Policy. vol. 30, pp. 9-45.

Sargent, T. J. & Wallace, N. 1973, Rational Expectations and the Dynamics of

Hyperinflation.’ International Economic Review, vol. 14, pp. 328-50.

Watson, M.W. 1986, Univariate detrending methods with stochastic trends’, Journal of Monetary Economics. vol. 19, pp. 49-75.

Webb, S. B. Fiscal News and Inflationary Expectations in Germany after World War

I’, Journal of Economic History. vol. 46, pp. 769-94.

Yeager, L. B. 1981, Experiences with Stopping Inflation. Washington: American Enterprise