Gold Silver Ratio Trading Silver Investing Daily

Post on: 23 Июль, 2015 No Comment

Gold Silver Ratio Trading

While the ratio of silver to gold available in the earths crust is estimated anywhere from 25/1 to 18/1, the silver to gold production ratio is only about 8/1. This is because silver, with a few exceptions, is generally a by-product thats refined in the pursuit of gold, copper and other metals.

Rounding overall availability of silver to 20/1 in relation to gold, for simplicity, silvers value should have been approximately $50 when gold was $1,000 and $100 when gold reaches $2,000. According to production alone, if the market value of silver were equal to its availability in relation to gold, it would have been $100 when gold reached $800, and $200 when gold reached $1,600.

However, as noted, silver has extensive industrial uses while gold does not. What is impossible to tell is how much above ground silver still exists in stockpiles around the world. It is estimated that a total of 40 billion ounces (1.37 million tons) of silver have been mined in human history.

Of this 40 billion, almost 6 billion (15%) has been consumed through industrial use in the past decade. How much was consumed in previous decades is difficult to tell. In an effort to avoid over-sensationalizing our numbers, well use a very conservative estimate of 37.5% total industrial consumption. This would leave us with 25 billion total ounces of silver (857,000 tons).

From this perspective, in relation to the estimated 178,000 tons of gold in the world, the silver to gold ratio would be about 4.8/1. In other words, if gold were $2,000 per ounce, this ratio would dictate $416 per ounce silver.

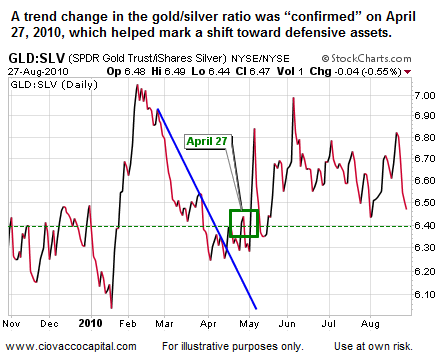

The silver-to-gold price ratio is a straightforward equation that anyone can watch when considering which of these two metals to invest in. Additionally, there are different ideas about what would be the best trade in relation to the ratios.

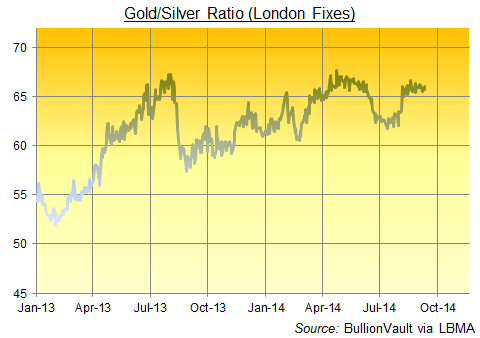

In recent years, the ratio has changed dramatically, moving as high as 80/1 about three years ago. Of course, even 80/1 is a bit shy of the 100/1 high of February 91, but still higher than even 20 year averages. On the other hand, during the past 35 years the historical average of about 16/1 had only been approached once, in January, 1980, when it bottomed at 17/1. Get more here.

Even if youre not going to base your trades solely on the gold silver ratio, this can be an important factor to look at, along with all the others, when you are looking to initiate or get out of a position in silver. With gold trading at about $1766 and silver at $35.39, that gives us a current ratio of just about 50:1. This points to silver being a bit of a better trade then gold right now, according to the article.