Gold Silver Ratio

Post on: 23 Июль, 2015 No Comment

Friday January 17, 2014 11:37

Looking for a new commodity to trade? Create one by combining two exciting commodities that you may already know: gold and silver. Access fresh trading opportunities by analyzing the price of gold divided by the price of silver. For this trade, individual traders could consider the most liquid US mini-sized precious metals futures, which are 33.2 oz. mini-sized gold futures (YG) and 1,000 oz. mini-sized silver futures (YI) listed on NYSE Liffe US. Trade the gold:silver ratio, or YG/YI, based on technical or fundamental analysis, and take advantage of significant margin offsets to maximize capital efficiencies. Ratio here means the multiple that gold prices are trading over silver prices. If gold prices are $1575.00/oz. and silver prices are $30.00/oz. then gold prices are 52.50 times the price of silver and the ratio is 52.50:1.

Initiating YG/YI

To trade a spread relationship, go long one metal and short the other in approximately equal notional amounts. Assuming gold prices are $1,575/oz. and silver prices are $30.00/oz, using 33.2 oz. mini-sized gold futures (YG) and 1,000 oz. mini-sized silver futures (YI), you could take a 3 lot position in gold and an opposite position of 5 lots in silver. The notional amount of the mini-sized gold position would be $156,372.00 (calculation: $1,575.00/oz. x 33.2 oz. x 3 contracts) and the notional amount of the mini-sized silver position would be $150,000.00 (calculation: $30.00/oz. x 1,000 oz. x 5 contracts). As of February 25, 2013, initial margin per contract for 33.2 oz. mini-sized gold futures was $2,640.00 and for 1,000 oz. mini-sized silver futures it was $2,750.00.

The relationship between gold and silver prices is strong. The 40 day correlation coefficient is a measure that determines the degree to which two prices are associated over this time period and ranges from -1 to +1. -1 indicates a perfect negative correlation and +1 indicates a perfect positive correlation. As of February 25, the YG YI correlation coefficient was .8706. Given that the ratio trade consists of opposite positions in correlated products, there is significant margin relief. The margin offset is 70% on a 3:5 basis, which means if you are long 3 mini-sized gold futures in your account and short 5 mini-sized silver futures (or vice versa), initial margin is 30% of what the combined gross margin would be for these positions on a stand alone basis. Thus, total initial margin for this position is $6,501 (calculation: (30 % x $2,640.00/oz. x 3 mini-sized gold contracts) + (30% x 2,750.00/oz. x 5 mini-sized silver contracts)). In this example, the initial margin for the ratio trade is 2.1% of the combined notional value of $306,372.00. For perspective, the current initial margin for 33.2 oz. mini-sized gold futures is approximately 5.0% of the notional contract value, and for 1,000 oz. mini-sized silver futures it is approximately 9.1%. Trading the gold:silver ratio provides exceptional capital efficiencies.

Trading YG/YI: Technical or Fundamental?

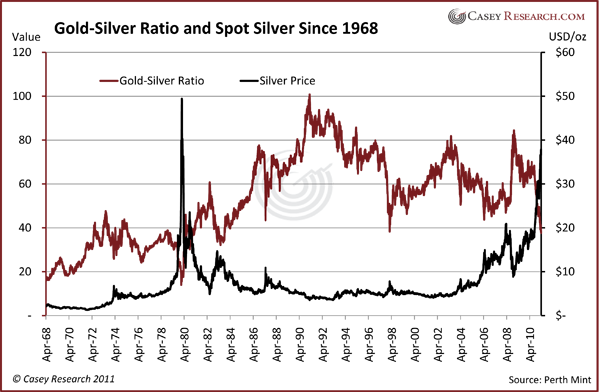

Technical traders can overlay their favorite studies on the gold:silver ratio chart to see if they get reliable signals to initiate a trade. Fundamental traders might look at supply/demand statistics and the characteristics of each metal. For example, silver has more industrial applications than gold, so silver prices might outperform gold prices in a period of economic recovery. Gold prices, on the other hand, might outperform silver prices in times of economic distress due to its reputation as a safe haven.

P&L Example

If you think gold prices will rally faster than silver prices or that they will decline more slowly than silver prices, you might go long the gold:silver ratio, or buy gold and sell silver. With gold prices at $1,575.00/oz. and silver prices at $30.00 oz. you would be long the ratio at 52.50:1. If the difference between gold and silver prices widens, the trade is profitable. If the difference between them narrows, the trade is not profitable. In the below p&l examples, for simplicitys sake, we assume the price of gold does not move. Additionally, p&ls do not take into account transaction fees or interest costs. The first table is the p&l if the ratio moved 2.9% wider (in your favor) and the second table is if the ratio narrowed 2.9% (against you).

Initiate @ 52.50