Gold Prices Under $1 200 an Investment Opportunity for Gold Bulls

Post on: 14 Июнь, 2015 No Comment

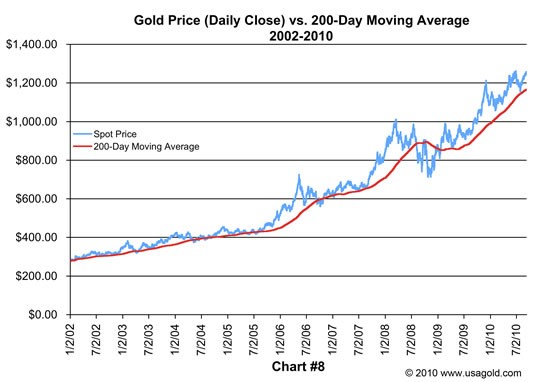

Gold prices have fallen below $1,200 an ounce and negative sentiment continues to increase. The news keeps claiming gold prices will go down further and “funds” are building up short positions. But I’m not worried. In fact, I am more bullish on gold prices now than ever before.

Why? I believe these low gold prices are presenting a solid opportunity for long-term investors.

Mark my words: in times of great uncertainty comes the best investment opportunity. I am bullish on gold because I see the most basic fundamentals influencing gold prices are improving. Those fundamentals are supply and demand. While the supply side continues to face scrutiny, demand remains strong.

Gold Companies: Supply Side Getting Crushed

To give you some idea, in the first 11 months of 2014, U.S. gold mines produced 193,000 kilograms (kg) of gold bullion. We don’t have the December numbers yet, but if we assume that production in that month was about 17,500 kg (the average in the first 11 months), then production for the entire year would be about 210,500 kg. (Source: U.S. Geological Survey web site. last accessed March 10, 2015.) If this ends up being the final number, then it will be the lowest level of gold production by U.S. mines since 1990. This is something that shouldn’t go unnoticed.

Other major gold-producing regions are reporting similar, if not worse, production figures as well.

Looking forward, gold production seems to be in trouble. Remember: there is no incentive for producers to produce if gold prices are low. Paying attention to guidance provided by mining companies on their gold production, we aren’t hearing much good news. Even if they are reporting an increase in production this year, it’s not substantial. (Read what I learned at the PDAC mining convention this year .)

I am bullish on gold because I see the most basic fundamentals influencing gold prices are improving. Those fundamentals are supply and demand.

Special: An Important Message from Michael Lombardi:

I’ve identified six time-proven indicators that now all point to a stock market crash in 2015. You can see my latest video, Six Time-Proven Indicators Now All Pointing to a 2015 Stock Market Crash, which spells out why we’re headed for a crash and what you can do to protect yourself and even profit from it, when you click here now.

Demand Side Getting Better

With supply declining, one must really pay attention to the demand side. Going back to Economics 101, both demand and supply declining would mean lower prices. But this isn’t the case in the gold market.

Currently, in gold, we’re seeing increased demand for the precious metal—and it’s continuing to increase. In fact, I think 2014 gold consumption numbers were great. There was even increased demand from India (following the easing of restrictions) and China.

I am paying a significant amount of attention to the central banks, though. They didn’t care much about gold prices in 2014; they bought more. In total, central banks bought 477 tonnes of the yellow metal over the year. (Source: World Gold Council. February 12, 2015.) I continue to ask one question, though: With the U.S. dollar rising, the values of their currencies will decline significantly. As this happens, will the world central banks buy more gold to stabilize their currencies?

Where’s Gold Headed Next?

I don’t know how one can be bearish on gold when the fundamentals are improving. Gold prices are only going down because the U.S. dollar is strengthening. Compare the precious metal prices with other currencies, and you will see they are up year-to-date.

With all this in mind, I continue to keep an eye on gold mining companies. More specifically, I’m paying more attention to the companies that are looking to increase production and reduce costs this year.