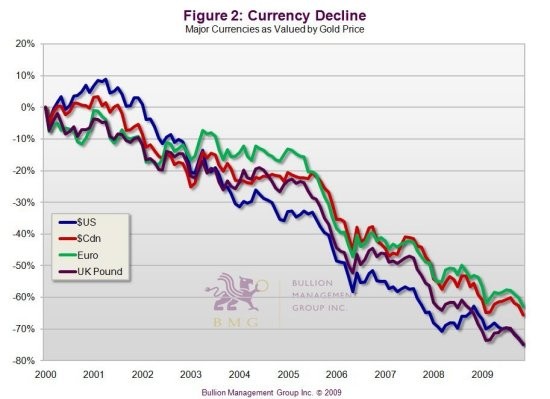

Gold priced in other currencies may hold better value

Post on: 9 Май, 2015 No Comment

Jan 6, 2015 — 3:49 PM GMT

Gold priced in currencies other than the dollar may offer better value, UBS said in a report on Tuesday.

The market is looking towards the greenback and other outside forces for guidance rather than the uptick in physical demand in Asia, it suggested.

We expect physical demand to gain more prominence in the weeks leading up to the Chinese New Year in mid-February; but for now, we see few internal factors to dictate golds direction, Edel Tully of UBS said.

Physical support from China appears to be buoying the market currently, with premiums on the Shanghai Gold Exchange averaging $3.50-4.50 over spot on the au9999 kilobar contract, up considerably since the start of December.

This theme is expected to continue over the coming weeks in the run-up to the Lunar New Year, an auspicious time for consumers to buy gold.

Gold struck a three-week high in early morning London trading at $1,215, though it has since retreated slightly to $1,209.20/1,210.00 per ounce, up $6.50 on Mondays close.

But the gains in gold come amid an uneasy environment for the metal, with the dollar hitting a new nine-year high against the euro this morning at 1.1883.

The dollars strength does not bode well for gold, Tully added. However, this suggests to us that gold priced in other currencies may have better prospects and may offer better value.

Since gold priced in the euro has climbed above 1,000 per ounce for the first time since September 2013, positioning gold priced in euros rather than the dollar could prove a more attractive strategy because it allows investors to take advantage of golds safe-haven properties while being prepared for further euro weakness, she said.

Investors continue to eye the Greek snap election later this month in what Prime Minister Antonis Samaris is describing as a vote that will ultimately determine the fate of the countrys membership of the euro.

According to Der Spiegel, German Chancellor Angel Merkel is ready to accept a Greek exit should anti-austerity Syriza party win.

The ECB has also already warned that a move against austerity could see economic sanctions imposed on the country, which may trigger another crisis in the bloc.

Uncertainty in Europe, especially as the Greek elections approach, does not necessarily have straightforward implications for gold prices: any safe-haven bids could be offset by the impact on EURUSD, Tully said.

UBS also favours gold priced in the Swiss franc, which is currently at its highest also since September 2013 at 1,220 per ounce.