Gold Price Technical Indicators and Forecast

Post on: 3 Август, 2015 No Comment

Comments below updated on Monday, July 5)

The indicators turned lower with the recent weakness in the gold price. Longer term remains negative as price remains below the all time high of $1,264 hit in in the past month — the gold price is heavily influenced by the U.S. Dollar which has been stronger in the past 2 months. A stronger dollar usually weakens the gold.

Gold S ummary: Gold we little changed (Friday), now trading just above the range of most of the past 5 months and just above its recent high of $1170 which it hit two weeks ago. Activity in the gold market appears to be ordinary fluctuation, mostly by day traders — there is no indication of increased interest in the gold market. (Click here for a 2 year gold chart — click here for a 10 year chart). ( Click here for June gold and scroll beneath the chart for a computerized technical analysis of the gold market.)

Based on the latest weekly report (as of June 29), the number of long speculators in the gold market was 330 thousand contracts, up 14 thousand from the previous week. There is no indication of any sustained significant buying. ( Click here for actual figures) (Click for actual figures for the years: 200 2 — 20 10, 2001. 2000 , 199 9 . )

The slow economy has diminished the number of physical gold buyers which is reflected in the latest demand figures for physical gold. Demand figures for the 4th quarter of 2009 (latest available) show one of the sharpest declines in demand in recent history — total demand was down significantly in all categories — jewelry demand was down 32% while total demand for all uses (including retail investment, industrial demand, electronic trading fund (ETF) investment) was down 36%, a relatively huge decline in demand, It has been mostly speculators that have driven up the price (reflected in the latest Commitment of Traders report).

A significant factor is the outlook for the stock market since commodity prices have recently been influenced by the sharp moves in the stock market. The stock market has been overpriced in the extreme — now the price earnings ratio on the stock market averages is no longer published as it has been since 1936, a major change in reporting activity in the stock market. As of the end of November (latest available) the price earnings ratio on the S&P 500 was 85, one of the highest since records were kept on the index in 1936. The stock average remains overpriced in relation to earnings in the extreme. a very negative indicator since stock prices ultimately depend on earnings. The ratio is very high when compared to an historical average of closer to 15 or 20 times earnings ( click here for a chart of past price earnings ratios). A falling stock market is potentially bearish for the gold.

Some investors believe the economy is improving, but the encouraging indicators are few and far between.

The number of total open contracts now (as of yesterday, latest available) was near 601 thousand contracts now at the record 2 years ago at almost 600,000 contracts.

An important factor is that under present economic circumstances, there is less money with which to buy jewelry or to invest in commodities, gold included. This is reflected in the low level of demand in the latest reports. ( Refer to the tables which show demand in tonnes, rather than dollars to get a more accurate picture. ) Demand for jewelry which usually represents about 70% of demand for gold was down 30% in the latest reported quarter (fourth quarter of 2009).

In spite of the recent rally, a resumption of the decline could potentially take the gold price down significantly if the U. S. Dollar resumes its rise. Click for a chart of June Gold. the most active contract ( scroll beneath the chart for a computerized technical analysis ) Click here to put recent activity in a longer term context. (Click here for recent futures quote) ( here or here or here or here or here or here for 24 hour spot price).

The gold price could potentially fall to near $500 in a relatively short time. As an example, after gold rose sharply in 1979-1980 to $850 it was followed by a drop to near $500 in less than 2 months. It will not be surprising to see the gold price take a similar loss in a short time (click here for a long term chart).

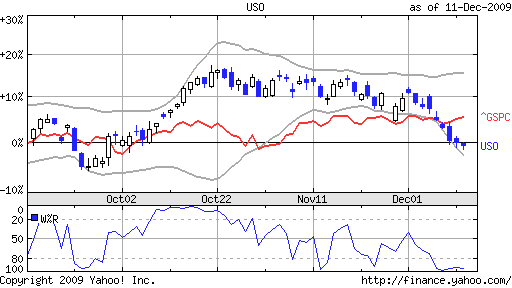

The July Crude Oil contract (now the most active contract) settled today (Friday) at 72.14. It was largely the rise in the Crude Oil price which helped bring gold to its recent high levels — now the Crude Oil has fallen back from last year’s highs. Crude Oil is half of what it was a year ago.

Demand for physical gold was at its highest during the bull market in stocks in the 1990’s when public interest in investment was at its highest and there was more money around with which to buy gold jewelry. Since then demand for physical gold has been mostly declining. Now that the global economy is mostly slowing, it is likely there will be even less money available to buy gold jewelry.

The number of total open contracts in the New York gold futures market hit the highest in history yesterday (Thursday), at 605,792, over four times as many as normal and the highest number of open contracts since the Comex began trading gold in 1975. The number of open contracts has since fallen back but now recovered again to near its previous high.

The potential still exists for a large rise in the gold price in the longer term if the U.S. Dollar resumes its weakness. The potential exists for gold to rise possibly as high as $1,500 or even $2,000 or higher if the gold continues its uptrend. (Under almost similar circumstances in 1979-1980, the price of gold and silver tripled, or more.) One significant factor so far remains different — interest rates soared in 1979-1980 but that has not been the case now (at that time longer term Treasury interest rates were over 15%, while the prime borrowing rate reached 21%).

As the gold chart shows, the gold price rose to highs not seen since 1980. The 9 day relative strength is typical of other indicators as well) It would normally be overbought between 70 and 80 (although it could go higher) and oversold between 20 and 30. Now (Friday) it is at 53, still below its recent high of 91 (hit on November 25, 2009) and above its low in 2008 at 12.

Long speculators outnumber the shorts by 61% to 12% (as of April 30, latest available).

The September U.S. Dollar Index was higher today (Friday), closing at 86.50, not far from highest point in 6 months. Any weakness in the Dollar may help the gold price (although the Dollar seems to have potentially found some support in its present range) which is still a long way from its high around 120.00 where it traded at in February 2002. ( Click here for more info about the U.S. Dollar Index and click on the U.S. Dollar Index in the right column. Click here for a longer term chart of the Dollar.)

The gold price is heavily influenced by day traders in the futures market. Usually 95% or more of the trading is done by day traders.

Because of the high volatility gold traders may consider the use of gold options. A good place to get futures and options prices is at the New York Mercantile Exchange. the largest and most significant market for gold futures trading. ( Another good place for gold option prices is on this link — click on either Call or Put in the far right column.)

The September Canadian Dollar settled today (Friday) at .93.90.

The September Australian Dollar settled today (Friday) at .83.50.

The following article is from Forextraders.com.

How high can gold rise?

As gold keeps breaking new records, and excited traders speculate on the difficult future fating the U.S. currency based in technical indicators, the fundamental factors behind the trend remain clear, increased worries about the solidness of U.S. public finances, the lack of any serious government plan to resolve long standing issues related to the future of the social security system, eroding credibility of the U.S. motto about a strong dollar, and the general weakness in the fundamentals of the global economy ensure that the told-dollar trend is likely to remain firmly pointed to higher peaks for the foreseeable future.

Traders would prefer to get rid of dollars in as large quantities as possible, but the lack of any meaningful substitute means that market participants always hold more of the U.S. currency than what is deemed to be prudent. Yet at the same time, neither Japan, the European Union, or China show any willingness to create a new alternative to the U.S. currency by encouraging the appreciation of their national currencies, and given the enormous imbalances that sustain the dollar’s stays as the global currency, it is hard to see how the USD can be dethroned by any of the favorite candidates.

Purchasing gold, on the other had, offers a fine solution to the Gordian Knot by lumping them on the same side, into the basket of worthlessness and placing gold on the other side, as a store of value that thrives when uncertainty, insecurity, and fear rule the global economy. And, when we recall the never ending speculations about the dollar’s demise, it is only natural that the metal will find attention (regardless of the price tag, until a bubble develops, and a long term downtrend is established. We are apparently very far from that turning point, however.

Gold has some powerful dynamics behind its rise, and it doesn’t seem outlandish to imagine a target of 3000-4000 in the next five years, if, as anticipated, economic activity goes for a second dip once the impact of government stimulation and private speculation and bubble-building lose their dominant effects in the markets. We are firmly of the opinion the dollar will remain the global currency in at least the next decade, even if it depreciates somewhat further before regaining its value. It is very hard to imagine Europe replacing the United States as the economic superpower of the world, that potentials is only possessed by China. And China is of course light years away from becoming a finance center, with its extremely backward legal system, shallow but highly volatile and unpredictable markets, and financial system at the stage of infancy. The forex market will go through the rest of this decade in a state of agitation, no doubt, but it may well turn out to be sound and fury, when we are able to reconsider everything with hindsight.

Keeping your money safe:

During these uncertain weeks ahead, for those who may want to stay all or partly on the sidelines, the safest place to keep your money and get near the highest interest rates (usually but not always) is in U.S. Treasury obligations. You can open your own account (minimum $100), free of any commissions or any other costs (excepting an annual minor maintenance fee). To go directly to their site, click TreasuryDirect (a U.S. government web site). You will find out everything you need to know. You can also call at the number they furnish — they are usually very helpful. Interest on U.S. Obligations are exempt from State or local income taxes. but subject to Federal income tax.

Interest rates now (January, 2009) are near the lowest in history but are usually higher during less volatile times.

Some physical gold fundamentals .

For the latest available supply and demand figures for physical gold, the World Gold Council has published actual figures for the past several years.

Demand figures for the full year of 2007 show total demand for the year was up 4%, but maybe more significant is the latest reported quarter, (4th quarter of 2007) total demand was down 17% for the quarter (843 metric tonnes vs. 1,013 last year), largely due to a 17% decrease in jewelry demand. This was a period during which the dollar was making new lows, widely thought to increase gold investment, but so far it has not. The lower demand may be due to the big increase in price, suggesting that higher gold prices will decrease the demand.

A very fundamental issue is whether the gold can continue to rise when supply is up and demand is down and remains at relatively low levels compared to the demand during the 1990’s (click for latest supply and demand figures).

When the gold price did in fact break out and soared in 1979-1980, there was actually a demand for physical gold and a rise in price was justified. There were often long lines at gold dealers as many people rushed to buy Krugerrands and other gold investments. Nothing like that is happening now as so far the demand is mostly confined to the futures market.

Demand for gold was helped by the bull market in stocks during the 1990’s when there was more money to buy jewelry. For example, global demand for gold jewelry was over 3,700 metric tonnes in 1996 compared to only 2,425 in the year 2007.

As an indication of the public’s interest in gold now, following are the figures published by the U.S. Mint showing the amount of gold sold by the U.S. Mint in the form of American Eagle coins bullion sales (in no. of ounces):