Gold IRA Investment and Investing Can Provide High Returns

Post on: 23 Май, 2015 No Comment

Investing for retirement is something that most investors strive for. Setting aside something for the future starts for many people at a relatively young age and for savvy investors who understand that the sooner they start, the less they will need to invest, there some interesting choices being made in terms of financial vehicles.

Back in the 1990, most investors turned to equities as their vehicles of choice. The bull market seemed to have no end in sight which left many unprepared investors with substantial losses when the market downturn finally did hit in the early 2000s and again in 2008 and 2009.

Today, investors understand that in order to be truly successful, it is necessary to diversify the assets in their portfolios. This does not mean choosing different types of stocks or mutual funds, though, but rather different types of assets altogether.

Why Gold? Why Not!

One way that investors are successfully diversifying and spreading the risk is by adding gold and other precious metals to their portfolio mix. Gold has provided investors with the opportunity for growth for many centuries, and it continues to do so today.

In addition to growth, though, investors are turning to gold for a variety of other reasons as well. Some of these include:

- Diversification Gold allows investors an opportunity to diversity the assets in their portfolio. In fact, one of the best ways to ensure that assets are properly allocated and diversified is by choosing vehicles that are not too closely related. Due to the fact that gold has always been correlated negatively with the movement of stocks, it can provide investors with an ideal way to diversify a primarily equity-filled portfolio. By placing gold into an IRA account, it can reduce both the risk and the overall volatility by a substantial degree.

- Hedge Against Inflation For many years, gold has also been used by investors as an inflationary hedge. The key reason for this is because golds value traditionally goes up when the cost of living rises. Therefore, by adding gold into ones investment portfolio, it can help to keep pace with the ever rising cost of goods and services over time. This can be especially beneficial for those who are retired or who are approaching retirement in their lives.

- Asset Protection Gold can also be used as an asset protector in an investment portfolio. This is due in large part to its diversity and reduced risk.

Making Gold IRA Investments

Over the past four decades, one of the most popular ways to invest for retirement has been through the IRA, or Individual Retirement Account. Since the creation of the IRA back in 1974, many investors have faithfully contributed to their accounts each year.

Because such accounts are typically opened and managed via traditional financial institutions such as banks and brokerage firms, the investments that are chosen to be placed inside IRAs have most often consisted of equities such as mutual funds and stocks and bonds.

One reason for this is that banks and brokerage firms can typically only offer these types of assets to their customers. Another reason is that there are many financial professionals who are just simply not aware that gold and other precious metals are in fact allowed to be placed inside of certain types of IRA accounts.

But, contrary to what some may believe, the IRS actually does not place very many limits at all on the types of assets that can be placed inside of a self directed IRA account and there are some IRA custodians that will allow these other types of assets such as gold and precious metals. In doing so, not only can investors reap the benefits of investing in these particular assets, but they can also obtain the benefits of tax deductions and tax deferred (or tax free) profits that apply to IRA investing.

The good news is that this type of investing has the potential for truly great profit. By combining the tax advantages of having a self directed IRA account with the appreciation potential of gold and other precious metals investments, investors can vastly benefit and at the same time, they can also be in charge of what goes in and comes out of the account itself.

IRS Gold IRA Requirements

When adding gold to an IRA account, the IRS (Internal Revenue Service) has some fairly strict guidelines that stipulate what types of metals are allowed to be placed inside of the account. In addition, the metals must also meet a certain standards for fineness.

Allowable metals per IRS requirements include the following:

- American Eagle Gold Coins

- American Eagle Silver Coins

- Canadian Maple Leaf Gold Coins

- Canadian Maple Leaf Silver Coins

- Austrian Philharmonic Gold Coins

- Austrian Philharmonic Silver Coins

- Gold and silver bars from various recognized refiners

- American Eagle Platinum Coins

- Canadian Maple Leaf Platinum Coins

- Isle of Man Noble Platinum Coins

- Platinum bars from various recognized refiners

- Canadian Maple Leaf Palladium Coins

- Palladium bars from various recognized refiners

Per the Internal Revenue Service, precious metals fineness standards include:

- Gold .995 percent or higher

- Silver .999 percent or higher

- Platinum .9995 percent or higher

- Palladium .9995 percent or higher

How to Get Started

There are numerous benefits to gold IRA investment starting with the many advantages that owning gold can provide, and then coupled with the added tax incentives that owning this vehicle inside of an Individual Retirement Account can offer.

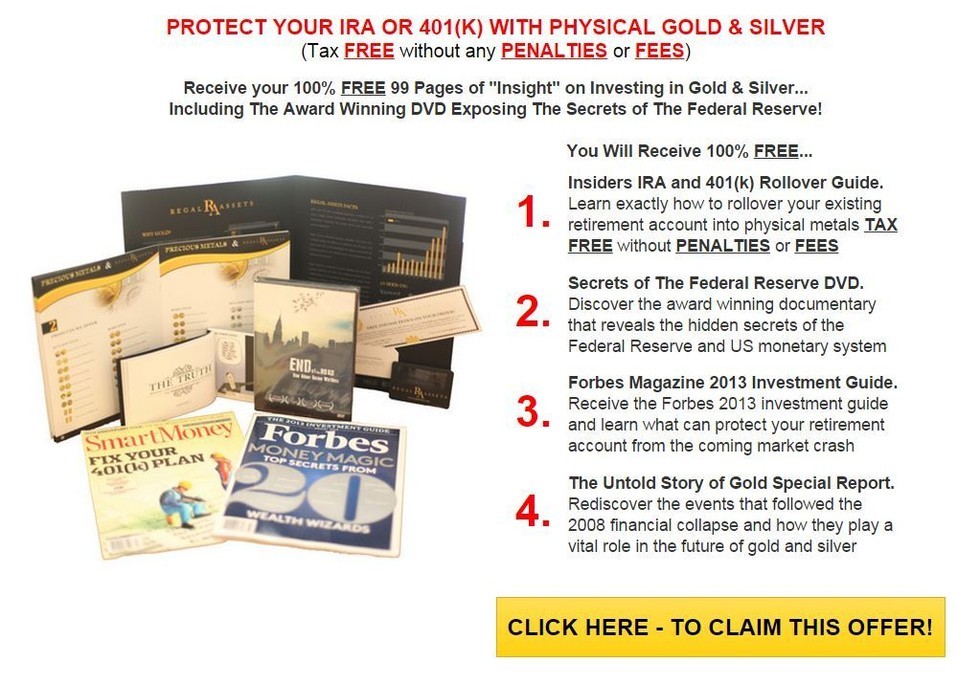

Opening a gold backed IRA account is easy. Today, there are many gold IRA companies that can be found online. Investors can narrow down their search by seeking the companies such as Regal Assets that are highly rated by the Better Business Bureau (BBB) and TrustLink and that have outstanding reputations for their customer service.

Most companies provide the IRA account paperwork directly on their website. This way, investors can get the process started quickly and easily. Once the account has been opened and funded, investors can begin to invest in the metals that will best serve their specific financial needs and goals for both the short and long term time horizons.