Gold ETF Outflows Paint Only Half the Picture

Post on: 12 Август, 2015 No Comment

Gold ETF Outflows Paint Only Half the Picture

By Alena Mikhan and Jeff Clark, Casey Metals Team

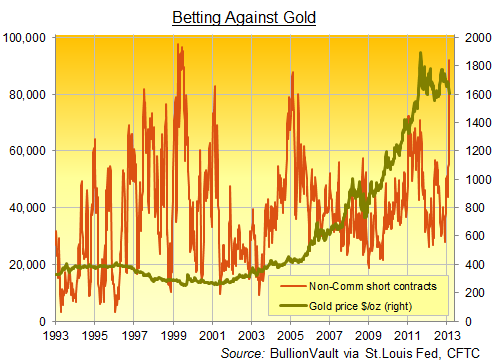

Since January 1, the holdings of gold-backed exchange-traded funds (ETFs) have dropped by nearly four million ounces (125 tonnes). February turned out to be the worst month for the worlds largest ETF, the SPDR Gold Trust (GLD), which saw its holdings drop to 39.7 million ounces (1,236.73 tonnes), its lowest level since October 2011.

If this were the only data investors looked at, they might conclude that everyone is selling and maybe even that the bull market is over. But these data are misleading.

Thats because while ETF holdings are declining, the physical market is seeing robust support. In fact, the US Mint the bellwether for measuring demand of physical gold in the Western world reports that sales of gold and silver coins are soaring.

(Click on image to enlarge)

As the chart shows, while current GLD holdings are lower than a year ago, US Mint gold coin sales are much higher.

Lets take a closer look at this clear divergence between the two gold investment types.

The Fickle ETF Investor

Since their introduction, gold-backed ETFs have become very popular, largely because they provide quick and easy exposure to the gold price. Since 2004, paper gold vehicles, as bullion ETFs are often called, have accumulated around 2,500 tonnes of gold, thus becoming a major player in the market. As a result, their holdings are closely monitored by investors and analysts. Concerns about falling holdings are thus understandable.

But this convenient way to trade gold has attracted lots of different types of investors, including traders, speculators, momentum players, and hedge fund managers who dont want to bother with storage. Many of these types have little interest in the gold market itself; they are playing fleeting trends and want the quickest and cheapest way to participate. Theres strong reason to believe that the recent selling has come primarily from this category of investor.

Further, ETF investors dont always follow the gold price.

(Click on image to enlarge)

You can see that while the gold price has been falling since October 2012, GLD investors have demonstrated two opposing behavior patterns. In the final quarter of 2012, holdings grew and even hit an all-time record high of 43 million ounces (Moz) in December. Since the beginning of this year, however, the fund has been seen massive redemptions, its holdings reaching the lowest level since the fall of 2011. This about-face is another hint that its the short-term player and not the big-picture investor dumping shares.

The Stalwart Physical Investor

While ETF holdings have been in decline, the physical market has seen the opposite trend. 2013 started very strong for the bullion market, particularly coin demand. According to US Mint data, sales of American Eagle gold coins reached 80,500 ounces in February, up 283% from the 21,000 ounces sold in February last year. In the first two months of this year, the Mint sold 230,500 ounces of the gold bullion coins, 56% more than during the same period of 2012.

Notice the volatile but steady rise in gold coin sales from the US Mint over the past 13 months.

(Click on image to enlarge)

Silver coin purchases paint an even more dramatic picture. In fact, demand was so great that the Mint suspended sales in mid-January because it ran out of coins. Even with the temporary suspension, January sales of American Eagle silver bullion coins spiked to all-time record of 7.5 Moz. February demand was 3.4 Moz, up 126% from last Februarys sales of 1.5 Moz. Cumulative silver coin demand for the first two months this year totalled 10.87 Moz, already a full third of total coin sales in 2012.

Heres the picture of US Mint silver coin sales over the past 13 months.

(Click on image to enlarge)

Keep in mind that bullion purchases from the US Mint account for only part of global physical demand (whereas GLD represents the bulk of gold ETF holdings). For example:

- Central banks around the world continue making record purchases. Last year, central banks added the most gold to their reserves since 1964 17.2 Moz (534.6 tonnes), 17% more than the previous year. Were convinced they will continue to buy gold and remain an important force in the gold market in 2013. The most notable recent purchases were made by South Korea (20 tonnes or 0.64 Moz), Russia (12.2 tonnes or 0.39 Moz) and Kazakhstan (1.5 tonnes or .05 Moz). The point here is that they were buying while ETF holders were selling.

- Buying of physical gold in Asia continues unabated. For example, during the Spring Festival (held in February) in China this year, sales of investment gold bars increased twofold. Chinese retailers also report that purchases of gold coins and jewelry increased 20-30% over the same period a year ago.

North America accounts for less than 10% of the global investment demand for gold, while China and India alone comprise 52%. In the greater scheme of things, what the East is doing about gold and silver will ultimately have a bigger impact on the market.

Its clear that most gold sales are coming from the paper market and not the physical market. Those buying bullion are more inclined to be long-term investors than those buying the ETFs. This makes sense; if your main purpose is to preserve wealth through turbulent times, what would you be more inclined to buy paper, or the real thing?

Those who own bullion are also less likely to sell on a whim. Some decision-making went into their buying locating a reliable vendor, deciding what form of metal to buy, submitting payment, and making arrangements for transfer and storage. Thats a lot of effort to unwind on the basis of a short term fluctuation. While the Hard Assets Alliance program allows one to easily sell metal online, holders of physical gold are less likely to do so during temporary price corrections.

ETFs are different in this respect. Since they trade like stock, any investor can quickly enter and leave the market. Some ETF investors may have a long-term investment horizon, but there are clearly those who use the ETF in pursuit of quick returns.

ETF outflows are mainly attributed to hopes for an improving economy. While its too early to say how strong or stable the apparent recovery actually is, we think these investors are overlooking the serious inflation waiting for us on the other side. Its possible the economy wont improve at all, and we still get rising inflation.

The core reasons for owning gold have not changed, as we think physical buyers recognize. Ongoing currency debasement means the long-term prospects for gold are as strong as ever. Therefore, any further decline in prices should be viewed as a signal to add another gold Eagle or silver Maple Leaf to your stash.

Gold and Silver HEADLINES

India Rolls Out New Regulations for Gold Jewelry Purchases (Mineweb )

India imposed new mandatory rules for jewelers, demanding they collect a KYC (know your customer) document from every person purchasing jewelry worth $919.60 (Rs 50,000) or more, an equivalent of 15 grams (0.5 troy ounces) of gold.

The new requirements were introduced with a stated intention of preventing money laundering and tax evasion, as well as to curb gold demand in the country. Gold traders, indeed, expect jewelry sales to decline. at least officially; an ever-larger consumer shift to the black market seems the most likely response to these regulations. Its happened before in India.

Indian Gold ETFs Buck Global Trend (Mineweb )

The year started on an optimistic note for Indian gold-backed ETFs. India appears to be the only market on an uptrend for this kind of investment class, showing net inflows of US$14.7 million (Rs 800 million) in January. Gold ETFs in the country reached the US$2.22-billion (Rs 120-billion) mark in India for the first time.

For many years India has been the worlds top gold consumer. Their investment market consists mostly of jewelry or gold bars. But since the gold ETF debut in India in 2007, this investment class has been struggling for traction. It is still a small universe in terms of gold holdings compared to imports, but there is big potential for further expansion of gold ETFs because as the government continues to impose new rules and restrictions on physical gold market, investors will increasingly see the advantages gold ETFs can offer.

Infographic: Why Smart Companies Are Focusing on Comminution (Visual Capitalist )

The infographic summarizes the main challenges for miners (falling ore grades and rising energy costs) and reveals the solution help to cope with these issues energy-efficient comminution strategies. The leaders of the industry (including Barrick and Newmont) are working already on improving their comminution processes, which allows them to reduce energy consumption and save money.

Interview: This Week in Money with Louis James (TalkDigitalNetwork )

Louis James, senior metals investment strategist at Casey Research, participated in the This Week in Money podcast during the last PDAC conference in Toronto. Note: Louis interview starts 17 minutes and 21 seconds into the podcast.

This Week in International Speculator and BIG GOLD Key Updates for Subscribers

International Speculator

- Our favorite copper producer released its latest financial statements, wrapping up another profitable year, despite a highly volatile market .

- A pre-development company with a world-class gold mine in the making is also making progress at one of its early-stage properties .

BIG GOLD

- It turned out to be silver week in the BIG GOLD portfolio, as three silver producers filed important news. Check out the latest press releases and our comments and recommendations on the BIG GOLD portfolio page .