Gold ETF

Post on: 21 Апрель, 2015 No Comment

Categories

An ETF is an Exchange Traded Fund which is traded on the major stock exchanges. And when you buy an ETF, it means you are investing in a cumulate of companies rather than a single corporation. Investing in precious metals, particularly gold. is becoming very popular these days because the prices of gold skyrockets instantly. But, a special care has to be taken while making investments in gold. There are many problems in relevance to gold investing. Most common of them include insurance, storage, moving, reselling and so on. These issues can be eliminated effectively if we adhere to the Gold ETF funds . These Gold ETFs are the best ways to trade in gold.

Things to consider before choosing any gold ETF

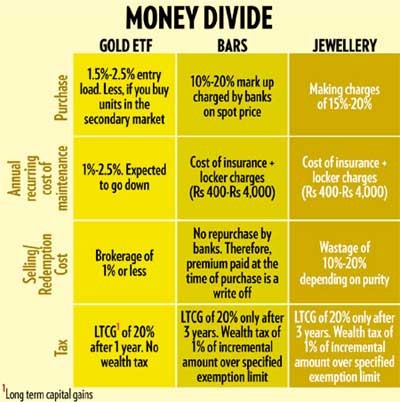

Out of many gold ETFs available in the market, it is very confusing for an ordinary investor to decide which one he should pick out. The most vital role in deciding any ETF is played by the expense ratio, that is, the expenses that the investor is charged by the fund house. This is an important factor that decides your net returns from your gold ETF investment. More the expense ratio, lesser is the net return. Therefore, the first thing to be checked out in the offer document of gold ETF must be the expense ratio. In case any two ETFs have the same expense ratio, we need to look out for the track records. Moreover, since a gold portfolio consists of gold and money market instruments, the returns from gold ETF also depend on how fund manager is supporting funds between money market securities and gold. Here, money market instruments refer to very liquid and very short term maturity debt instruments.

Expense ratio of gold ETFs

Expense ratio is the most important factor while choosing gold ETF. Lower expense ratio proves to be better for investors. Some AMCs display only investment management charges and not the total expenses that they are going to charge to the scheme. So, IF we have to choose a Gold ETF out of many, this important factor should be taken care of. Expense ratio comprises of investment management and advisory fee, custodial fees, registrar and transfer agent fees, marketing and selling expenses, brokerage and transaction costs, audit fees, fund transfer costs and other expenses such as costs related to investor communications, etc.

How gold ETF work

Since we have picked out the best option that is Gold ETFs, it is now important to understand the working of gold ETFs. The basic idea of gold ETF is that the value of the shares will increase with the price of the gold bullion and the prices of both the entities, that is, physical gold as well as individual shares, increase simultaneously. The major participants in gold ETFs are ETF sponsor, authorized participant, custodian, exchange, retail investors and institutional investors. When a mutual fund sponsor (e.g. HDFC, Quantum) senses a market for gold ETFs, it has to arrange physical gold and for that, it approaches authorized participants and if the deal becomes successful, the fund sponsor files a prospectus with SEBI. Once it is approved, money from retail investors and physical gold from participants is collected and it is then kept in the custody of custodians. Further, ETF sponsor provides ETF units back to the retail investors. Then gold ETF is listed on the exchange and the units are traded like any other stock. The authorized participants get gold ETF units worth the physical gold. And they have to take care of creating the market by supplying gold ETF units as per demand.

Reasons to prefer Gold ETFs

Gold trading can be done very comfortably at any time during stock market hours utilizing your online brokerage account. And since the price of an ounce of gold these days is not something that everyone can afford to purchase, this is a good thing that gold ETFs offer that there is no need to buy a large amount of gold to invest. You can buy in portions of an ounce.

If you are an ordinary investor and very new to the market then it will be helpful for you if you follow a professional. This would protect you from losing out on a lot of profits and taking unnecessary risk at times.