Gold And Silver When Precious Metals Bottom Is Irrelevant To Your Financial Health

Post on: 1 Июнь, 2015 No Comment

Saturday 20 July 2013

As ardent as Precious Metals, [PMs], buyers are, a good many of them do not comprehend

their importance. Everyone agrees they are resoundingly better than any fiat currency, as

history has amply proven. However, few consider the why PMs are so anathema for all

central bankers.

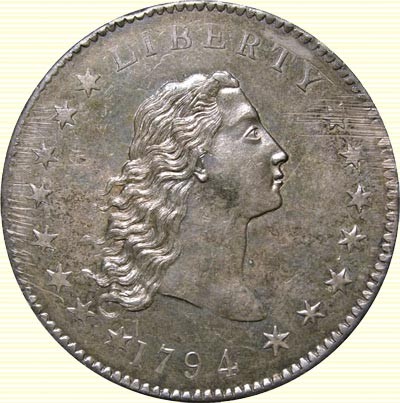

There was a time in this country when gold and silver were the coin of the realm. Actually,

they still are! The Coinage Act of 1792 has never been repealed, and that means, by law,

gold and silver are, [read section 20], the current money of account of the United States.

There is a very potent message within that Act, and like we said last week, Knowledge is

not of value, using it is.

Here is what not enough people know, even in the PM community: The qualities within a

gold coin are title, rights, and interest. When gold was used to purchase anything, all title,

rights, and interest transferred from the gold coin to whatever was purchased. It was paid

in full.

By contrast, thanks to the Rothschilds, the genesis for the entire Western worlds financial

system, central bankers have replaced ALL title, rights, and interest in whatever you buy

with commercial debt instruments, liens. All Federal Reserve Notes are evidences of debt.

They are not dollars, even though the word is printed on them, and the Federal Reserve

has admitted as much. Federal Reserve Notes, [FRNs] are commercial debt instruments,

and they are issued by the privately owned corporation, The Federal Reserve.

Debt is not money. It never was and never will be. The lie has been sold to the public, and

the public has bought it, in its entirety. As an aside, if you have not yet looked up cognitive

dissonance, this would be a good time. What is a FRN? It is not Federal; it is issued by a

private corporation. Look up Federal Reserve in any government blue pages in the phone

book. It aint there. You will find it closer to Federal Express in the white pages.

There are no reserves backing a FRN. It is the same as monopoly money. Each have the

same intrinsic value. One is believed [cognitive dissonance, again] to be of value, the other

is known as play money. A few know the truth and see the two as equal.

It is not a note. There is no promise to pay anyone anything at anytime. Any questions?

Debt is a lien, so whenever you use FRNs to buy anything, whatever you purchase carries

with it a lien. This is why when you purchase a house or a car, the government keeps real

title, and all you get is an equitable title, usage, like a rental because you pay annual rent

back to the government. Whenever you sell your house or car, the lien transfers with it.

No matter what you buy, a house, a car, furniture, equipment, etc, the lien of 100% goes

along with it, because you used a FRN, and all title, rights, and interest fully belongs to the

creditor, the Federal Reserve. Also, for the privilege of using a FRN debt instrument, you

get to pay a tax on them. [Enter IRS]

With gold and silver, you paid in full for whatever you bought, and you received all rights,

title, and interest. The government has no claim against you. You do not need the

government because you are dealing with coin of the realm that gives you absolute right,

title, and interest. Can you better understand why Socialist Franklin Delano Roosevelt

ran the scam he did for the New World Order to have all persons turn in their gold, an

order issued by Executive Order. Few knew that Executive Orders only applied to those

within the employ of the federal government! Of course, the federal government did

opposed by governments? Three words: Rights, Title, Interest. By stripping people of

their most accessible form of wealth, they became dependent upon the government. How

many people are dependent upon Social Security, [another scam], Medicare, and now the

largest growing segment, Food Stamps?

If you have wealth, and gold and silver are forms of wealth, [no matter how anyone would

say otherwise], you do not need fiat; you do not need the government. However, the

government needs you! By taking away your wealth and leaving you only with debt, you

are caught up in their web.

The above explanation has been the primary reason why the New World Order has taken

over each Western countrys currency, replacing all gold and silver backed lawful currency

with [worthless] paper fiat. As Chuck Colson, then Special Counsel to Nixon back in the

1970s, was quoted as saying, When youve got them by the [financial] balls, their hearts

and minds will follow. Guess where the New World Order has you?

Think about this when you next use your credit card, or fiat FRNs. Prior to the 1930s,

Americans used coin of the realm, and United States Notes, [actually issued by the US]

that were backed by gold and silver, with a promise to pay metal specie if one wanted to

have their lawful money so redeemed. Now, thanks to fiat, the United States has slipped

into Third World status, just not yet recognized by the masses. It is going to continue to

get worse.

The above issue has now been compounded by the growing concern that central bankers

have little to no gold left, even though they have been leasing, releasing, and scamming

everyone with their previously unquestioned practices. There are numerous stories

relating this latest ongoing scam, so we need not dwell any further on it.

There are two situations going on. Some express it as the price of gold, or the gold price.

We do not know what that means? What is the price of gold, if not the gold price? Having

some clever form of expression will never resolve the problem.

One more time. Buying and holding physical gold and silver gives you rights, title, and all

interest, aka full ownership. Acquiring them during theses tumultuous times is your best

form of wealth protection moving into an increasingly uncertain future. If you want to

attach physical ownership to the paper prices that are fully controlled by central bankers,

you can, but it misses the point for your future financial well-being.

turn around to the upside and more secure in your holdings. At current low prices,

opportunity is so ripe.

Mention was made that rallies are a normal feature of any bear market, and it is possible

gold may break through the immediate resistance area of 1,300, as we show on the daily

chart. If you look at late June, when price declined under 1,300, there was a brief two-day

rally that failed.

Compare those two trading days then with the last seven now. Price is not reacting away

from that resistance. We often state that the how of a price reaction, or lack of one, is the

markets way of telling us what is likely to happen. It appears that buyers are absorbing

One has to suspend reliance on the natural order of supply and demand in the PMs, for

now, until the unnatural forces of faux supply, pretend non-existent interest of demand

We can say with certainty that there has been greater buying than selling at the lows in

both metals, and that shows clearly in the silver weekly chart. We do not know how much

is simply short-covering, still a positive sign, and how much may be actual new longs being