Glossary J Dalton Trading

Post on: 16 Март, 2015 No Comment

A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

Anomaly: An anomaly is a single price or price levels that lack symmetry, an unusual structural arrangement in the Market Profile®; they represent structural weakness. Learning to spot anomalies is the first step toward understanding the information that anomalies provide.

Asymmetric opportunities: An asymmetric opportunity is present when the risk of a trade is exceeded multiple times by the profit opportunity. Asymmetric opportunities are not to be confused with market symmetry. Risk is measured from the location of a structural stop (as the stop relates to the Market Profile® two-dimensional structure) with the potential profit being calculated using an exit at a potential visual market destination.

Auction process (two-way): The purpose of an auction is to facilitate trade. Prices constantly auction from low to high and from high to low to fairly distribute the bids and offers presented by the market participants of all timeframes. This is the fairest way to allocate prices and contracts among competing bids and offers; the byproduct of the two-way auction process is market-generated information.

Balance: This refers to trading ranges, brackets, balance areas, congestion areas, and consolidation ranges—all synonymous terms. They define price ranges in the market that are containing trade. Within these containment ranges reversion to the mean trades are the favorite of short-term traders. We often refer to these containment ranges as “paradise” for short-term traders. Bigger opportunities occur as price auctions outside of these containment ranges. Balance occurs in all timeframes. For shorter term or day traders balance may be an inside bar or multiple periods of price containment. Balance and excess are the two most important concepts you will be introduced to because they signify change or the potential for change to take place.

Balance area rules starting with inside days:

- Market may slightly extend the range in either direction, stays in balance. Patience is in order.

- Market explores upside breakout and is met by aggressive sellers; prices fail to be accepted above the breakout. Fade the price probe failure—the potential target is for rotation to the opposite end of balance.

- Market explores to the upside; higher prices receive the unexpected response and attract even more buyers. Higher prices are accepted, breakout is successful. Go with price acceptance in the direction of breakout.

- Market explores downside breakout and is met by aggressive buyers; prices fail to be accepted below the breakout. Fade the price probe failure—the potential target is for rotation to the opposite end of balance.

- Market explores to the downside; lower prices receive the unexpected response and attract even more sellers. Lower prices are accepted, breakout is successful. Go with price acceptance in the direction of breakout.

Buying tail: This is formed bysingle prints (single TPOs) on the bottom of a profile; a gauge of buyers’ reactions to a lower advertised price opportunity. The greater number of single TPOs that form the buying tail the more aggressive the buyers’ reaction.

Carry forward: Simply means that you record market-generated information and incorporate it into your market perspective and analysis going forward. This practice helps you maintain a bigger perspective and helps you avoid getting caught up in the day. It is market-generated information that you employ to understand the auction process, the odds, and helps you formulate an effective strategy and tactical plan for the current session.

Clean: A term we use to identify the age of a trend. If the breakout was to the downside, we consider a breakout of balance “clean” when there is distinct spacing between the bottom extreme of the upper balance area and the top extreme of the next lower balance area that develops after the breakout. By observing the distance between balance areas we can develop a sense of a trend’s strength and the likelihood of a further price move in the direction of the trend. A wide distance between balance areas signifies that a trend is still young. An upside breakout would be the mirror image. See example:

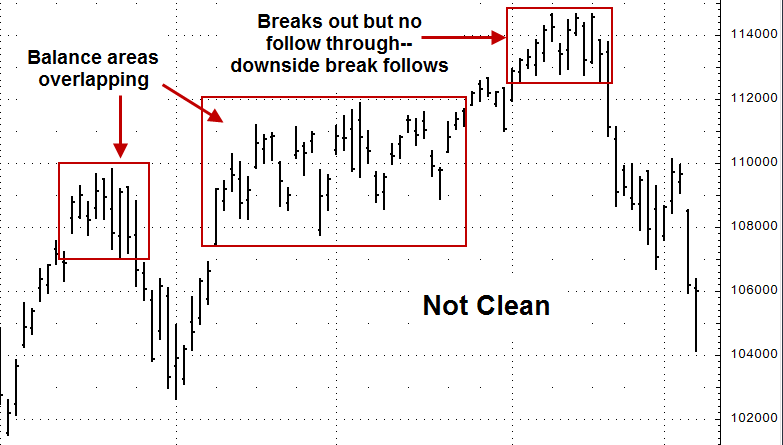

Similarly “not clean” occurs when balance areas are overlapping. In an upside breakout, the lower extreme of the upper balance area is inside the prior, lower balance area. This signifies that the trend is maturing and finding it more difficult to push higher. A downside breakout would be the mirror image. See example:

Cognitive dissonance. The anxiety we feel when we are experiencing two simultaneous conflicting thoughts or ideas; for example, the monthly jobs report is very negative or “bearish” while market-generated information is equally positive or “bullish”. This is a constant and ongoing issue with us as traders.

Completion: The most common two-way auction completion is identified via “excess”: a rapid counter auction that fades the most recent auction high or low. It is not uncommon to see an auction that has not yet completed itself; this would be identified via “poor” or “unsecured” highs or lows. The concept of “completion” is applicable to all timeframes; there could be completion of the day timeframe while still having an uncompleted short-term auction.

Daily range: The height of the profile from high to low. While trading occurs in the electronic markets for most of a 24 hour period, when we refer to daily range we are referring to the time that a market is open—the traditional “pit session” hours.

Destination trade: A term that applies to a very visual level to which the market may trade. A typical destination trade would be from the top of a five-day trading range to the bottom of the range. On an upside break out of balance, the destination trade may be to the bottom of a previous trading range low or to a yearly or monthly high. Once again, markets are very visual.

Diffusion model: Information is the driving force of all markets; information has no power until someone acts on it. Understanding human nature is key to understanding the totality of the auction process. The following behavior is applicable to all independent timeframes: (Chapter Two and Chapter Seven of Markets in Profile and Chapter Six of The Tipping Point offer further elaboration on this topic.)

- The innovators are the first to act and the hardest to detect; they are mostly individuals and hedge funds that are not driven by committee decisions. They are generally very low-keyed and shy away from publicity.

- The early adopters are next and climb aboard a trend early in the process. (Remember: these concepts are applicable to all timeframes independently.) They are also less likely to be driven by communal decisions. They can become very aggressive.

- The early majority are generally the more astute larger organizations and individuals. This group represents the heart of the bell shaped curve.

- The late majority is led by the larger, slower moving institutions and individuals; those who require substantial information prior to making a commitment or decision. They tend to be more committee based if they are institutional.

- The laggards are those that are extremely late to the auction; they enter just when the innovators are packing up to go home or have already faded the current auction.

Dominant timeframe: Some background is necessary before you can begin to incorporate this concept; however, once you understand our use of the term timeframe you will also understand that each of these timeframes behaves differently. You will also appreciate that they may act separately, jointly, or counter to each other. It is important in our trading decisions to understand which timeframe or timeframes are dominant on any given day. For example, if the longer timeframes have little interest during the day session, the day timeframe may be able to dominate the daily auctions. On other days, there may be a great deal of interest by the longest timeframe, who then takes control; this is often why we experience trend days. Part of your accumulated experience is discerning who is participating in the auction by understanding the expected behavior of these multiple timeframes.

Dynamic references: References are static and dynamic; static references are preexisting while dynamic references are created during the pit session (or overnight) auction. Examples of dynamic references include buying and selling tails and POCs. If these dynamic references are not taken out during the current session, they become static references for following sessions. Dynamic references are the most current references that develop in real-time.

Elongation: The simplest definition for an elongated profile is one that is lengthening; a profile that is elongating represents a market that is proceeding directionally on a convictional course; a non-elongating Profile represents a market that lacks directional conviction. See below:

Excess: Excess marks the end of one auction and the beginning of a new auction. It is visible within the two-way auction process via buying and selling tails. Excess occurs in all timeframes; it completes an auction. There are always multiple two-way auctions at work; one could be completed while another is still active. Excess occurs in all timeframes. As was stated earlier, balance and excess are the two most important concepts you will be introduced to because they signify change or the potential for change to take place.

Exogenous event: An unexpected event that wasn’t considered within anyone’s model of expected market moving events; these events occur more than most mathematicians anticipate. They contribute to market uncertainty.

Exponential effect. As we accumulate either negative or positive information we can’t simply assume that each new piece of negative information, for example, can be added or incorporated into our analysis by simple mathematical addition. As the negative information begins to accumulate, each new piece of information may have the effect of very rapidly multiplying the possible outcome of risk or opportunity. We have experienced this effect as we build sand castles where finally the last grain of sand collapses the castle. Graphically the effect would look something like the following graph.

Gap: Is another form of excess. Price moves rapidly away from a prior trading level or reference; a gap signifies a total reordering in market thinking. NOTE: A gap, as it is employed in the Field of Vision video, Mind over Markets. and Markets in Profile, is measured from the previous day’s high or low—not from the settle. A gap signifies a market that is out of balance and presents a large opportunity.

Gap Rule: If the gap is filled and value cannot at least be similar value to the prior day, odds of a later day move in the direction of the gap are likely.

Go with trades: Go with trades are required to benefit from breakouts from balance, trading ranges, etc. To benefit from these breakouts, traders will be paying ‘10’ for something that may have been priced at ‘6’ prior to the breakout, for example. These trades, very often, represent a dynamic change in market thinking as well as risk and opportunity. These trades are high risk if you are positioned against the breakout; but large opportunities if you are going with the breakout. With successful breakouts, structure and value will follow. The opposite of go with trades are reversion to the mean opportunities

Half back: This reference is usually reserved for day and short-term timeframe trading and is most applicable when the day or short-term timeframe is dominating the market. It is also most applicable during the market’s initial auction; if there are day or short-term timeframe buyers below the initial rally high, or day or short-term timeframe sellers above the early auction decline, they tend to surface on a 50% pullback or 50% rally of the initial auction range (high to low). Throughout the day the half back reference ”floats” as there is range extension; however, it is still a day and short-term timeframe reference. We stress day and short-term timeframe because when the market is dominated by longer timeframes they pay no attention to these very short-term references. It is always important to know what timeframe is dominating since the trading behavior will change.

Some days have no initial balance as the market begins to trend immediately from the opening range with constant range extension.