Getting into gold with bull spreads

Post on: 5 Май, 2015 No Comment

A bull spread is a simple derivative with built-in floor and ceiling levels that define the lowest and highest points at which it can settle. This means youll always know your maximum potential loss and profit from the outset.

Bull spreads are short-term contracts. settled based on an underlying market, making them useful for hedging against movements in that market. Nadex offers bull spreads on stock indices, forex and commodities like grains and metals.

Using bull spreads offers several benefits because they are ideal for the retail trader looking for high leverage and hedging opportunities.

Gold trading is currently one of the hottest commodities for trading because its considered a safe haven investment. While gold prices bounce around, this metal is always expected to go back up, especially in times of financial turmoil. An effective way of taking advantage of the opportunities in the gold market is by using bull spreads.

Studies show that the prices of rare metals, specifically gold, fluctuate on an average close to 30 percent. This is why trading gold with bull spreads can be beneficial.

Gold can be extremely volatile. The average true range for gold was about $30 for most of 2013. That is equal to a $3,000 swing. Such volatility can create opportunities if you set an appropriate strike price and date of expiration. After determining the direction, you can then decide on a strike price. The right strike price is one that can be reached within the price movements or range of gold and is not above the resistance point.

Lets take a look at a specific example.

Lets say European leaders are meeting to discuss economic policy, and you believe a positive outcome may shorten demand for gold. In this example the underlying gold futures market is trading at around $1,728.2, and you decide to trade a bull spread .

You believe the price of gold will fall in anticipation of positive news from Europe.

You choose the following contract: Gold (Feb) 1700.0-1750.0 (1:30PM). This contract will expire at 1:30 p.m. today. You decide to sell because you think the gold future will reach below $1,728.0 at 1:30 p.m. Your position will expire at 1:30pm. You select 3 contracts at the bid price of $1,728.0. Each tick that the price moves is worth $1 per point.

Your maximum profit and maximum loss are displayed automatically. In this trade, the floor and ceiling have been set at $1,700 and $1,750 respectively, which means that the most you can make is $840 and the most you can lose is $660*.

Once place you can use bull spreads is Nadex. The difference between Nadex’s calculated expiration value and your opening price of $1,728.0 will determine your profit or loss.

Lets say that at 1:30pm, Nadex’s calculated expiration value for gold is down to $1,692.5, which is below the $1,728.0 mark you chose. This is beyond the floor of this trade, so your profit is calculated against the floor level of $1,700.

The difference between your opening price (1728.0) and the floor level (1700.0) is

280 ticks. Multiply 280 by the number of contracts (3) and the contract value per tick ($1) to calculate your gross profit, which is 280 x 3 x $1 = $840*.

However, there is a possibility that your selection wont be profitable. Lets say that at 1:30pm, Nadex’s calculated expiration value for gold is up to $1,748.0.

This is within the ceiling of this trade, so your profit is calculated against the settlement value of $1,748.0. The difference between your opening price (1728.0) and the expiration value (1748.0) is 200 ticks. To figure out your loss, you multiply 200 by the number of contracts (3) and the contract value per tick ($1) to calculate your gross loss. In this case, thats 200 x 3 x $1 = $600*.

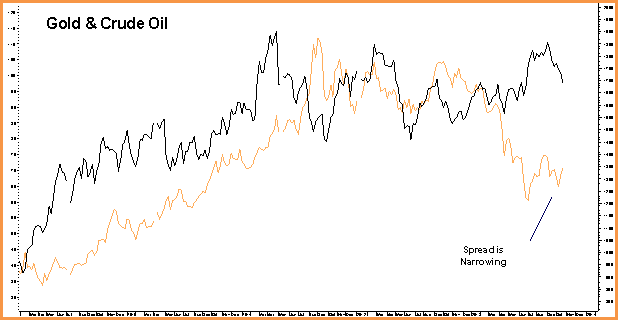

Gold went on a tremendous bull run from 1999 to 2011. Despite this, many bulls managed to lose money by getting in at the wrong time. Corrections, when they came were sharp and costly. Some analysts believe the long-term bull market in gold is over and some believe gold is simply taking a rest until the next leg higher. Regardless of who is right, gold will be volatile and have significant two-way moves. It is important to have a defined risk when entering a position. Bull spreads allow traders to do this.

Next week we will cover using bull spreads in the crude oil market.