Galliard Stable Value Fund 2015

Post on: 16 Март, 2015 No Comment

2BTransition%2Bupdate%2B1.jpg?w=500#q=Galliard /%

3A%2F%2Fwww.galliard.com%2F?w=250 /% Galliard focuses exclusively on providing fixed income and stable value management services to institutional investors. Galliard is an independently operated

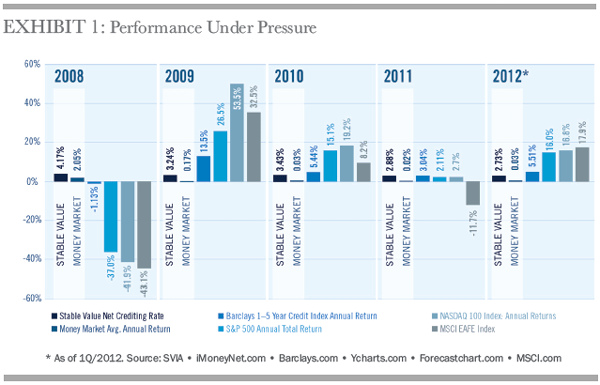

3A%2F%2Fwww.investopedia.com%2F?w=250 /% Pros and Cons As mentioned previously, stable value funds pay an interest rate that is a few percentage points above money market funds. They also do so with

3A%2F%2Fwww.blueprairiegroup.com%2F?w=250 /% Stable value fees can be confusing. For certain types of products like the pooled funds described previously, they’re expressed as an

3A%2F%2Fwww.forbes.com%2F?w=250 /% Investors worried about rising interest rates should consider stable value funds, a little-understood insured option found in 401(k) plans.

3A%2F%2Fwww.bogleheads.org%2F?w=250 /% Isn’t the credit risk of buying a Stable Value Fund analogous to buying a single corporate bond of a single issuer, which happens to be an insurance company?

3A%2F%2Fwww.abglogin.com%2F?w=250 /% METLIFE STABLE VALUE FUND Metlife Series 25157 — Class 35 A Reliance Trust Company Collective Investment Fund 12/31/2014 Performance Return YTD 2014 2013 2012 2011 2010

3A%2F%2Fwww.fatwallet.com%2F?w=250 /% I’m interested in parking my money into a stable value fund which I believe is superior to CDs in terms of returns while being only marginally riskier.

3A%2F%2Fwww.pionline.com%2F?w=250 /% Ameren Corp. St. Louis, added the Galliard Stable Value Fund as an investment option in its $1.9 billion 401(k) plan, confirmed Mary Ellen Brown, supervisor-trust investments. The option replaces the Northern Trust Collective Stable Asset Fund

3A%2F%2Fwww.bloomberg.com%2F?w=250 /% 21 (Bloomberg) — Galliard Capital Management Inc.’s stable-value funds about $1 of every $5 transferred by plan participants was put in a stable-value fund. While the funds recently have outperformed the stock market, investors should realize

3A%2F%2Fwww.investmentnews.com%2F?w=250 /% Galliard Capital Management Inc.’s stable-value funds, designed to preserve principal in tumultuous times, drew more than four times the usual inflows in August as market volatility increased, said managing partner John Caswell. Investors in retirement

3A%2F%2Fwww.thinkadvisor.com%2F?w=250 /% Investors flocked to stable value funds in an effort to smooth volatility experienced in August, apparently seeing them as a higher-yielding alternative to money markets. Bloomberg reports Galliard Capital Management’s stable-value funds saw more than

3A%2F%2Fwww.reuters.com%2F?w=250 /% today announced that Galliard Capital Management has selected it to manage $515 million of stable value assets in the Wells Fargo Stable Return Fund. Stable value funds seek to preserve principal while providing stable returns and the opportunity for

3A%2F%2Fwww.businesswire.com%2F?w=250 /% NEW YORK—(BUSINESS WIRE)—TIAA-CREF, a leading financial services provider, today announced that Galliard Capital Management has selected it to manage $515 million of stable value assets in the Wells Fargo Stable Return Fund. Stable value funds seek to

3A%2F%2Fwww.marketwatch.com%2F?w=250 /% I also think some hype is by the money market industry — and even some firms who provide both stable-value and money-market funds, but make higher profits on money-market funds. In a 2012 P&I Conference call Karl Tourville of Galliard said we have gone

3A%2F%2Fwww.fa-mag.com%2F?w=250 /% (Bloomberg News) Galliard Capital Management Inc.’s stable-value funds, designed to preserve principal in tumultuous times, drew more than four times the usual inflows in August as market volatility increased, said managing partner John Caswell. Investors

3A%2F%2Fwww.nytimes.com%2F?w=250 /% Galliard Capital Management, a subsidiary of the Norwest Corporation that manages $4.3 billion in assets, $2.6 billion of which is in stable-value funds, is »actively considering» registering a fund for I.R.A. investors, said Karl Tourville, a managing

3A%2F%2Fwww.wsj.com%2F?w=250 /% But stable-value accounts can be a smart option for the most conservative slice of a 401(k) portfolio, especially in the current interest-rate environment. These low-risk accounts are paying yields comparable to those of diversified bond funds and