Forging Frontier Markets

Post on: 16 Март, 2015 No Comment

Frontiers are very rarely stable. The very notion of a frontier appeals to our inherent desire to push ahead, explore and discover new opportunities. As it has always been with the physical boundaries conquered by explorers or the knowledge boundaries overcome by scientists and philosophers, so it is with investment markets.

Market frontiers are dynamic — constantly moving — as little-known opportunities in countries, technologies or industries are uncovered and evolve into established assets with measurable properties. In this case, the risk, return and correlated properties are central to the management of investment portfolios. If you’re interested in breaking new ground in portfolio, read on to find out how frontier investments do just that.

The Dynamic Frontier Vs. the Static Investment Policy

Despite the dynamic environment of a frontier market, we often encounter a certain rigidity when studying the role of frontier markets in investment decisions. For example, investment policy statements will typically allocate weighting for non-domestic equities into a binary division of developed and emerging markets . as if there were no middle ground between, say, Germany and Egypt.

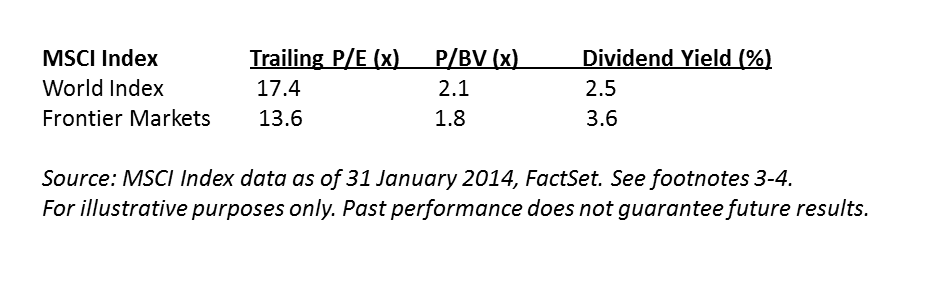

All countries that fall into a published category of emerging markets (for example the Morgan Stanley Capital International (MSCI) indexes) may make up some small, fixed percentage of a portfolio, while a mix of the world’s so-called developed markets of North America, Western Europe and Japan will usually be awarded a higher weight to reflect the lower perceived risk.

This artificial construct, though arguably useful from a practical standpoint in its simplicity, does not accurately reflect the dynamic movement of markets along a continual spectrum of risk-return correlation opportunities. Investors who are aware of this dynamic frontier can benefit from more precise management of risk-return exposures. To start with, it can be helpful to have a historical perspective on frontier markets and how the frontier has evolved over time. (To learn more about the risk/return relationship, be sure to read the Risk/Return Tradeoff section of our Financial Concepts Tutorial .)

A Brief History of Frontier Markets

The Investment Landscape in the 19th Century

The middle of the 19th century was tumultuous, with major social and political change occurring in Europe while the Industrial Revolution. which had first emerged in late 18th century Britain, was disrupting and transforming economies from Liverpool to Leipzig. Across the Atlantic Ocean, a new republic was in the early stages of a growth trajectory, with railways pushing across uncharted territory to establish new markets for the burgeoning industrial output of a new manufacturing economy. The United States was indeed a classic frontier market, with seemingly endless opportunities for growth and plenty of attendant risk — the Civil War being perhaps the most notorious but far from the only disruptive event of this period.

And the U.S. was not the only frontier market of its day — the English, Dutch, French and Spanish colonies in Southeast Asia, the Middle East, Africa and Latin America were all at various times attractive investment draws for wealthy European families and institutions. Unlike these markets, though, the U.S. would grow to become the dominant developed economy of the 20th century, while over a century later, many of those former European colonies would come into renewed focus as independent countries in successive new ages of frontier markets.

Japan . Prototype of a Modern Emerging Market

The term emerging markets — at least insofar as it relates to investment portfolio management — really didn’t come into vogue until the 1980s, yet there was an earlier prototype.

In the immediate aftermath of WWII, Japan’s economy lay in ruins, yet over a 25-year period from 1955 to 1980 the country’s real GDP grew by an average annual 7% on the back of a robust export-led economy and a unique model of business-government planning that was neither socialist nor unabashedly capitalist. Investors who ventured into the Japanese stock market over this period were appropriately rewarded, with the Nikkei 225 Stock Average growing from 425 at the end of 1955, to 7,116 by December 31, 1980 — a 12% average annual return. By this time, Japan was no longer considered an emerging economy and leaders of Japanese industry and finance (such as Sony (NYSE:SNE ), Honda (NYSE:HMC ) and Mitsubishi Bank (NYSE:MTU )) obtained listings on the New York Stock Exchange via a new financial instrument called American depositary receipts (ADRs), making these shares available for inclusion in a growing number of global institutional portfolios. (Read our ADR Basics Tutorial to learn more about this type of financial instrument.)

A Succession of Tigers

The success of the Japanese export model launched the next wave of frontier markets — the so-called four Asian Tigers of South Korea, Hong Kong, Singapore and Taiwan. By the 1980s, when these countries were appearing with increased frequency in the business news of the day, the term emerging market was coming into its own as a distinct asset class. These markets were seen as riskier than more developed economies, with generally weaker economic, legal, political and social infrastructures, but with outsized growth opportunities that could provide hefty returns to an equity portfolio.

The dynamic frontier pushed out further still as other Asian economies like Malaysia and Indonesia joined the original four Tigers. Meanwhile, the rise of market economies in Eastern Europe opened up a new horizon in this part of the world. The Latin American market, once primarily synonymous with chronic debt and currency crises, became vibrant again as countries from Mexico to Chile opened their economies and embraced market-based approaches to trade, currency and infrastructure.