Forex Correlations Dow Jones Industrial Average Drives Forex Moves

Post on: 23 Июнь, 2015 No Comment

Forex correlations to the US Dow Jones Industrials Average emphasize that financial markets remain as interconnected as ever, and the fate of the downtrodden US Dollar may depend on the next moves in financial risk sentiment.

Near-record correlations between the Australian Dollar, Euro/US Dollar, Canadian Dollar, and the Dow Jones Industrial Average suggest that currencies may continue to move in lock-step with risk. Extraordinarily low interest rates from the US Federal Reserve have made the US Dollar a prime funding currency in the FX carry trade. Speculators may pay near-zero percent interest rates to borrow dollars and invest in the high-yielding Australian Dollar and other counterparts.

The highly speculative FX Carry Trade would be at risk on any significant correction in the Dow Jones and broader equity indices. The Dows pullback from recent peaks could indeed be the start of a larger decline if we see further disappointments in earnings reports, and it may be critical to watch stock markets during US earnings season.

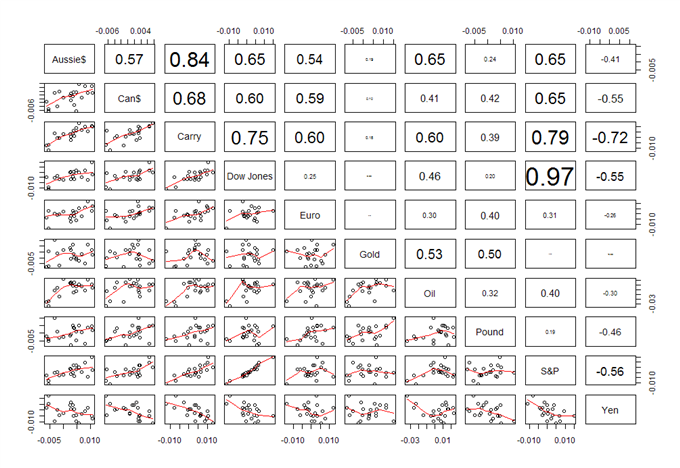

Forex Correlations Summary

Forex correlations against Oil, Gold, and the Dow Jones Industrial Average for the past 30 calendar days:

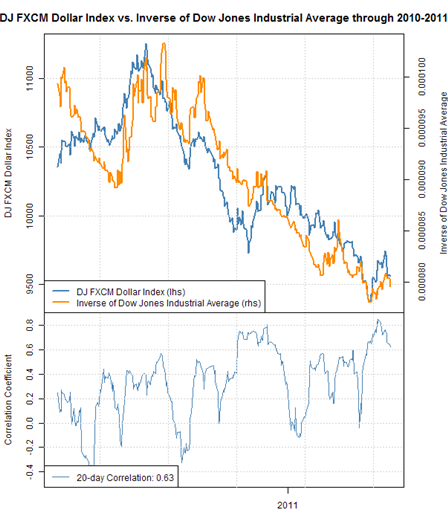

Euro/US Dollar and the US Dow Jones Industrials Average

The Euros correlation to the US Dow Jones Industrial Average has hit near its historical highs, emphasizing that the single currency remains very sensitive to broader risk sentiment. The ongoing European sovereign debt crisis leaves the single currency especially vulnerable to sudden deteriorations in risk appetite.

Thus it seems that the Euro/US Dollar currency pair will remain a goodif not perfectproxy for trading the Dow Jones Industrials Average. If Portugals requested bailout fails to completely calm market fears, we might expect the Euro to significantly underperform the Dow Jones and other US equity indices.

Australian Dollar /US Dollar and the US Dow Jones Industrials Average

Both the Australian Dollar and the Dow Jones Industrials Average continue to trade near significant peaks, and continued rallies in the Dow could push the AUDUSD to fresh record highs. As the currency with the highest short-term interest of any G10 nation, the Australian Dollar remains a primary destination for speculative capital in the FX Carry Trade. Yet as a fundamentally risky strategy, we could expect any significant pullbacks in global risk appetite to similarly curtail interest in the Australian Dollar against the low-yielding US Dollar and Japanese Yen.

The Reserve Bank of Australias benchmark interest rate currently stands a substantial 4.50 percentage point premium over the US Federal Reserve equivalent. Such a significant yield advantage will keep the Australian Dollar a good high-yielding proxy to trading the US Dow Jones Industrials Average.

Canadian Dollar and Dow Jones Industrials Average

A strong correlation between the Canadian Dollar/US Dollar currency pair (inverse of USDCAD) and the Dow Jones Industrials emphasizes that the currency remains closely linked to risk sentiment. The especially strong link is historically unusual and suggests that the high-flying Canadian Dollar has become a destination for global speculative capital. Thus we may expect the Loonie to continue trading off of broader moves in risksuggesting that the USDCAD could bounce significantly on a correction in the Dow Jones. The USDCADs similarly strong link to crude oil prices keeps focus on leveraged markets and their effects on US Dollar currency pairs.

Written by David Rodriguez, Quantitative Strategist for DailyFX.com

If you would like to receive this report and others via e-mail, send a message with subject line Distribution List to drodriguez@dailyfx.com.

The information contained herein is derived from sources we believe to be reliable, but of which we have not independently verified. FOREX CAPITAL MARKETS assumes no responsibility for errors, inaccuracies or omissions in these materials, nor shall it be liable for damages arising out of any persons reliance upon this information. FOREX CAPITAL MARKETS does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FOREX CAPITAL MARKETS shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.