Foreign Currencies – Diversify With Global Solutions

Post on: 16 Март, 2015 No Comment

So why isn’t your money?

Foreign currencies

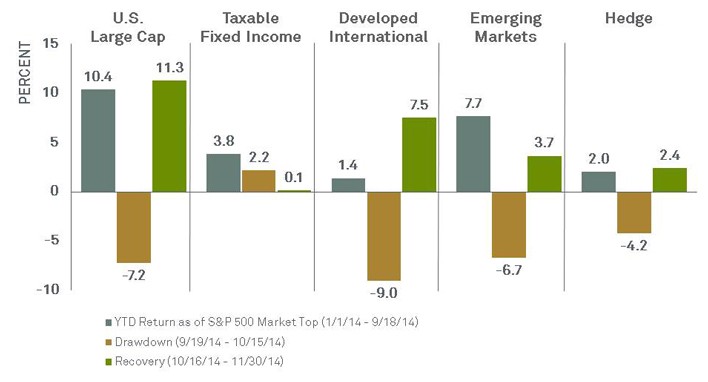

It’s tough to quantify the immense value gained from traveling the world and learning from new cultures. What’s easier to quantify is the value of adding foreign currencies to your financial portfolio. It can mean broader diversification, less portfolio volatility and new gainsand like with world travel, it’s also important that you understand the risks. 1 With our WorldCurrency accounts, you’ll discover simple and straightforward access to the world’s major currencies and many from emerging markets. You’d never restrict yourself to national boundaries, so why restrict your money?

Risks & Rewards

All world travel involves some potential for risk and reward. The same holds true when putting money into the world’s currencies. Know them up front so you can diversify with confidence.

Get in touch

Get to know us

Legal

i Important Disclosures

Deposits denominated in foreign currencies are susceptible to losses and gains due to currency price fluctuations.

If you request funds in this account be denominated in a currency other than the currency you deposit with EverBank, we will convert your currency using a then current Exchange Rate. The Exchange Rate you pay will be within 1% of the available Market Rate for the selected foreign currency. The Market Rate is a market price available on the Interbank currency market and is not published in any newspaper, on any website or in any other publicly available source. Published exchange rates or spot rates may not accurately reflect rates on the Interbank Market or the Exchange Rate available to you. You are not obligated to conduct Exchange Transactions with EverBank. For important exceptions from the standard pricing described above and for more information about EverBank’s Exchange Rates please see the Foreign Currency Deposit Account Disclosure in your Personal Account Terms, Disclosures and Agreements Booklet.

Not all WorldCurrency accounts pay interest. Single currency CDs and multi-currency CD Baskets generally offer a fixed interest rate. Certain WorldCurrency Access accounts earn interest. Interest earned will be calculated and credited in the accounts denominated currency. Please visit our website for current rates and minimum balances to earn interest.

EverBank is an FDIC insured federal savings bank. The standard FDIC insurance limit of $250,000 applies per depositor, per insured depository institution for each account ownership category. FDIC insurance covers against loss due to the failure of the institution, but not due to fluctuations in currency values. Due to the nature and volatility of the foreign exchange market, the values of currencies are subject to wide fluctuations against the U.S. dollar. Foreign currency denominated instruments will entail significant risk exposure to adverse movements of the foreign currency relative to the U.S. dollar. The amount of deposit insurance available for products denominated in foreign currency will be determined and paid in the United States dollar equivalent of the foreign currency, as the value of such currency is determined by the FDIC under its regulations, on the institution’s date of default. You can lose money, including principal, due to currency fluctuations. Please only deposit money that you can afford to risk, and as part of a broadly diversified strategy.

Certain EverBank accounts may be denominated or partially denominated in a Non-Deliverable Currency (NDC). Current NDCs offered by EverBank include the Chinese renminbi, Indian rupee, Brazilian real and Russian ruble. See your Account Terms, Disclosures and Agreements Booklet for more information regarding delivery restrictions, exchange rates, and funding and withdrawal restrictions on NDCs.

/media/_img/logos/ehl.png /% %img src=/

/media/_img/logos/fdic-small.png /%

2013-2015 EverBank. All rights reserved.