Five reasons China will fail to dominate—Commentary

Post on: 16 Март, 2015 No Comment

Getty Images

woman walks with her child on a street as schools were closed due to the heavy smog in Jilin, northeast China's Jilin province.

1. China’s domestic economy is unstable. China’s economy is dangerously skewed towards investment, which is unsustainable. Half of China’s economic output is fixed capital, compared to 15 to 30 percent in most countries. This infrastructure binge means there is a great deal of waste. For example, more than 55 new airports are planned by 2015, even though recent figures suggest that 75 percent of China’s airports lose money.

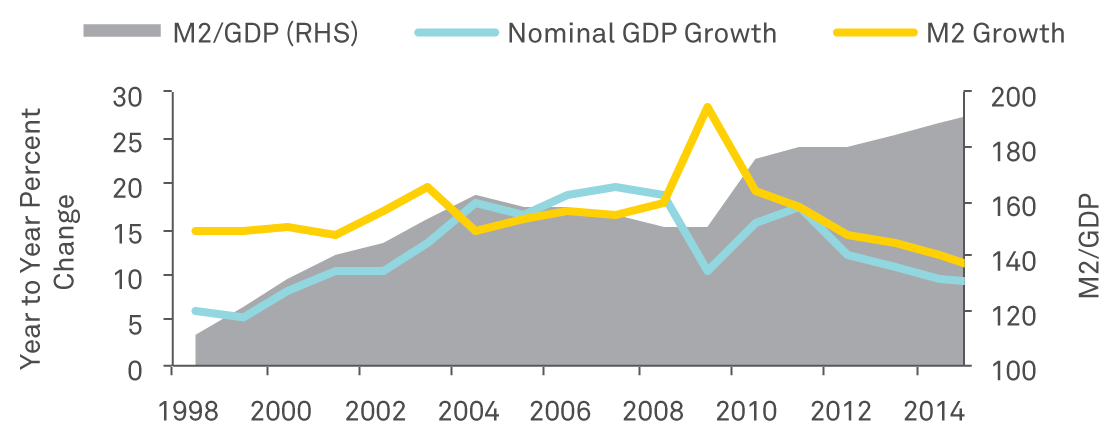

The Chinese economy is becoming even more unstable as government and corporate debt are rising quickly. China’s National Audit Office issued a report in December showing China’s public debt has more than doubled since 2010 to 58 percent of GDP, sending the financial press into fits. More than a fifth of new debt issued is being used to retire old debt and localities still rely heavily on land sales to pay off old debts, both major red flags.

2. Chinese innovation is in its early days. China was recently ranked number 25 in global innovation, behind Poland and Australia. Falsified academic research is rampant and successful businesses are often built by simply copying foreign business models. Nevertheless, Beijing is pushing hard to create high value products and climb its way up the innovation curve. It is trying to drive new ideas through business incubators at universities like Tsinghua in Beijing, through private sector corporations like Xiaomi, and by purchasing nascent technology from abroad and bringing it back to China, as is frequently happening in clean technology.

3. China’s demographic, pollution and social challenges are curtailing growth. There’s an adage that China will grow old before it grows rich. And it’s true. China is projected to be the world’s oldest society by 2030 and this rapid demographic shift is expected to cut more than 3 percent from GDP between now and then. On the environmental front, China’s now infamous airpocalypse has left Beijing, Shanghai and much of the country covered in intense smog the past two winters. Water pollution is also serious with up to 300 million Chinese lacking access to safe drinking water. These challenges will require massive economic change and capital to fix, which in turn will curtail China’s ability to grow its global presence and require it to focus resources on the home front.

4. The state-owned sector makes it challenging to create global companies. China’s economic and innovation challenges are partially a symptom of the continued dominance of the 114,000 State Owned Enterprises (SOEs). While SOEs enjoy preferential treatment for loans and subsidies, their return on equity is still only half that of the private sector. Moreover, SOE culture does not work on a global scale. Successful global corporations thrive on a meritocratic system that SOEs simply do not have.

5. China is not doing enough to curtail corruption. China still turns a blind eye to its rampant corporate corruption. Most Chinese companies do not have truly independent directors and accounting scandals remain all too common. Building global businesses without strong corporate governance is nearly impossible and China Inc. has a long way to go to change its corporate culture.

China’s economic rise is the defining trend of the past 25 years. As Chinese companies start to go abroad in earnest, they will likely lead in Asian markets and be important players around the world. However, the PRC’s economic fragility, innovation struggles, demographic and environmental challenges, reliance on SOEs, and corruption issues will continue to limit its ability to truly dominate the global business world.

— By Ed Sappin

Ed Sappin is the CEO of Sappin Global Strategies. a strategy and investment firm dedicated to the energy and innovation economies in the U.S. and abroad. Follow him on Twitter @esappin .