Financial Derivatives 101 Futures

Post on: 22 Апрель, 2015 No Comment

Eventually in your investing life, you will learn about financial instruments other than stocks. While learning doesn’t necessarily imply using these instruments, it’s always good to know what tools are available to you that can help maximize or improve your investment outcomes. This article is the first part of two. Here, I’ll give you an intro to derivatives called futures. then I’ll talk about options in the next article. C’mon, let’s level-up!

Definition

A derivative is basically a contract between two or more parties, whose value is dependent upon or derived from one or more underlying asset such as stocks, bonds, commodities, currencies, and even market indices. Other “exotic” derivatives are featured in this WealthLift article. but for now we’ll stick with the basics of futures.

Futures are financial contracts that obligate the buyer to buy the underlying asset. and the seller to sell an underlying asset at a predetermined future price and date.

Underlying Assets

The most common underlying assets for futures are physical commodities (like gold, oil, corn, coffee, cotton, cattle, hogs, or wheat) and financial instruments like currencies, bonds, and indices.

Standardized Quantity

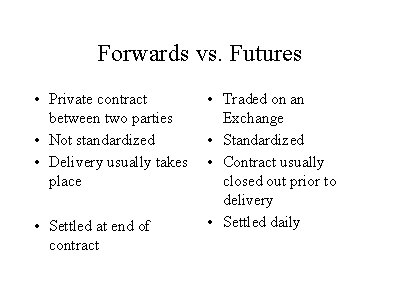

Futures contracts are standardized and specific in their quality and quantity, and are traded on futures exchanges like the Chicago Mercantile Exchange CME. For example, one futures contract for corn (ticker symbol ZC) obligates a buyer to buy 5,000 bushels of corn, with a certain grade, at an agreed-upon future date and price. A sample of a futures contract specification can be found here .

Settlement

Settlement is the term used to describe the act of consummating the contract on the expiry date. The expiry date is the agreed-upon time and day that a particular futures contract stops trading, and it is also when the final settlement price of the contract is determined. Most commodity futures are settled with the physical delivery of the asset, while futures contracts on financial instruments are usually settled in cash.

Use

Futures contracts are mainly used for either hedging or speculating. For example, oil producers can hedge (reduce risk) by selling futures contracts to lock in prices. This protects them from potential falling prices, because they can sell oil today (at current prices) for a future delivery date.

Let’s say a crude oil producer determines that it will beat all its earnings estimates if it’s able to sell its inventory at $106 per barrel, however, they know that there is a supply glut and prices will be falling soon. The best way for them to avoid selling at potentially lower prices is to sell futures contracts. In real life, they could have locked in that $106 per barrel last May 1, 2012 for delivery the following month. That would have ensured the selling price of their oil, which in turn would result in blockbuster profits.

Speculators, on the other hand, do not necessarily look to deliver or accept settlement of the underlying assets. They just buy and sell (or short) contracts to profit (or lose) on the difference between buying and selling price. For example, a trader who speculates that crude oil prices are headed upward may buy one contract of crude oil futures at $92 and sell at $94, for a gain of $2 or 200 cents. Since these contracts are standardized, a one cent gain (one tick) on a single contract represents a $10 gain (this is specific for crude oil contracts and will vary for others). Thus, a 200 cent gain is equivalent to a $2,000 (200 x $10) profit for the trader. Please take note that losses are calculated in the same manner, meaning you will lose $10 for every cent that you will lose on a single crude oil contract.

Trading

As I’ve said, futures contracts are traded on futures exchanges. This being the case, these contracts can be bought or sold in an instant, and people trading them can gain or lose money depending on the prices at which they bought or sold. Remember that these contracts do not necessarily have to be held until the delivery date, so traders can speculate on price direction alone, without the need to accept the physical delivery of the commodity. To buy or sell a futures contract, futures exchanges require traders to post a performance bond more commonly known as margin. This is usually 5% 15% of the contract’s notional value, but it varies depending on the underlying asset’s volatility and price. For example, one futures contract of corn requires a minimum balance of $2,363 in a trader’s futures account. Instead of depositing $17,000 (the notional value of 5,000 bushels of corn), a trader just needs to have a minimum balance of $2,363 in his or her futures account to be able to trade one futures contract of corn.

Futures are a great way for speculators to participate directly in price trends of commodities. They are easily traded in an organized and standardized manner, plus, some of them are relatively accessible even to small investors due to their low margin requirements. However, extra care must be taken when trading futures. Always keep in mind the expiry dates, minimum price fluctuations, contract size, and margin rates because these factors also affect your ability to profit or lose. As I always suggest, start practicing with paper trading before putting real money on the line. This will help you hone your skills with futures trading without incurring real costs on the outset.