Fight back to protect your Isa from inflation

Post on: 29 Апрель, 2015 No Comment

Government policies in the UK and Europe could stoke inflation. Here’s how to fight back and inflation-proof your Isa.

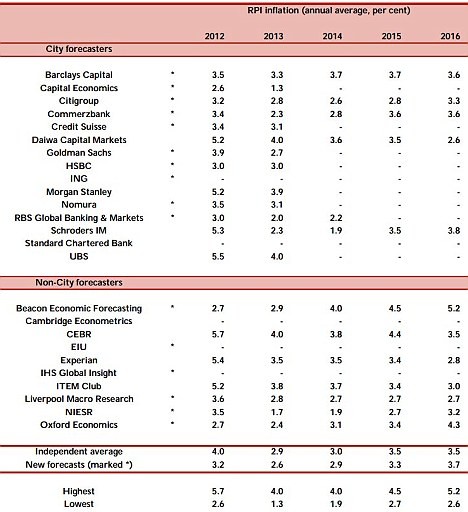

On the face of things, there’s little in the recent fluctuations of the UK’s inflation indices to suggest that consumers are in for anything beyond further steadily creeping price increases in the coming months. The Consumer Prices Index (CPI) has stuck stubbornly at 2.7 per cent for the past four months, notwithstanding the government’s 2 per cent target, while the Retail Prices Index (RPI), which includes housing costs, stands at 3.3 per cent, having bobbed around between 2.6 and 3.9 per cent during the course of 2012.

But there are fears that inflation could in due course be very much on the rise, if the UK and European governments fall back on the erosive power of rising prices as the easiest way – perhaps the only effective way – to reduce the enormous national debts they are wrestling with. The Investors Chronicle columnist Alastair Blair forecasts that ‘as soon as it can be engineered, Mario Draghi and Mark Carney will set their inflation dials to 7 per cent. And once that seems normal they will turn it up higher’.

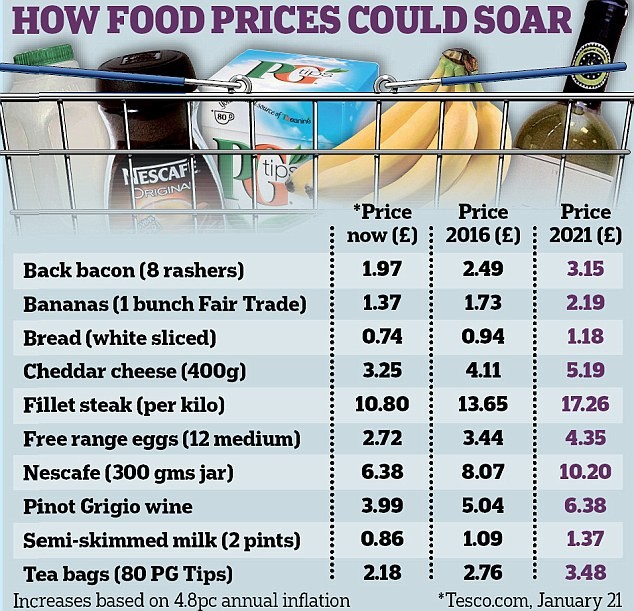

He may be taking an extreme view – many commentators see much less cause for alarm, at least in the short to medium term – but the fact remains that even now, inflation is causing increasing problems, especially for pensioners on fixed incomes and relying on savings income to supplement their pensions. Adrian Lowcock, senior investment manager at Hargreaves Lansdown, points out that although savers may not be worried by the current rate of inflation, ‘in 21.35 years with RPI at 3.3 per cent, their savings would halve in value’.

So what are the options for Isa investors? Arguably the simplest and safest choice for inflation-proofing your cash has historically been National Savings & Investments’ index-linked savings certificates, which, being themselves tax-free, can run alongside other Isa investments. These pay an RPI-beating interest rate that guarantees growing purchasing power over the years; but there are no issues currently available or planned for the 2012/13 tax year, and no date available for future launches. Moreover, previous issues have sold out very quickly; register on the NS&I website (www.nsandi.com) for email updates if you want to take advantage of future releases.

What are the cash alternatives? Savings accounts in general hold very little joy at the moment, as the Bank of England’s Funding for Lending scheme (which provides lenders with very cheap cash with the aim of boosting the lending market) means banks no longer have any interest in attracting savers’ money through competitive savings rates. To outpace inflation, even basic-rate taxpayers need an account paying at least 3.39 per cent; there are presently no taxable accounts available that beat CPI after tax.

However, it’s still worth making use of your annual cash Isa allowance, worth £5,640 this tax year. Not only does interest accumulate tax-free, but current cash Isa rates are somewhat higher than those on taxable accounts.

Be warned – most cash Isa rates do not keep up with CPI either. But Anna Bowes, director of savingschampion.co.uk, highlights a handful paying rates higher than inflation (see the table on page 36), although most have restrictive terms – for example, requiring a linked bank current account or a large deposit to earn the top rate. Coventry Building Society’s 60-day notice Isa pays 2.8 per cent (including a 0.6 per cent bonus for 12 months), and only requires a deposit of £1. However, it’s limited to this year’s Isa allowance, as transfers in are not permitted.

Beyond cash, what other hedges against inflation could you consider? One traditional choice, suitable for the full £11,280 stocks and shares Isa allowance, has been inflation-linked gilts. These have the added attraction that they are linked to RPI, which has averaged around 0.7 per cent higher than CPI over the past 20 years. But they are widely considered to be very pricey, and therefore will not provide complete protection against inflation.

It could make more sense to look at an inflation-linked bond fund with greater strategic capacity. One possibility is Kames Inflation Linked fund, run by Stephen Jones. ‘Index-linked gilts remain at the core of our strategy, but we don’t just look at the UK – we make our choice from Europe, emerging markets, US and other index-linked government bonds,’ he says.

The fund also has a small exposure to the index-linked corporate bond market, which is again paying 1-1.5 per cent above government rates, as well as to commodities, the rising prices of which drive much wider inflationary pressure, and to gold. In addition it can hold

equities that pay rising dividends (for example utility, tobacco or oil company shares).

A less bond-focused alternative is the Trojan fund, picked by Adrian Lowcock as a useful inflation hedge. This multi-asset fund holds equities, bonds, preference shares and precious metals as well as index-linked gilts, and aims for capital preservation and growth.

‘Manager Sebastian Lyon believes the actions of Western governments will ultimately end in higher inflation, but does not rule out a spell of deflation beforehand. He has therefore prepared for both eventualities. He believes his equity and bond exposure should help to offset the effects of high inflation. Gold, traditionally considered a hedge against inflation, could also provide shelter against deflation,’ explains Lowcock.

As well as gilts, it’s now possible to use your Isa to tap into a small selection of index-linked retail bonds issued by companies such as Tesco, Royal Bank of Scotland and Severn Trent Water.

‘These are riskier than gilts, as companies are regarded as more likely to default than the government,’ comments Robert Lockie, investment manager at Bloomsbury Wealth. The Severn Trent bond, for example, is paying a real rate of 1.3 per cent, adjusted to take account of changes in RPI.

Retail bonds can either be purchased individually (through the London Stock Exchange’s Order Book for Retail Bonds) or via funds of index-linked corporate bonds; Gavin Haynes, managing director of Whitechurch Securities, suggests M&G’s UK Inflation Linked Corporate Bond fund as a good choice, or SLI Global Index Linked Bond fund for a wider perspective.

Gold is another longstanding inflation hedge, as the price tends to rise in line with inflation over the long term. But its popularity as a safe haven against the volatility of recent years means gold bullion has seen huge price increases since 2008. Moreover, rapid growth in the gold exchange traded fund market has resulted in very active trading and in the gold price itself becoming highly volatile, warns Jason Hollands, managing director of communications at Bestinvest.

He says gold-mining stocks and funds, which have done badly over the past 18 months or so compared with physical gold, offer better prospects for more adventurous investors. ‘Some well-regarded value investors have increased their holdings in gold equities to reflect a re-rating opportunity,’ he adds.

Hollands also highlights absolute return funds that ‘utilise sophisticated investment techniques with the aim of producing attractive returns irrespective of the direction of markets’. He recommends Standard Life GARS as ‘a steady performer across different economic backdrops’.

Finally, bear in mind that over the longer term, the stock market generally proves a better inflation hedge than most fixed-interest investments for an Isa. Defensive sectors such as utilities, energy, foods and pharmaceuticals are traditionally good sectors for investors taking a medium to long-term view, as these companies can raise prices effectively within an inflationary environment. Haynes likes Rathbones Income for its strong record of rising distributions year on year.

The bottom line, for anyone reliant on savings/investment income that outpaces inflation, is that they will have to shop around regularly and probably be willing to take some investment risk in their Isa.