External Environment Business and Inflation

Post on: 16 Март, 2015 No Comment

Richard Bowett analyses the nature of inflation; how it affects business and how the Government seeks to control it

What is Inflation? Inflation is a general rise in prices. or a fall in the value of money. It means that year after year, 100 buys gradually less and less.

How is Inflation Measured?

Inflation is measured by the Retail Price Index (RPI). This is like a huge shopping trolley which government inspectors take round the shops every month. They fill it with a representative sample of all the goods and services that people typically buy. Then they add up the prices and compare them with the previous months prices. Although figures are collected monthly, they are normally quoted annually eg inflation is 2% pa which means average prices are rising by 2% every year.

Inflation is given as an index number. This means the first years calculation is set at 100, and every year after is measured in relation to that. So if 1990 = 100, and 2000 = 110, we know instantly that prices have risen 10% over the 10 years. This is just a way of making the data quicker to understand.

The RPI isn’t the only measure of inflation. There is also RPI(X) which excludes mortgage repayments, and RPI(Y) which excludes indirect taxes (VAT and duties such as fuel duty).

The RPI is a good measurement but not 100% accurate, so it is possible sometimes that the government under- or over-reacts to inflation data.

Whats Wrong With Inflation?

Its a matter of degree; 25% inflation is much worse than 5% inflation. Some countries (eg Russia and Serbia) have recently had hyper-inflation with prices rising by up to 1000% pa! Low inflation, such as the 2% or so the UK has at present, is not a real problem.

The UK has had a big problem with inflation in the past. It rose to 28% in the late 1970s. This caused significant problems with growth and employment. The memory of this time makes the government very determined now to keep inflation under control. Why?

1. Inflation distorts prices between different time periods. Normally, people save some money, and there is a balance between savings and spending. Savings go to banks where they become loans for business investment. If there is inflation, youre better off spending the money now before it loses its value, so consumption now rises at the expense of consumption later; savings are money you plan to spend later.

2. Instead of saving, consumers may start borrowing. 10 000 borrowed now will buy lots of things, and by the time you repay it in a few years time, the 10 000 is worth less, and is probably easier to repay if your salary has risen because of inflation. So consumers tend to borrow more and spend even more.

3. Interest rates rise. If a lender normally wants 5% to let someone else use the money for a while, and inflation is also 5%, then the lender will want 10%. This puts up business costs and makes borrowing less and therefore investment less; less investment means less growth and employment.

4. Inflation causes uncertainty which increases risk. Higher risk means businesses are less likely to invest, with the results mentioned in 3.

5. Inflation re-distributes wealth and income. People with fixed incomes eg some pensioners see the real value of their income fall (they become worse off) and other people get pay rises to compensate for inflation (they become better off). Wealth moves from savers to borrowers eg house price inflation makes the owners of houses much better off, and the mortgages become easier and easier to repay.

6. Input prices (raw materials, wages and supplies) rise so business costs rise. Wages are often the largest business cost, and there could be a danger of a wage-price spiral where rising costs leads to higher prices, workers ask for a pay rise in compensation, so costs rise again, so prices rise again, and so on.

7. Shoe-leather costs. Because prices are always changing businesses and consumers spend a lot of time looking for the best price (walking up and down the high street) which is a cost and they may not find the best deal, which is another cost.

8. Menu costs are the costs of constantly changing prices as in the literal example of reprinting the menu. But its not just the price labels on the goods, but the whole business system that has to be changed.

9. Wage negotiation. If there is inflation, workers will want pay rises. The actual time and cost of negotiating this, and making the necessary administrative changes can be quite high. Whilst managers are negotiating, they arent doing anything else.

10. Asset-price inflation. Houses, shares and other investments (even art & antiques!) often rise in price during inflation as investors look for a safe haven for their money. These prices then rise due to strong demand, which attracts further buying. So normal spending patterns are changed because of less spending on normal goods and services and more spending on assets. This switch reduces demand for normal businesses and creates an artificial bubble in these other markets.

11. Trade. If the UK has higher inflation than competitor countries (which it isnt now, but it has been for a lot of the last few decades) then UK prices gradually rise above imported prices. More imports are bought, so demand leaks out of the country and leaves UK businesses in a weak position. The same effect occurs with UK export businesses. The eventual effect may be a fall in the which puts prices back where they were, but leaves UK consumers worse off because they can buy fewer imports than before.

How is Inflation Caused?

There are three main views about how inflation is caused:

1. Demand-pull. This means buyers want to buy more than sellers can actually produce; so sellers start to put prices up.

2. Cost-push. This means business costs start to rise (eg oil prices rise, or wages start to rise) and sellers need to put prices up to compensate.

3. Monetarist view. This means the government allows too much money to be created. If the supply of money rises, then the price falls just as if the supply of potatoes rises, then the price falls. The price of money here is how many goods and services it will buy. If the price of money falls, then it will buy fewer goods and services ie prices of goods and services rise and the value of money falls. This is inflation.

4. In practice, we might get bits of each.

How is Inflation Controlled by the Government?

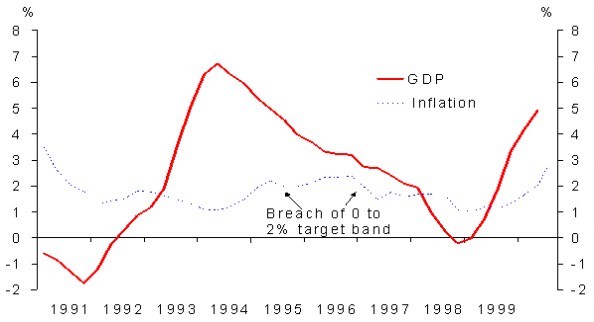

In 1997 the new Labour government gave monetary independence to the Bank of England. This means the Bank decides what to do without political interference. The Bank created the Monetary Policy Committee (MPC) which is given the job of deciding on the level of interest rates. They have a target of 2.5% inflation +/- 1% (1.5% — 3.5%).

If inflation looks to be getting too high, then they will raise interest rates. This affects businesses and consumers.

1. Consumers will find it more attractive to save more and spend less. They will find it more expensive to borrow money for spending. Most consumers also have mortgages. The repayments become more expensive so their disposable income falls and they spend less. Overall, spending in the economy falls.

2. Businesses find it more expensive to borrow money for investment and growth. Investment spending is also spending in the economy, and this falls.

Of course, there is a cost to this, because growth and employment are reduced, so the Bank has to weigh this up carefully. If inflation looks too low, it cuts interest rates with the opposite effect, and growth and employment are increased.

How is Inflation Prevented?

As well as the activities of the MPC, there are other factors which make inflation more or less likely. Basically, inflation is rising prices, so anything that stops prices rising will make inflation less likely.

1. Competition. If there is a lot of competition in a market, businesses try harder to keep prices low to keep buyers.

2. Elasticity of demand. If goods are elastic, buyers will resist price rises. Elasticity is related to substitutability, so if there are plenty of substitutes, then buyers will simply switch spending away from the more expensive products. Imports are a kind of substitute. Competition leads to more choice, so this affects substitutes as well.

3. Elasticity of supply. If businesses can increase output without increasing costs, then price rises are less likely. For example, economies of scale make sellers keen to actually cut costs to expand output and sales.

4. If output rises, businesses buy more inputs, so we need to think of the elasticities of supply and demand in these markets as well, not just finished products. As businesses buy more inputs, these prices may stay much the same, or start to rise which puts up business costs. Wages are especially important because wages can be a very large business cost, and because the labour market isnt quite the same as the potato market.

5. Labour causes particular problems.

- Wages are sticky downwards. If there are too many potatoes on the market, the price falls until buyers decide to buy again. But workers dont like wage cuts, and it is much easier to put the price of labour up than down, even if it might be a good idea. This gives us a rare benefit of inflation, because it cuts the real cost of wages (albeit slowly) while other prices are rising, so labour ends up being cheaper if this is what is needed eg unemployment is high.

- Skills shortages may develop in particular parts of the labour market. For example, two years ago there was a desperate shortage of IT workers due the dot.com boom. Wages for these workers rose sharply, and businesses even started poaching each others employees with ever-ritzier job offers. This puts up costs. Inevitably other groups of workers got jealous and began to press for rises which put up costs even more. At the same time there were pockets of high unemployment in the country because some workers are geographically immobile (they wont/cant move to where the jobs are) or occupationally immobile (they dont know how to do the new jobs) or both.

6. Efficiency. If costs rise there are two answers. Only one is to raise prices. The other is to become more efficient so unit costs fall and profits are restored. The more efficient businesses are, the less likely it is they will have to raise prices, and the less likely is inflation.