Europe s QE Experiment Adding Stock ETF Exposure And Hedging Against The Unforeseen

Post on: 7 Октябрь, 2015 No Comment

Europes QE Experiment: Adding Stock ETF Exposure And Hedging Against The Unforeseen

The outperformance by Germany as well as Europe over less recent quantitative easers is worthy of note. It tells us that the countries/regions that are in the process of actively weakening their currencies the ones that are actively lowering the costs of servicing their sovereign debt by the most significant amounts via ultra-low yields are seeing the greatest pop in near-term equity prices.

For those who do not understand why the yen strengthens in risk-off environments, you may need a refresher on the carry trade. Investors borrow the low yielding yen to invest in higher yielding assets or higher appreciating assets. However, there is a serious consequence for playing the game at the wrong time; specifically, the yen rise in value when institutions and hedge funds rapidly sell stocks, higher-yielding bonds and higher-yielding currencies to avoid paying back loans in a more expensive yen. The Japanese currency can rise rapidly and the reverse carry trade can take on a life of its own.

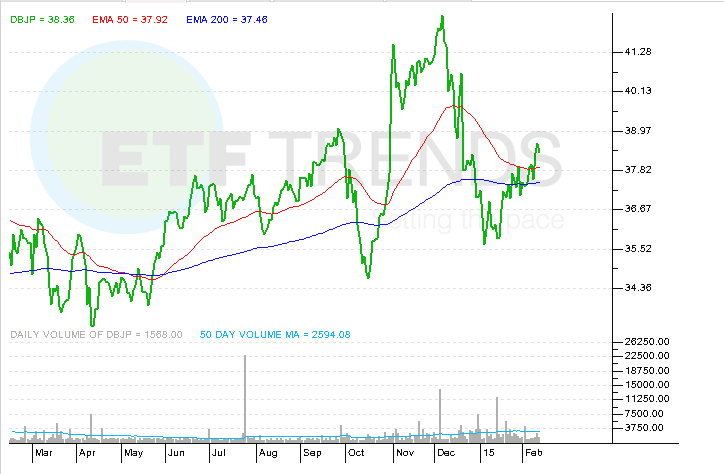

During Januarys volatility in U.S. stock assets, FXY has crossed above its 50-day moving average. If the risk off volatility has truly run its course due to the European Central Banks mammoth QE promise and the Bank of Japans existing promises, FXY should stabilize rather than climb. Conversely, additional gains for FXY would suggest additional unwinding of the yen carry trade as well as a high probability of heavy volume selling of stock assets.

The potential for the carry trade to unwind and the yens historical record as a safer haven currency is the reason for its inclusion in the FTSE Custom Multi-Asset Stock Hedge Index. This index that my Pacific Park Financial colleague and I created with FTSE-Russell- the one that many are already calling MASH holds the franc, yen, dollar and gold. It also owns long maturity treasuries, zero coupon bonds, inflation-protected securities, munis, German bunds and Japanese government bonds. Year-to-date, the FTSE Custom Multi-Asset Stock Hedge Index is up 4.5%.

Shouldnt investors just play market-based securities in a way that has worked so well during the Federal Reserves QE3? The shock-and-awe, 1.5 trillion dollar, open-ended, bond-buying bazooka that gave U.S. stocks double-digit percentage gains in 2012, 2013 and 2014? After all, the European Central Bank (ECB) is proffering $1.1 trillion euros into 2016. The problem in the comparison between these programs is that 80% of the sovereign bonds are being bought by the national central banks and not the the ECB itself. This means that each country (e.g. Austria, Belgium, France, Germany, Greece, Italy, Spain, etc.) is responsible for its own default risk.

It follows that I might be willing to add a fund like iShares Hedged German Equity (HEWG) to my barbell portfolio. alongside several existing components such as iShares S&P 100 (OEF), SPDR Sector Select Health Care (XLV) and Vanguard Dividend Growth (VIG). I might be a bit more skeptical of iShares Currency Shares MSCI EAFE (HEFA), simply because of the drag of extreme debtors on the periphery of Europe (e.g. Spain, Portugal, Greece, etc.).

By the same token, I have slowly increased exposure over the last three months to a number of existing holdings on the other side of the barbell. They include SPDR Gold Trust (GLD), iShares 10-20 Year Treasury (TLH), Vanguard Extended Duration (EDV) and, more recently, FXY. Remember, multi-asset stock hedging does not mean that your dynamic hedging loses when riskier stock assets win. On the contrary. Both sides of the barbell tend to perform in late-stage bulls.

You can listen to the ETF Expert Radio Show “LIVE”, via podcast or on your iPod. You can follow me on Twitter @ETFexpert .

Disclosure Statement : ETF Expert is a web log (”blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc.. a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial. Inc. and/or its clients may hold positions in the ETFs , mutual funds. and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange -traded products compensate Pacific Park Financial. Inc. or its subsidiaries for advertising at the ETF Expert web site . ETF Expert content is created independently of any advertising relationship .

Share this post: