ETF Insider Debuting Our AllETF Portfolio Business Insider

Post on: 13 Апрель, 2015 No Comment

The last few days have seen a number of interesting developments in financial markets, as commodities have seemingly resumed their skyward trajectory and Europe once again seems headed for a complete meltdown. Against this backdrop, we introduce the ETF Insider all-ETF portfolio, a hands-on portfolio that seeks to establish a small handful of tactical positions around a core of ETF holdings covering the major asset classes. First, however, we check in on the technical ETF trading ideas from Monday. updating performance through the first few days of the week.

Week To Date

Investors have been taken on a wild ride in the early part of this week, as disappointing economic data put stocks in an early hole on Monday morning. That early sell-off was triggered by a spike in Europe-related anxiety, as investors fled towards safe havens over worries that election results in Spain would make austerity campaigns more difficult and that issues in Italy would intensify in coming months. Activity was light on Tuesday, as many traders still remained on the sidelines given the ongoing concerns in Europe and a lack of meaningful data releases. With anxiety levels still elevated, safe havens continued to appreciate and gold made quite the run higher, charging past $1,525 an ounce. Another major development in commodity markets came in the energy space, where Goldman Sachs upgraded its price forecast for Brent oil to $120 / barrel from $105 previously.

Today, equities finally made a push higher, although investor sentiment was still mixed at best given the worse-than-expected durable goods orders and housing data. Orders for durable goods fell 3.6% in April given a steep decrease in demand for aircraft and autos. Housing prices also slipped lower and fell a seasonally adjusted 2.5% in the first quarter of 2011–though there was some good news. “Fortunately, serious delinquency rates also are declining,” said FHFA Acting Director Edward DeMarco. Precious metals continue to push higher, with gold surpassing the $1,530 an ounce level and silver trading well above $37 once again. Oil futures are also making a run higher, rising just past $101 a barrel, while U.S. dollar weakness continues to be the longer-term theme as the dollar index has failed to gain any ground even amidst the recently shaky performance of equities.

Checking In: Technical Trading Ideas

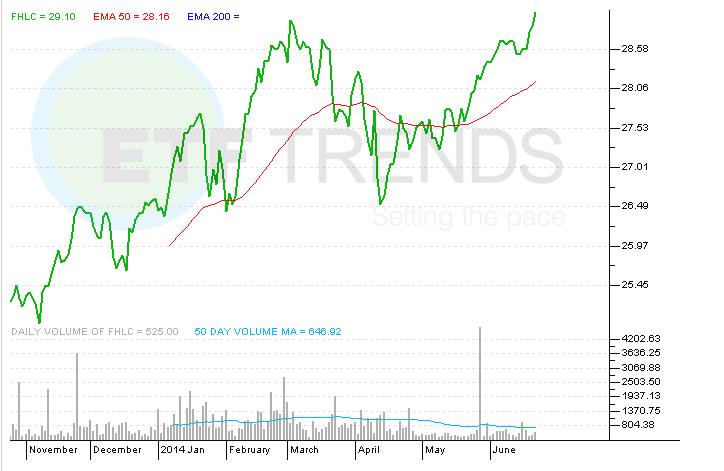

This week our technical trading ideas focused on highlighting opportunities to establish short positions in the U.S. financial sector and mid-term Treasuries, along with a bullish outlook for copper based on key technical levels. The last few days have altered the outlook for some of these plays, prompting a reevaluation of our positions:

Technical Trading Idea #1: Short XLF

Financials tumbled to start the week thanks to broader risk aversion related to ongoing woes in Europe. That put our short call on XLF in good position, as this SPDR fell in Monday trading. The subsequent sessions saw continued weakness in financials, sending XLF closer to the 200 day moving average that we cited in our Monday analysis.

Since the start of the week, XLF has managed to hit our very near term target of $15.45 a share quite nicely, even declining as low as $15.39 Tuesday mid-day. We’re happy to take profits at our suggested price target, which yields a 0.6% gain in just two days of trading. If weakness persists in the financial sector, XLF will likely wander sideways and eventually take a dive lower towards $15 a share.

Technical Trading Idea #2: Short IEF

IEF opened higher on Monday morning above the suggested support level of $96; however, the fund quickly gave up its gains as equities found their footing and rose in afternoon trading. Treasuries continued to sink on Tuesday and IEF dipped as low as $95.64 a share, but failed to accelerate downwards as we had anticipated.

This pick has been flat and for that reason we recommend holding the short position on IEF until the fund manages to close above $96 a share. Any strength in the equity markets over the next few days could easily send this fund lower towards our target of $94.45 a share, but if anxiety continues to steer investors away from riskier assets, then U.S. Treasuries could continue their slow and steady rise.

Technical Trading Idea #3: Long JJC

JJC opened at $52.14 a share, which was far lower than anticipated given that the fund previously closed above $54 a share on Friday. Likewise, going long turned out to quite profitable as the fund has posted a gain of nearly 4% since Monday’s open. Copper prices appear to be building support at current levels which leads us to believe that JJC is worth holding given the attractive upside potential. Our price target for the next month remains at $60 a share; however, we advise more conservative traders to take some profits off the table and lock in gains at current prices above $54 a share.

ETF Insider Portfolio

The ETFdb Insider Portfolio is highlighted below, along with a discussion of each of the components and our rationale in the current environment. As discussed in more detail below, we’ll continue to be on the lookout for attractive opportunities to establish positions in asset classes that suffer a sell-off, maintaining a cash position in hopes that an opportunity to go “bargain shopping” arises: