ETF Bear Put Spread Options Strategy Explained

Post on: 25 Июнь, 2015 No Comment

by Justin Kuepper on May 23, 2013 | ETFs Mentioned: GLD

Exchange-traded funds (“ETFs”) have become a very valuable tool for investors seeking exposure to all corners of the market. While they provide diversified exposure in a single U.S.-traded security, equity options can be used in conjunction with ETFs to create more complex trading strategies designed to achieve specific goals or targeted strategies [see also ETF Call And Put Options Explained ].

In this article, we’ll take a look at how bear put spreads can be used to place a controlled bearish bet on an ETF’s direction.

What Is a Bear Put Spread Strategy?

Suppose that an investor has a bearish outlook on a commodity like gold and wishes to devise a strategy to profit from its decline; however, short-selling the SPDR Gold Trust (GLD, A- ) could be a bit risky given the commodity’s volatile dependence on external events. After all, a single comment out of the U.S. Federal Reserve about further easing could send it sharply higher [see also How To Take Profits And Cut Losses When Trading ETFs ].

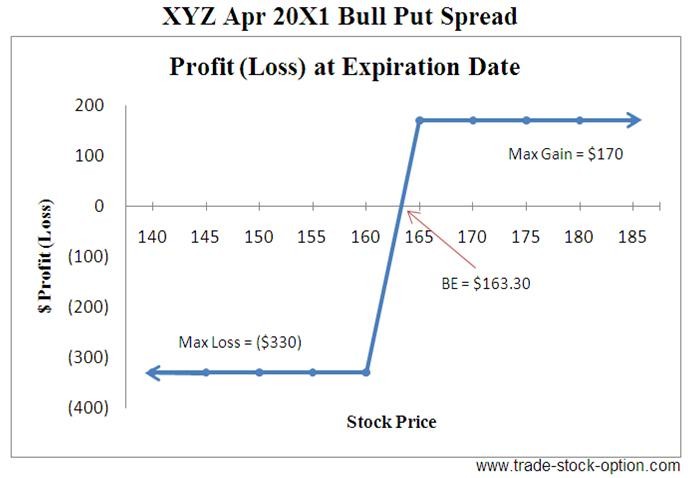

The investor may instead want to consider establishing a bear put spread by buying one put and selling a second put at a lower strike price. Unlike a single long put option, the strategy puts a ceiling on both the profit and loss possibilities, with the cost of establishing the position being the maximum potential loss and the difference in strike prices being the maximum profit.

The bear put spread’s option diagram looks like this:

Who Is the Bear Put Spread Strategy Right For?

The bear put spread is a moderate bearish strategy that lets ETF investors profit from downside in the underlying stock, but with less risk than many other bearish strategies. Due to the limited profit and loss potential discussed above, investors that want to limit their risk or keep their cost basis low often use bear put spreads as their preferred bearish options strategy [see also How To Take Profits And Cut Losses When Trading ETFs ].

A few scenarios where the strategy might make the most sense include:

- Event Risk Situations - where an ETF could rapidly appreciate in price, causing an otherwise successful bearish position to take a turn for the worst.

- Moderately Bearish Situation - where an investor is uncertain about future price movement, but believes it’s more likely to go down than up.

- Favorable Pricing Situations - where an investor may be able to acquire put options at favorable prices, creating a very cheap and low-risk trade opportunity.

What Are the Risks/Rewards?

The bear put spread has a very well defined risk/reward profile, given that both upside and downside are explicitly limited. As the two put options cancel each other out on the upside or downside, the breakeven point is equal to the purchased put strike price minus the net debit paid to establish the bear put spread at the onset of the trade [see also How To Hedge With ETFs ].

The max profit/loss for the position includes:

- Max Profit occurs when the underlying ETF’s price falls below the lower strike price at expiration and is limited to the difference between the two strike prices, minus the initial outlay paid to establish the bearish put spread and any commissions.

- Max Loss occurs when the underlying ETF’s price rises above the upper strike price at expiration and is limited to the initial outlay to establish the bearish put spread minus any commissions paid to enter the position.

How to Use a Bear Put Spread Strategy

Using the example above, let’s assume the investor wants to establish the bear put spread on the SPDR Gold Trust ETF. The current price is at $142.00, so the investor purchases a 145 put option for $675 and sells a 140 put option for $350, both for the following month. The result is a net debit spread of $325 when establishing the position [see 101 ETF Lessons Every Financial Advisor Should Learn ].

From this point, a few scenarios could play out: