Emini basics the basics of trading emini futures

Post on: 21 Июнь, 2015 No Comment

E-mini basics

This is a section to start your e-mini futures education for it offers the very basics pertaining to trading these financial instruments.

What are e-mini futures

E-mini futures, often referred to simply as e-minis, are smaller units of older, grown-up futures contracts that have been around for quite a while. E-mini contracts are still relatively new to the trading scene having arrived at it only a decade ago, while the full contracts have been around for longer than two decades.

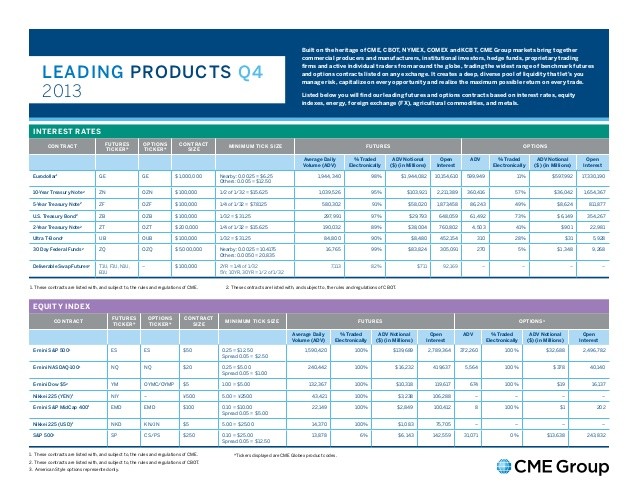

There are several futures markets that have developed both full and e-mini contracts. The most popular of them is the S&P 500 futures whose e-mini contract is often denoted by ES, its ticker name. Another very popular emini contract, which was launched two years after the S&P 500 e-minis is the NASDAQ 100 emini, frequently referred to by its ticker name of NQ. Yet another one is Russell 2000, originally known among traders as ER2, but now as TF after moving to a new physical trading exchange.

And while in real life situations these tickers may be different depending on your broker and even more on the charting platform you use, there is one thing all these contracts have in common: they all trade electronically on Globex, while their bigger brothers trade on the Chicago Mercantile Exchange (CME) or similar exchanges with a physical pit. There is one well known e-mini contract that calls the Chicago Board of Trade (CBOT) its home and that is the Dow Jones e-mini. It trades electronically just as the other mentioned above. Its often used ticker name is YM.

All of these e-minis have yet another thing in common: they are futures contracts for stock indices. While there are now e-minis for other futures in the markets that can be commodities (such as gold, silver or crude oil) or currencies (e.g. yen, euro), these newcomers are usually much less liquid then the stock index e-mini futures and so trading them can be much tougher if not much riskier. If you are just starting in this field, I suggest that you stick to the more established emini markets that guarantee better volumes and thus also better trades due to better liquidity.

How one makes money trading e-mini futures

Stock index e-minis are very often used for day trading which boils down to speculating in which direction the value (price) of their underlying index will move. If you expect it to move up, you buy one or more e-mini contracts and if the price indeed moves in your favor you can then unload these contracts for a profit. If you expect it to move down, you take a short position, selling e-mini contracts, and if you predicted the move right, you can brag about the dough you have made riding the move and exiting it at your target. Clearly, when your predictions do not pan out, you will end up with a loss. It is because of this speculation on which way the index will move that futures often lead the index price.

This price for some indices can be calculated to the second decimal point, but even in such cases the price of the related emini market changes by some larger fixed values known as ticks. For ES, 1 tick corresponds to $12.5 and one point consists of 4 such ticks. For YM, the tick is the same as the point and both are equal to $5. When your position moves in your favor by 1 pt, you can make $50 in the ES contract or $5 in YM per contract, assuming you are able to unload it after the move is over. Whether this is possible or not depends on your e-mini market liquidity at the given (exit) price. Now, you should better understand why it is always a good idea to trade liquid markets. Simply because these markets allow you to take your profits (or losses) more easily.

The size of the profits you can make while day trading e-minis is a function of the intraday range of your emini market. In ES, whose average intraday range is about 10 pts, the profits of 10 pts could in principle be possible, but in practice, because of the market unpredictability, most daytraders should be happy with a consistent daily profit of 2 pts which not infrequently is made only after several trades. If the commission is included (around $5 per round turn for the average emini broker), this profit is smaller than $100 per contract and thus in order to increase it most day traders employ more than one contract in their trading.

Good emini trading results such as these are certainly possible once you have trained yourself, which may take weeks to months, but can be quite worthwhile.MORE

The margin and the leverage in day trading e-mini futures

How many contracts you can trade depends primarily on the e-mini margin which in turn varies from one broker to another. Some brokers out there, those who cater specifically to e-mini traders, set their day trading margins as low as $500 per contract, and sometimes even lower. Most, though, require you to have at least $1000-2000 per contract in your account before you can trade. It is, however, highly advisable to have at least twice the margin per contract if you are to feel comfortable trading. Not all of your trades will be winners, you need to account for losers as well. Since the losers will cause drawdowns in your equity, you need to have some cushion to withstand them. Twice the margin is, in my opinion, the absolute starting minimum, three times is even better, particularly if you are a total beginner. In order to be allowed to trade, your equity must never fall below the margin level per contract. If it does, you need to reduce the number of contracts you trade and if this is not possible, you need to stop trading until you raise enough capital again.

The reason trading e-mini futures, or futures in general, attracts so many wannabe traders is due to, in part, if not mainly, the huge leverage they offer. Sometimes, to control one e-mini contract all you need to do is deposit $500. Now, obviously, this is usually enough only to cover the margin minimum; to actually trade you need to deposit a bit more, but not really that much more, relatively speaking. Twice that would be just fine to start trading, at least in principle.

Suppose now that you indeed had a grand in your futures account with a broker that set the e-mini day trading margin at only $500. Suppose also that what you wanted to trade is ES, the e-mini contract of S&P 500. Since one point of this instrument equals $50 and its price is these days (April 2007) about 1450, it is quite easy to find out how much dollar value you can control with your $1,000. It is simply $50*1450=$72,500. That’s right: your paltry $1,000 (or even $500 in principle, though only theoretically) can control as much as $72,500!

Now, with the same amount ($1,000) you would be able to control at most $2,000 of a stock value provided you had a margin account. That’s how great leverage futures offer. It is certainly huge compared to virtually all other trading instruments with the exception of currency (Forex) pairs, where the leverage in question can be even greater, and spread betting which gives you a comparable power of leverage.

More e-mini futures basics

For more basic information on trading emini futures, including inexpensive e-mini trading courses, see other articles in this e-mini education section. You can also check out our own original offer, a popular e-mini day trading course, KING . that should appeal to both beginners and more advanced e-mini traders.