Emerging Markets ETF Great for Investing in Emerging Markets

Post on: 17 Июль, 2015 No Comment

7 Ways to Invest in Emerging Markets with ETFs

You can opt-out at any time.

Please refer to our privacy policy for contact information.

Emerging markets are a great way to increase profit potential in a portfolio. However investing in foreign markets can be a difficult challenge. Enter emerging markets ETFs, a type of foreign ETF which offer instant access to up-and-coming markets with one simple transaction, not to mention the benefits .

If you want exposure to emerging markets, here are seven ETF strategies to utilize for your portfolio. And when you’re ready, make sure you check out our thorough list of emerging markets ETFs

1. Broad Emerging Markets ETFs

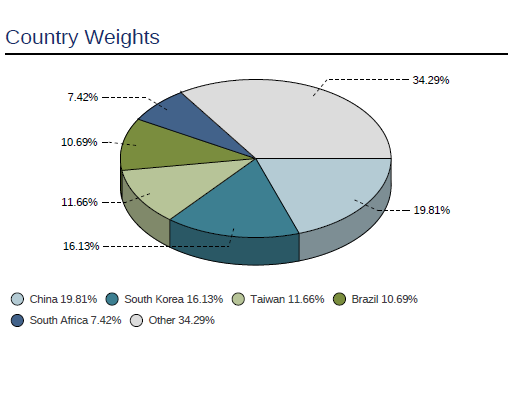

There are certain ETFs than contain assets correlating to multiple emerging markets. For example, EEG, the Emerging Global Shares Dow Jones Emerging Markets Titans Composite ETF, contains assets in order to catch emerging regions such as Brazil, Mexico, and South Africa as well as twelve other countries.

This type of ETF works for the investor who wants some emerging market potential in a portfolio, but doesn’t have a distinct opinion on which region should be the focal point. So EEG gives an investor exposure to multiple industries like oil. energy. and financials in emerging market regions.

2. Targeted Emerging Markets ETFs

Similar to a broad emerging markets ETF, there are some ETFs that focus on only a select few emerging markets. For example, a BRIC ETF on focuses on securities in four countries – Brazil, Russia, India, and China.

EEB, the Claymore / BNY Mellon BRIC ETF is an example of a BRIC ETF which consists of securities only in the four above-mentioned countries. So this ETF will give an investor exposure to industries in these regions.

3. Specific Emerging Markets ETFs

The best way to target a specific emerging market region or country is to utilize a foreign market ETF. For example, if you want to invest solely in China. you can purchase a market ETF like FXI, the iShares FTSE/Xinhua China 25 Index ETF. Or maybe Columbia is an area of focus, then an investor can buy GXG, the Global X / InterBolsa FTSE Colombia 20 ETF. Specific country ETFs for specific emerging markets.

If China is the country of choice, then look no further than our list of China ETFs .

4. Bond Emerging Markets ETFs

An international bond ETF can be a way to gain access to emerging markets. Foreign bond ETFs are a good way to enter emerging markets, hedge foreign interest rates, an even create a revenue stream for a portfolio.

If you have interest in researching these types of ETFs, look no further than our list of international bond ETFs .

5. Currency Emerging Markets ETFs

Sometimes an investor may not want to invest in the industries of an emerging market, but instead the currency of that foreign region. Whether it’s a need to hedge interest rate risk or make a exchange rate play, a foreign currency ETF may be the way to go.

If this is the direction your investment strategy wants to take, here is a list of foreign currency ETFs for your research.

6. Commodity Emerging Markets ETF

As the Cheers song goes, Albania’s chief expert is chrome. So maybe you are not to confident in the overall economy of a certain region, but the chief commodity interests you. That’s when you can consider a specific commodity ETF .

For example if you have a lot of risk in a country that depends on gold, then you can sell a gold ETF to hedge your risk. Or if you feel there is a country that will benefit from coal mining, then a coal ETF could be a fit for a portfolio.

7. Industry Emerging Market ETF

Similar to the commodity ETF strategy, you may feel an emerging market region has an advantage due to advancements in a certain industry. Is there a certain emerging market country that is making progress with solar energy that could benefit other emerging markets? Then maybe you should consider the purchase of an industry ETF. which will give you instant exposure to that sector instead of the actual country.

And while these are some emerging market strategies to consider, you are not limited to these ETFs. You can consider style ETFs or even ETF options. Investment strategies should always evolve, these are just a few for your emerging markets investment arsenal.