Emerging Markets Dominate Global GDP

Post on: 16 Март, 2015 No Comment

Portfolios have not caught up with this shift, says Jan Dehn of Ashmore

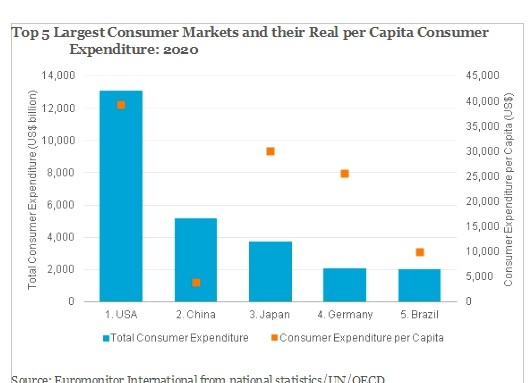

The U.S. and China are neck and neck when it comes to having the worlds largest economy this year.

But theres another race thats already been won: emerging markets have overtaken developed economies when it comes to having the largest share of global GDP.

This is clear from new IMF data released in April, explained Jan Dehn, head of research for Ashmore Investment Management. Clearly, both investor perceptions about and allocations to EM continue to lag far behind EMs rapid fundamental advances.

This is true in both equities and fixed income, but especially in fixed income, where allocations by many investors lag weighting implied by simple GDP weighting by as much as ten times, the former Credit Suisse First Boston researcher noted in a report on Tuesday. This suggests that EMs long-term technicals remain extremely strong.

According to the IMFs April 2014 World Economic Outlook analysis, the emerging markets share of global GDP hit 50.4% in 2013, up from 31% in 1980.

How did this happen?

These economies increased their share of global GDP by an average of 0.6% per year over the past 33 years, Dehn notes. And theres no end in sight.

Interestingly, the IMF expects EM share of global GDP to increase at an ever faster pace going forward. According to its forecasts, EMs share of global GDP will grow by an average of 0.7% per year from now until 2019 to reach 54.5%, the ex-World Bank employee explained.

The allocations to these markets on the part of most central banks, sovereign wealth funds, public and private pension funds, endowments, foundations and retail investors, are massively below what would be implied by simple GDP weighting, Dehn writes.

As for major emerging markets, the expert points to positive conditions in China. where manufacturing is stabilizing.

Official manufacturing [as measured by the Purchasers Manufacturing Index or] PMI in April was 50.4, up from 50.3 in March, Dehn said in his recent report, titled Move Over Please!

Though Ashmore does not expect a substantial pickup in manufacturing or growth as China transforms its economy from export to domestic-demand led the countrys policies should produce growth sustainability once inflation returns in the worlds QE economies and EM currencies strengthen by virtue of the strong external balances, the group says.

No country in the world will be more impacted by this change than China, Dehn stressed.

Meanwhile in India, the Finance Ministry has said it will move to makes its capital market more investor friendly after the current elections.

When viewed in conjunction with ongoing reforms of the Indian banking system our reading of the tea leaves suggests an opening of the Indian domestic bond market to foreign investors in the not-too-distant future, the expert said.

And theres more good news for countries like South Korea, which recently reported stronger-than-expected growth data: April exports rose 9% year over year vs. the anticipated 5.5%.

In Mexico, Dehn points out, further reforms of the energy sector should be coming. The country should begin to see investment in the sector with material upside accruing to Mexico through the medium and long term, he added.

In terms of where EM economies stand compared with their more developed counterparts, the analyst highlights another significant statistic: Portugals debt-to-GDP ratio is 130%, compared with an average of 34% all 165 emerging economies.

Related on ThinkAdvisor: