Emerging Market ETFs EEM v ETF News And Commentary

Post on: 26 Апрель, 2015 No Comment

Share | Subscribe

Although emerging markets investments have gained significant interest among investors from the developed nations in the past decade, it is traditionally considered to be a riskier proposition than domestic U.S. investments. This is primarily due to the fact that most of these nations are commodity-centric economies which makes them highly susceptible to any downtrend in the global economy.

Also, emerging market investments can take a severe hit from the appreciation in the U.S Dollar versus the domestic currency in which the asset (i.e. stocks/bonds) of the ETF are denominated. This causes returns to take a beating due to negative currency fluctuations even if the underlying asset class generates positive returns (see Currency Hedged ETFs: Top International Picks? ).

Thus, currency risk is an ever present concern for investors seeking exposure in the emerging markets space.

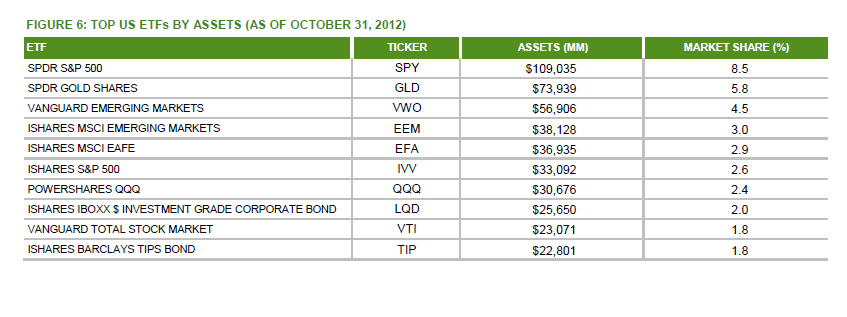

Despite these facts, the iShares MSCI Emerging Markets ETF ( EEM ) and Vanguard MSCI Emerging Markets ETF ( VWO ) have been extremely popular among U.S. investors in the past decade. In fact, these two ETFs are among the top 5 largest ETFs (in terms of assets under management) behind only the SPRD S&P 500 ETF ( SPY ) and the SPDR Gold Trust ( GLD ), combining to account for more than $100 billion in AUM.

This is in itself an astonishing achievement, which is highlighted even further considering the fact that both these ETFs are less than a decade old. Nevertheless, this kind of sums up the paradigm shift in the risk-return expectations and investment discipline of the U.S. investors in the past decade where most of the focus was shifted from the developed nations to the developing (emerging) economies, primarily in the quest for higher returns and portfolio diversification.

Interestingly these two exciting emerging market ETFs currently track the same index, the MSCI Emerging Markets Index which measures the equity market performance of various emerging markets ― both have very little to chose from in terms of country holdings. However, over the course of the next few months Vanguard seeks to switch over to an index created by index provider FTSE known as FTSE Emerging Index.

This is primarily aimed to reduce index related costs up to a great extent which if materialized, would bring down further its already paltry expense ratio thereby strengthening its competitive advantage in the expense front.

Presently, the country allocations for both EEM and VWO are almost the same with double digit exposure to countries like China, South Korea, Brazil and Taiwan. Some of the other top allocations include South Africa, India and Russia (see Can Anything Stop These Southeast Asia ETFs? ).

However, the new index i.e. the FTSE Emerging Index, is almost the same as the MSCI Emerging Market Index with the exception of one big factor-South Korea. This is especially true considering FTSE has been a strong believer that South Korea belongs to the developed markets space instead of emerging markets. Thus names like Samsung Electronics and Hyundai Motors will be missed from the new VWO.

While this brave move sure seems to have its own pros and cons, one thing remains certain. This will create some sort of differentiation between the almost identical emerging market ETFs on the investment objective and methodology front while catering to the similar target market. Therefore, in the future we can expect even more competition between the two.

Nevertheless, these emerging markets economies have come across as vital contributors to the overall global economic growth. In fact, the rising population and increasing per capita income in these economies make them accountable for a bulk of global consumption (read Access the $30 trillion Consumer Market with These ETFs ).

At first glance, these two products can be thought of as perfect substitutes for one another, especially considering the massive similarity between them. However, a closer look reveals differences that can go a long way in influencing investor decisions.

The table below summarizes some of their differences: