Drilling Down On Volatility Decay

Post on: 14 Июнь, 2015 No Comment

Seeking Alpha’s policy of full disclosure requires that I admit to not being a dentist, either in real life or acting as one on TV. Nevertheless four-fifths of me would recommend that you give yourself a good flossing before we get started with this article’s humorless section.

Intelligent investors and speculators who happen to lack an extensive background in mathematical finance are likely to be uncomfortable with their understanding of so-called volatility decay. As most readers of this article will know, volatility decay is the share price deterioration associated with leveraged funds that must rebalance their portfolios each trading day in order to meet an advertised return relationship (e.g. 2X or 3X) with some underlying asset. Uncorrelated movements in this asset’s daily return create quantifiable differences between the daily return relationship and the cumulative return relationship over many days. In the event that the underlying asset undergoes little net price change the associated ETF will suffer a loss. The magnitude of this effect can be so great that the leveraged ETF can lose share value even as the underlying asset posts a meaningful gain. Consequently these products come with more warnings than a cheap ladder: Never hold these instruments for more than a day, and These funds should be used by experienced traders only are the two disclaimers that come most readily to mind. Direct experience, however, is only one (usually painful) way to achieve greater understanding. So let us see if we can remove the mystery surrounding volatility decay through the relatively painless application of reason.

Trying to sort out this matter on one’s own can be a frustrating experience. In my opinion most of the publicly available documents that deal with this topic do not convey the essential aspects in a clear manner. Generally either too much or too little is demanded of the reader. In the first instance it is easy to find tangential presentations that are larded with (dubious) stochastic calculus to a degree that only a narrow class of mathematicians can decipher. In the second instance many authors merely state that the challenge of daily rebalancing (leading these funds to buy high and sell low over price swings) is the fundamental cause of the value decline. (A clear discussion of leveraged ETF rebalancing is given here .) In either case the typical reader will not gain an understanding sufficient to calculate volatility’s impact on any leveraged ETF of interest.

My solution to this dilemma is to demand a bit more from the reader with regard to the fundamental mathematics involved, but to make this demand only after the core problem has been clearly identified. The mathematical formulations are then made concrete via example graphical and tabular representations. This is, after all, a mathematical topic that transcends any particular market. Once understood these concepts can be applied to leveraged funds for any commodity or index asset.

In this article I will limit the specific examples to the ETFs that are based on the daily return of the S&P 500 index. There are two reasons behind this choice: 1) the extreme popularity of these funds, and 2) the annualized volatility of the S&P 500 index is readily expressible in terms of the familiar VIX index format.

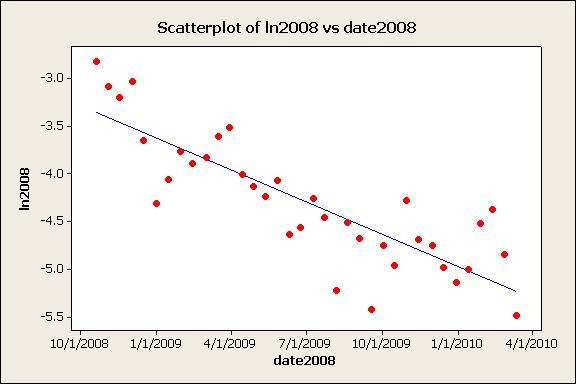

An interesting exception to the presentation dichotomy is found in a recent Seeking Alpha article by Jari Ulmer. (The link to this article is given below.) Therein he takes what appears to be a very practical empirical approach to quantify the volatility decay in two leveraged gold funds. While his article does not explore the mathematical basis for volatility decay, it does support the ideas presented here from the perspective of those who may be skeptical of detached analytical methods. I will present a derived graphic that can be compared to his empirical decay profiles.

What is Volatility?

Before we can discuss its impact on leveraged ETF returns we need to be clear in our minds as to what volatility means in the financial context. This matter is a little trickier than you might expect because its resolution reflects one’s stance on some controversial economic issues. But first it must be plainly stated that we are concerned with the volatility of daily asset returns and not the daily prices themselves. The returns are based on closing price differences between two consecutive trading days. This distinction is important because an asset that increases by 1% each day over ten consecutive days would have substantial price volatility but no return volatility over this interval.

Any sequence of asset returns can be resolved into serially correlated and uncorrelated components. The academic consensus is that there is little connection between the returns of stock portfolios from one day to the next, and so these returns are nearly completely uncorrelated or independent. Volatility is then a measure of the magnitude of an asset’s seemingly erratic (uncorrelated) return variation over some period of time.

The advocates of the methods of mathematical finance are wont to add an additional layer of meaning to this understanding of volatility. Instead of being simply uncorrelated, asset returns are assumed to be generated by a random (i.e. probabilistic) process, similar to the mechanics behind a pollen grain executing Brownian motion in a warm molecular soup. In this framework it is supposed that the realized (or historical) volatility is the time-average of a hypothetical instantaneous volatility. But having no means to connect instantaneous volatility to any concrete observable (such as fluid temperature and viscosity in the case of Brownian motion) the concept is rendered empty. The volatility of asset returns derives ultimately from the changing appraisals of the asset among the (changing) market participants. Consequently, asset volatility is not defined for any particular instant since change is excluded. Finally, the probabilistic interpretation of asset returns mistakenly promotes a sort of volatility pantheism, where volatility is construed to be an intrinsic property of the asset in question.

The theoretical support for the process framework derives from the supposed operation of perfectly efficient markets that adjust market prices instantaneously according to the incoming (random) news events. I should note that this framework is the ultimate basis for option pricing models and the VIX index calculation as well. Recall though that the VIX does not purport to measure the S&P 500’s instantaneous volatility-the theory holds that it measures the forward index volatility implied over the upcoming thirty days.

There are many good reasons not to buy into this attempted justification, and fortunately for us, we can discuss the impact of return volatility completely outside of this framework. For our purposes volatility is just a component of the statistical description of realized asset returns. More exactly we can compute and reference the moments (e.g. the mean and variance) of a sequence of daily returns without carrying the baggage of their probabilistic interpretation. Realized volatility can be expressed in a VIX-equivalent format as the square root of the annualized variance of daily returns. Any objective definition of volatility must always be backward-looking.

The Statistical Description of Cumulative Returns

Over time the cumulative return relationship between an asset and its derivative ETF tends to diverge from the closely managed daily relationship. To understand how this can happen we must know how cumulative returns are derived from daily returns. This is done most conveniently by using the statistical moments of the daily return sequence.

Let’s begin by considering a sequence of the S&P 500 index closing levels over the past [N+1] days. From this a corresponding sequence of [N] daily fractional returns can be computed: [r1. r2. r3 , rN ]. The cumulative return RN is defined by:

Unfortunately, this exact expression is clumsy and not particularly enlightening. It can be made more useful by transforming the chain of factors into an ordinary sum. This is accomplished by taking the natural logarithm of both sides:

This step has the additional benefit of letting us take advantage of the general understanding that each daily return will be much less than one (i.e. 100%). In this case each logarithm on the right-hand side can be replaced (with little error) with the following approximation:

Inserting this approximation into the prior expression leads to a set of sums that correspond to the first four moments of the daily returns. Terminating the power series approximation on an even power of [r] is helpful because the individual errors introduced by large positive and negative returns tend to cancel out in the sum. After the less significant terms are stripped away we can exponentiate both sides. The result takes on a more recognizable form:

Here the sums have been replaced with the normalized definitions of the sequence moments: the mean [r], the variance [ 2 ], the skewness [], and the kurtosis []. Due to the error cancellation property mentioned above, the last two terms in the exponent can be ignored so long as the skewness is not excessively great. The nominal decay in this case is defined by setting the mean [r] or mean daily return [MDR] to zero.

Figure 1 plots out the values for RN over the course of a trading year (N=252) as a function of the MDR for three typical variance values that are expressed in the VIX format. This makes the figure specifically applicable to the (NYSEARCA:SPY ) ETF. This plot assumes that the daily returns are distributed normally about the MDR, so this means that = = 0. The annualized percentage decay values at zero MDR are -1.1, -2.0, and -3.1 for the three volatilities in ascending order.

Figure 1

So what does this mean in simple English?

It means that the mathematics of combining daily fractional returns appears to negatively bias the ultimate cumulative return when the mean daily return is small. This bias is approximately proportional to the variance of these returns. The simplest discussions of volatility decay cover this point: A 10% decline from a high level still leaves you with a loss after a 10% gain from the lower level. It is interesting to note that this negative bias exists whether the asset in question is leveraged or not. Does this then mean that the underlying asset can suffer from volatility decay as well?

The technical answer to this question would be yes, but this is only because we have adopted the daily return frame of reference as the basis for computing the cumulative return. Viewed from this perspective the volatility bias is analogous to a pseudo-force in physics, where the apparent force (e.g. the centrifugal force ) is just an artifact of the observer’s non-inertial frame of reference. Our focus on the statistics of daily returns is then the financial equivalent of a non-inertial reference frame. It would seem then that the whole issue could be dismissed as an academic irrelevance. Or can it?

Real Decay is Relative

The way to regain solid footing, so to speak, is to focus our attention on the relative rather than the absolute performance of the derivative ETFs. An objective evaluation of volatility’s impact is obtained by comparing the theoretical performance of the derivative fund with its underlying asset over a period of [N] days. The roles that volatility and leverage play in establishing cumulative returns can then be identified.

Derivative funds are managed so as to produce a daily return at an advertised multiple (-1X, 2X, and etc.) of the underlying asset. The selection of a daily rebalancing frequency has real consequences as regards the volatility decay, and the focus on daily returns is no longer arbitrary. To see the impact of leverage it is sufficient to substitute the asset’s daily return [r] with the leveraged return [r] into a truncated version of the cumulative return equation.

Here RN () is the cumulative return of the derivative ETF with daily leverage []. Now this return will correspond to pure volatility decay, DN (), when the cumulative return of the underlying asset is zero. Since =1 for the underlying asset, this condition is given by:

Subtracting this expression for zero inside the bracketed term in the exponent gives us the expression for the relative volatility decay, DN ():

[d()] is the daily rate of volatility decay:

To get a feel for the magnitude of the decay for the S&P 500 derivative ETFs let’s use a daily variance of 0.000136. This particular variance corresponds to an equivalent VIX level of 18.5, and it is approximately the daily variance computed over the past two years. With this value we can populate the following table for leveraged S&P 500 ETFs: