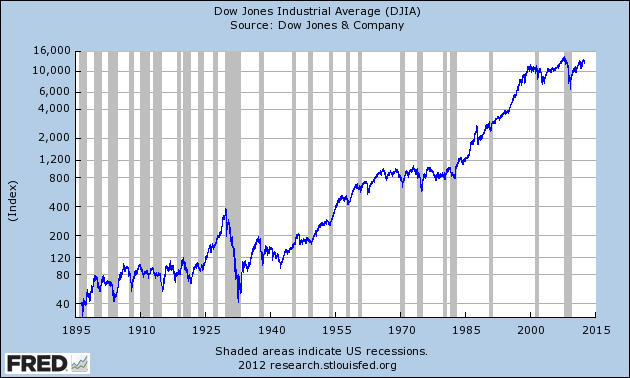

Dow Jones Industrial Average

Post on: 17 Июль, 2015 No Comment

Call It a Hunch, Were In For a Tumble

I dont have any complicated quantitative models at my disposal. I read, I think, and then I have a hunch. Then I have lunch.

I think the market rose too far, too fast and that we are going to test the March 9 low. The economy is not growing as fast as many had expected.

This morning the Federal Reserve Bank of New York released its Empire State Manufacturing Survey. This index of general business conditions fell to -9.41 in June, down from -4.55 in May. Economists expected a slight dip to -4.6 in this measure of regional manufacturing conditions.

Its midday Monday. After a 40% rally since the March lows, the S&P 500 is down 2.5% today. The Dow, which was just 5 points from breaking even for the year, is down 200 points, or 2.3%. The Nasdaq is down 2.7%.

The Wall Street Journal asks is this a bull or bear market? Signs Suggest Stocks Surge Is Blip Within a Bear; Still, Theres Opportunity.

This would seem to prove my theory from last week, when I decided that all the outflows from the large-cap U.S. stocks was a sign that the market had topped. I think were going to go back to near 7,000 on the Dow. Good time to take profits and wait for the sale to begin again.

Net Cash Inflows Double; Large-Caps Lose, Emerging Markets Win

Net cash inflows into all exchange-traded funds (ETF) and exchange-traded notes (ETN) grew to approximately $17.1 billion in May, doubling April’s total, according to the National Stock Exchange (NSX). Despite the huge inflow overall, ETFs holding large-capitalization indexes such as the S&P 500, Dow Jones Industrial Average and the Russell 1000 posted significant cash outflows. Meanwhile, emerging-market ETFs recorded huge net inflows.

iShares remained the top ETF firm with $290 billion in assets under management. State Street Global Advisors came in second with half that, $142 billion. Vanguard took third at $54 billion. PowerShares’ $31 billion came in fourth and ProShares $26 billion claimed fifth.

The SPDR Trust (SPY) remained the king with $63 billion in assets. SPDR Gold Shares (GLD) came in second with a distant $35 billion.

I noticed a trend of heavy net cash outflows from the large-cap U.S. equity funds. So, even as the market rose in May, the SPDR saw $146 million flow out in May. The PowerShares QQQ (QQQQ), which tracks the Nasdaq 100 and is the sixth-largest ETF, had outflows of $435 million. Meanwhile, $639 million was pulled out of the Dow Diamonds (DIA), which tracks the Dow industrials. Surprisingly, the iShares S&P 500, (IVV) which also tracks the S&P 500 and is the fifth-largest ETF, saw net cash inflows of $441 million. However, all the iShares ETFs that track the Russell 1000 or an offshoot also saw outflows. Does this mean that traders think the U.S. stock market has peaked and have taken profits? I wouldn’t be surprised.

That money appears to be moving into emerging markets. The iShares MSCO-Emerging Markets (EEM) took honors as the third-largest ETF upon receipt of $1 billion in cash inflows in May. The only ETF with more net inflows was the iShares MSCI Brazil (EWZ) with $1.5 billion.

Year-to-date net cash inflows totaled approximately $29.8 billion, led by fixed income, commodity, and short U.S. equity based ETF products, says the NSX. Assets in U.S. listed ETF/ETNs grew 10% sequentially to approximately $594.3 billion at the end of May. The number of listed products totaled 829, compared with 767 listed products a year ago. This data and more can be found in the NSX May 2009 Month-End ETF/ETN Data Report.